China and Central Asia: Bilateral Trade Relationships and Future Outlook

Central Asia is seen as integral to the stability and development of China’s western regions due to its geographical proximity. Further, the regional connectivity between Central Asia and China with Europe and the Middle East has been enhanced through the Belt and Road Initiative projects.

Recently at the second China plus Central Asia (C+C5) foreign ministers’ meeting held in Xi’an on May 12, 2021, China’s foreign minister Wang Yi called upon China and Central Asian countries to explore a new style of regional cooperation and build a community with a shared future.

Given this background, trade opportunities between China and Central Asia look promising.

The two regions trace their economic and trade relationship to the early 1990s. Subsequently, over the past 30 years, bilateral trade has grown significantly, including trade in simple consumables to high-tech products.

Why China is an important trading partner to Central Asia

While Central Asia does not rank highly among China’s trading partners, accounting for around one percent of China’s total imports and exports, respectively, China is Central Asia’s most important trading partner.

For example, according to the official statistics of each country in 2019, China is the largest trading partner to Kyrgyzstan and Uzbekistan by imports and is Turkmenistan’s largest trading partner by exports. China also ranks high as a destination for the imports and exports of other Central Asian countries.

More specifics can be found in the below table:

From 2015 to 2019, export of goods from Central Asia countries to China grew by 35 percent from US$15,054 million to US$20,276 million, with Kazakhstan, Tajikistan, and Uzbekistan reporting the fastest growth of over 50 percent.

In the same time period, goods exported from China to Central Asian countries increased 49 percent from US$17,563 million to US$26,207million. Uzbekistan reported the largest growth in purchasing from China, which rose by 126 percent from 2015 to 2019, whereas the goods exported from China to Tajikistan and Turkmenistan decreased.

China maintains positive trade balance with all Central Asian countries except Turkmenistan. This is mainly because of Turkmenistan’s low participation in the international supply chain and its high self-sufficiency rate of basic daily necessities, energy, and foods – the import volume of Turkmenistan is relatively small. In addition, Turkmenistan is rich in mineral and energy resources, which accounts for over 90 percent of its exports.

Country breakdown

China-Kazakhstan

In 2019, Kazakhstan had a GDP worth US$181.7 billion; its total exports amounted to US$60.3 billion and total imports amounted to US$41 billion.

