China’s Lithium-Ion Battery Industry – Overcoming Supply Chain Challenges

China’s lithium battery industry is seeing rapid growth amid sky-high demand from the electric car and renewable energy industries. However, a reliance on imports for key materials leaves the industry vulnerable to price fluctuations and imbalanced development within the domestic supply chain. The government is now calling on local authorities and industry players to address issues such as the high cost of raw materials, quality inconsistencies, and lopsided supply and demand.

China has been the single largest consumer of lithium-ion (or li-ion) batteries for five consecutive years. It is also the world’s undisputed king of battery production, with China’s largest battery manufacturer Contemporary Amperex Technology Co. (CATL) alone holding around 35 percent of the global li-ion battery market in the first quarter of 2022. In the field of solar battery modules, Chinese companies hold around 71 percent global market share.

The country’s booming new energy vehicle (NEV) industry and decarbonization-driven solar industry are contributing to China’s insatiable appetite for batteries. However, despite China’s dominant position in manufacturing, the country remains reliant on imports for key materials and components for their production, which makes the industry vulnerable to price fluctuations and supply chain crunches.

In addition, issues within the domestic industry, such as lopsided supply chain development, an imbalance in supply and demand, local protectionism, and quality inconsistencies are hampering the healthy growth of the industry. These inefficiencies are likely to exacerbate battery supply shortages for industries such as NEVs and solar, which may in turn slow the growth of these industries.

To promptly address these issues, China’s Ministry of Industry and Information Technology (MIIT) and State Administration of Market Regulation (SAMR) released a notice with a range of suggestions for improving the domestic li-ion market. These range from increasing capacity in fields that are lacking to improving quality control supervision to encouraging collaboration between industry players.

Below, we look at the growth of China’s li-ion battery industry and the current hindrances to the industry’s growth and discuss how the government hopes to overcome current difficulties.

Growth of China’s lithium-ion battery industry

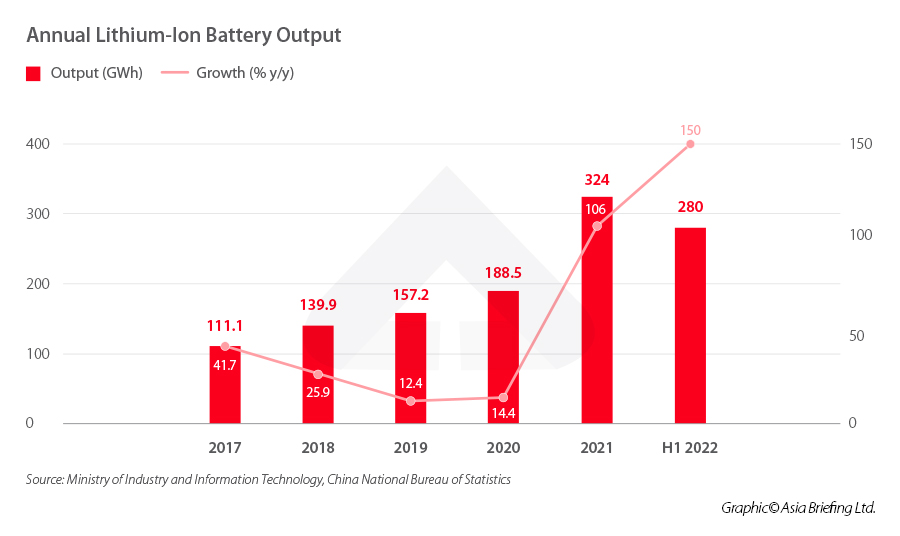

Despite the current headwinds, China’s lithium-ion battery industry has experienced multiple years of double-digit growth. In 2021, the total output of li-ion batteries reached a new high of 324GWh, an increase 106 percent from the previous year, according to data from the MIIT. 2022 is set to reach a new record, with total output in the first half of the year already at 280GWh, an increase of 150 percent from the first half of 2021.

Of the total output in H1 2022, the output of energy storage li-ion batteries reached 32GWh, while the installed capacity of power batteries for NEVs reached approximately 110GWh.

According to the 2021 China Lithium-Ion Battery Industry Development Index White Paper published by the China Electronic Information Industry Development (CCID) Group, a research institute under the MIIT, China’s power battery production capacity accounts for about 70 percent of the world’s total and Chinese companies account for six of the world’s top 10 lithium-ion battery manufacturers.