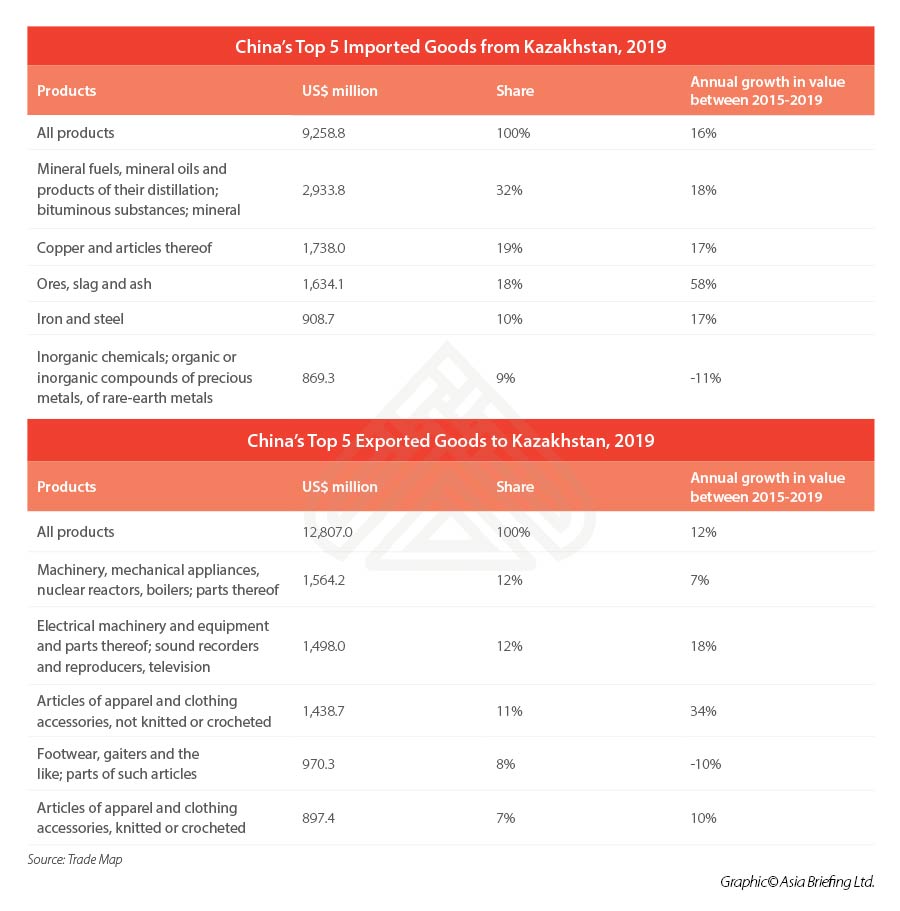

Based on 2019 data, China is Kazakhstan’s second largest trading partner. Kazakhstan’s imports from China were at 17 percent (US$6,537 million) and exports to China at 13.6 percent (US$7,823 million). Trade between China and Kazakhstan has grown steadily over the past five years, expanding at an average annual rate of 16 percent.

Over three years (2016-2019), China became Kazakhstan’s fastest growing export market, with growth in exported value having upped by 87 percent, as well as the fastest growing import market, with growth in imported valued having upped 56.4 percent.

Kazakhstan mainly exports crude petroleum, petroleum gas, refined copper, ferroalloys, and radioactive chemicals, and exports mostly to China, Italy, Russia, Netherland, and France. Since 2012, China has been the largest buyer of Kazakhstani uranium. The largest volume of supplies (57 percent of all exports) heads to China. Since the mid-2010s, after a long slide, Kazakhstan has modestly increased its non-hydrocarbon and metal exports to China. Kazakhstan’s exports of ores, slag, and ash to China experienced rapid growth with an annual growth rate of 58 percent between 2015 and 2019.

The top imports of Kazakhstan include medicaments, petroleum gas, cars, broadcasting equipment, and planes, helicopters, and/or space craft. The country imports mostly from Russia, China, South Korea, Germany, and Italy. Between 2015 and 2019, Kazakhstan increased its imports of China-made apparel, clothing accessories, and electrical machinery and equipment.

China-Uzbekistan

In 2019, Uzbekistan had GDP worth US$57.92 billion; its total exports amounted to US$14.1 billion and total imports US$21.5 billion.

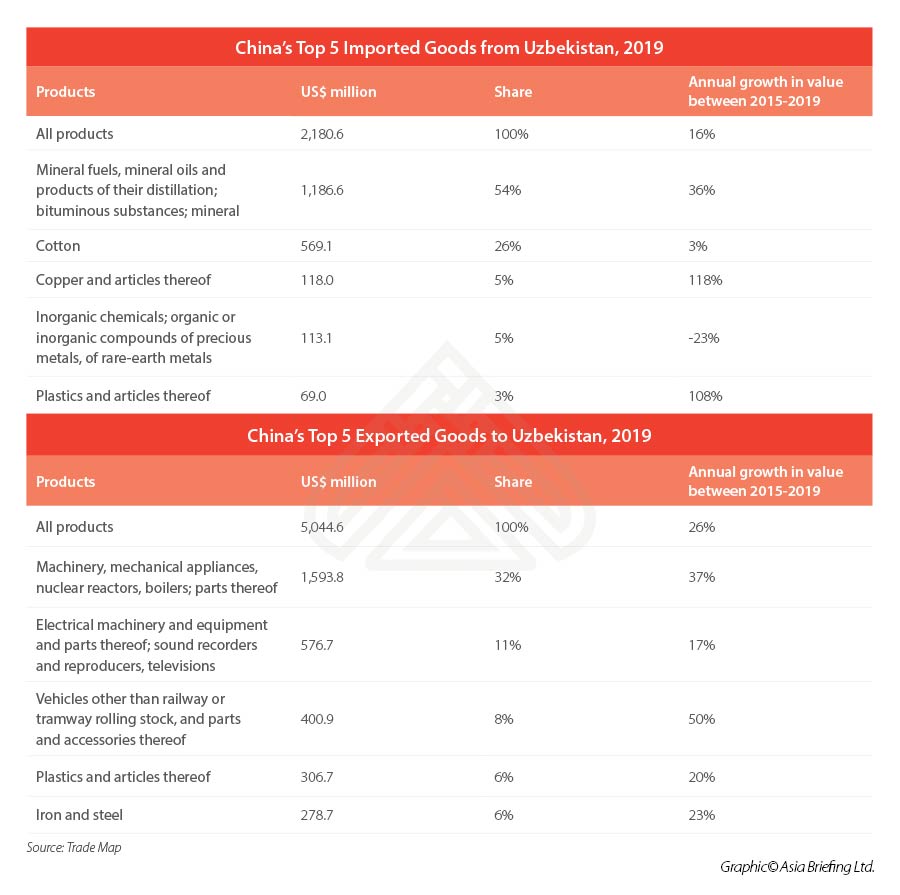

For imports, China is Uzbekistan’s largest trading partner, accounting for 23.1 percent of Uzbekistan’s total imports, and its fastest growing import market over the past decade. For exports, China is Uzbekistan’s third largest trading partner, accounting for 12.3 percent of Uzbekistan’s total exports.