China lithium imports and rising lithium carbonate prices

China has a wealth of natural resources, including many of the raw materials needed for the production of li-ion batteries, such as lithium, cobalt, and nickel. However, in many cases, China’s strength in these industries lies not in the number of resources and scale of extraction, but in its processing and refining capabilities. China held only around 7.9 percent of the world’s lithium reserves at the end of 2020, according to BP’s Statistical Review of World Energy 2021. However, the country is estimated to have 60 percent of the world’s capacity for processing and refining.

For this reason – and the extremely high demand for batteries – China is still reliant on imports for many of these materials. China’s main sources of lithium carbonate are countries such as Australia, Chile, and Argentina.

Reliance on imports makes China’s battery industry vulnerable to price fluctuations of raw materials, and due to the high demand and production shortfall, prices of certain materials are sky-high.

The price of battery-grade lithium carbonate, one of the core ingredients for making li-ion batteries, reached a record high of RMB 597,500 (US$89,019) per ton on November 11, according to data from Shanghai Ganglian E-Commerce Holdings, a provider of steel information services. The average price in November 2022 at the time of writing this article (November 28) was RMB 580,676 (US$86,513) per ton, a year-on-year growth rate of 201.08 percent.

Rebalancing the li-ion supply chain

On November 10, 2022, the MIIT and the SAMR released a notice on achieving coordinated and stable development of the lithium-ion battery industry supply chain. The notice is not a concrete policy document, but rather a call to various government departments and industry groups to take measures to address the issues discussed above.

Specifically, the notice seeks to address five key issues in the li-ion supply chain, which we will discuss below.

Factors such as explosive downstream demand and industrial growth, the complex and ever-changing pandemic situation, and increasing economic downward pressure are contributing to a recent imbalance between supply and demand and excessive price fluctuations of some intermediate products and materials in the domestic lithium-ion battery industry supply chain. In addition, the connection between upstream and downstream industries is inadequate, and hoarding and unfair competition has been seen in some areas. Production capacity has blindly expanded in some fields, while low-quality and low-price competition has occasionally taken place.

– Notice on achieving the coordinated and stable development of the lithium-ion battery industry supply chain

Rebalancing regional development of li-ion battery production

To tackle the issue of imbalanced development of different links in the supply chain, the notice calls on the responsible regional departments to identify the development of li-ion manufacturing, as well as the development of the “primary” materials (such as positive and negative electrode materials, separators, and electrolytes, among others) and “secondary” materials (such as battery-grade lithium carbonate and lithium hydroxide) within their jurisdiction. The purpose of this is to identify which areas of the supply chain may be underdeveloped and which areas are in oversupply and then seek to rebalance the development through targeted policy.

Specifically, the notice calls on developing the industry in accordance with the various 14th Five-Year Plans related to manufacturing (manufacturing development plans for the period from 2021 to 2025) and the Guiding Opinions on Promoting the Development of the Energy Electronics Industry (the “Guiding Opinions”). The Guiding Opinions stress the importance of “coordinated development” of industry chains and ensuring a balance of supply and demand.

The notice also proposes for government departments to then help battery companies set realistic development goals based upon the current industry trends and local industry conditions to ensure resources and efforts are placed in the right areas of the industry. Measures include providing sufficient investment in R&D and innovation, providing sufficient supporting funds, expanding the scale of production for different materials and components in accordance with demand, optimizing regional industry structure and avoiding “low-level simultaneous development” of different fields, so as to prevent inefficient and uncoordinated growth.

Balancing supply and demand to ensure the stability of the industry supply chain

To ensure stable development of supply and demand, the notice calls on government departments to promote communication and collaboration between upstream and downstream companies in the li-ion battery industry. This includes producers of li-ion batteries (battery cells and packs), primary and secondary materials companies, companies in upstream resources, such as lithium nickel and cobalt, li-ion battery recycling companies, lithium battery terminal application companies, and companies engaged in system integration, channel distribution, logistics, and transportation of li-ion battery products.

It also calls on companies in upstream and downstream fields to cultivate more in-depth and sustainable relationships by signing long-term contracts for orders, engaging in technical cooperation, and helping to stabilize the market by setting realistic expectations, clarifying product quantities and prices, and guaranteeing the supply of products.

The notice also states that the industry needs to adhere to the 14th Five Year Plan for Green Development (“Green Development FYP”) when it comes to battery recycling. The Green Development FYP calls for improving laws and regulations for battery recycling and “encouraging upstream and downstream companies in the industry chain to jointly build shared recycling channels and build a number of centralized recycling service outlets”

Finally, local market regulators are also tasked with increasing supervision and strictly investigating and addressing issues of product hoarding, price gouging, and unfair competition in the upstream and downstream li-ion battery industry in order to “maintain market order”.

Improving industry data monitoring

A major component of the effort to improve the li-ion battery industry’s development is improving data management. As such, the notice states that the relevant government departments are required to strictly implement the “Statistical Survey System for the Electronic Information Manufacturing Industry“. This system tracks the main indicators of key electronic information manufacturing companies, including the main financial and economic indicators, the production capacity of main products, sales, inventory, and more. It was formulated in order for stakeholders to get an accurate and timely understanding of the various industries in order to effectively implement industry management, ensure the safety and stability of industrial supply chains, and provide a basis for decision-making by leaders and government authorities.

The notice clearly states that the relevant government departments are responsible for using these industry statistics, better monitoring the production capacity and investment in the li-ion battery industry, and identifying issues such as abnormal price fluctuations, production capacity shortages, and over-investment.

Strengthening supervision and inspection to ensure the supply of high-quality li-ion battery products

In order to improve the overall quality of the li-ion battery industry, the notice calls on regulators to increase monitoring and take steps to ensure that companies and their products adhere to industry standards and regulations.

Local industry and information technology authorities and market supervision departments guide lithium battery enterprises to carry out technological innovation, strengthen quality control, optimize process flows, obtain quality certification, and improve testing capabilities of li-ion battery products. It also encourages companies to implement quality management systems, such as ISO 9000 (international quality management standards) and Six Sigma (techniques of improving business processes), to improve the one-time inspection pass rate of products and ensure product reliability, stability, and consistency.

Local market supervision departments are also tasked with carrying out product quality supervision and inspection of lithium battery manufacturers and organizing for the manufacturers to carry out product quality self-inspection and disclose the results of the self-inspection.

The local authorities are also encouraged to investigate and punish companies whose products do not meet mandatory national quality standards and violate regulations such as the Product Quality Law and mandatory national standards. Mandatory national standards include the Safety Requirements for Lithium-Ion Batteries and Batteries [No. GB 31241] and Safety Technical Specifications for Lithium-Ion Batteries and Batteries for Stationary Electronic Equipment [No. GB 40165].

The notice also states that SAMR and MIIT may organize for inspection and testing agencies to carry out spot checks on the quality of li-ion battery products.

Improving the environment to allow industry growth

The last section of the notice focuses on breaking down behavior and phenomena that may be hindering the coordinated development of the li-ion battery industry in China. This includes tackling issues such as local protectionism, unfair competitive practices among market players, and the adverse impact of COVID-19 measures on companies.

The notice doesn’t offer concrete ways to overcome these issues, but calls on local government departments to jointly build “an efficient, standardized, fair, and fully open national unified market for li-ion batteries”.

In relation to COVID-19 prevention measures, the notice states that COVID-19 prevention measures must be in coordination with industry development and that local government departments are required to help companies implement COVID-19 prevention and response measures in order to handle issues that may arise in the production, transportation, sales, and other phases of the production process in the event of a COVID-19 outbreak.

Will China be able to stabilize the lithium-ion battery market?

The notice on improving China’s li-ion battery market is only the latest of a series of efforts to achieve coordinated development of supply chains for key industries. On August 24, 2022, the MIIT, along with SAMR and the National Energy Administration (NEA) issued a similar notice calling for the coordinated development of the photovoltaic industry supply chain. This shows the government is keen to address shortcomings within domestic supply chains.

However, there are other factors that may help to cool the battery market besides direct government intervention in the industry. One is a decrease in demand for batteries from other industries, such as solar and NEVs. For instance, continued increases in the cost of NEVs may in turn reduce demand, and thereby ease demand for lithium. In the longer term, a reduction in the Chinese government’s NEV subsidies would further cool demand for car batteries.

In addition to the proposals mentioned in this notice, China is and will continue to make efforts to increase the extraction of key minerals, both in China and abroad, in order to meet domestic demand. A combination of increasing the supply of key minerals and keeping demand reasonable will be key for stabilizing the market and ensuring sustainable industry growth.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Maternity Leave and Payment: A Comparison of Relevant Rules in Mainland China and Hong Kong

- Next Article China-UK Trade and Investment Ties