The top imports of Uzbekistan are vehicle parts, packaged medicaments, refined petroleum, cars, and planes, helicopters, and/or spacecraft. The country imports mostly from China, Russia, South Korea, Kazakhstan, and Turkey. In recent years, Uzbekistan has increased imports of cars and their parts, machinery appliances, and electrical machinery and equipment from China.

Uzbekistan mainly exports gold, petroleum gas, non-retail pure cotton yarn, refined copper, and ethylene polymers. Uzbekistan’s exports of copper and plastics to China have grown sharply over the past five years, with an annual growth rate of over 100 percent.

China-Kyrgyzstan

In 2019, Kyrgyzstan had a GDP of US$8.46 billion; its total exports were worth US$2.93 billion and total imports US$9.58 billion.

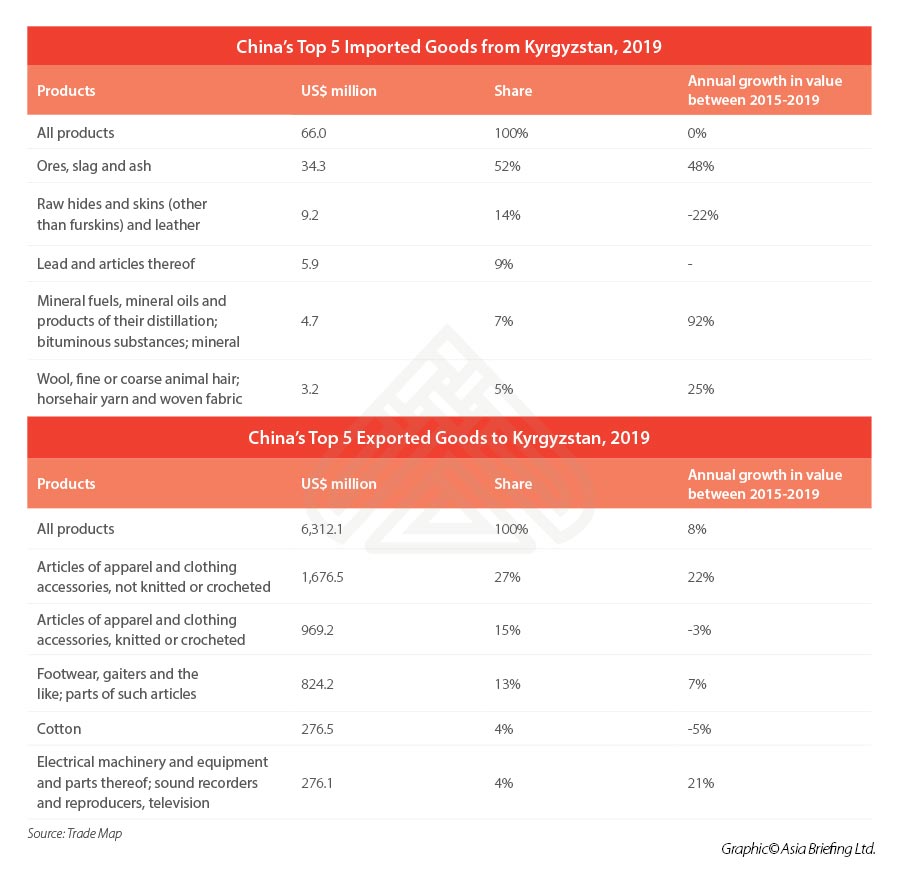

For imports, China is Kyrgyzstan’s largest trading partner. China is also Kyrgyzstan’s fastest growing import market over the last 10 years. For exports, China is Kyrgyzstan’s sixth largest trading partner in 2019, accounting for four percent of its total exports.

Kyrgyzstan mainly imports refined petroleum, rubber footwear, non-knit women’s coats, knit sweaters, and non-knit men’s suits. The country imports mostly from China, Russia, Kazakhstan, Uzbekistan, and Turkey.

Top exports of Kyrgyzstan are gold, precious metal ore, dried legumes, refined petroleum, and scrap copper. The country exports mostly to the UK, Kazakhstan, Russia, Uzbekistan, Turkey, and China.

China-Tajikistan

In 2019, Tajikistan had a GDP of US$8.12 billion; its total exports amounted to US$811 million and total imports US$4.02 billion.

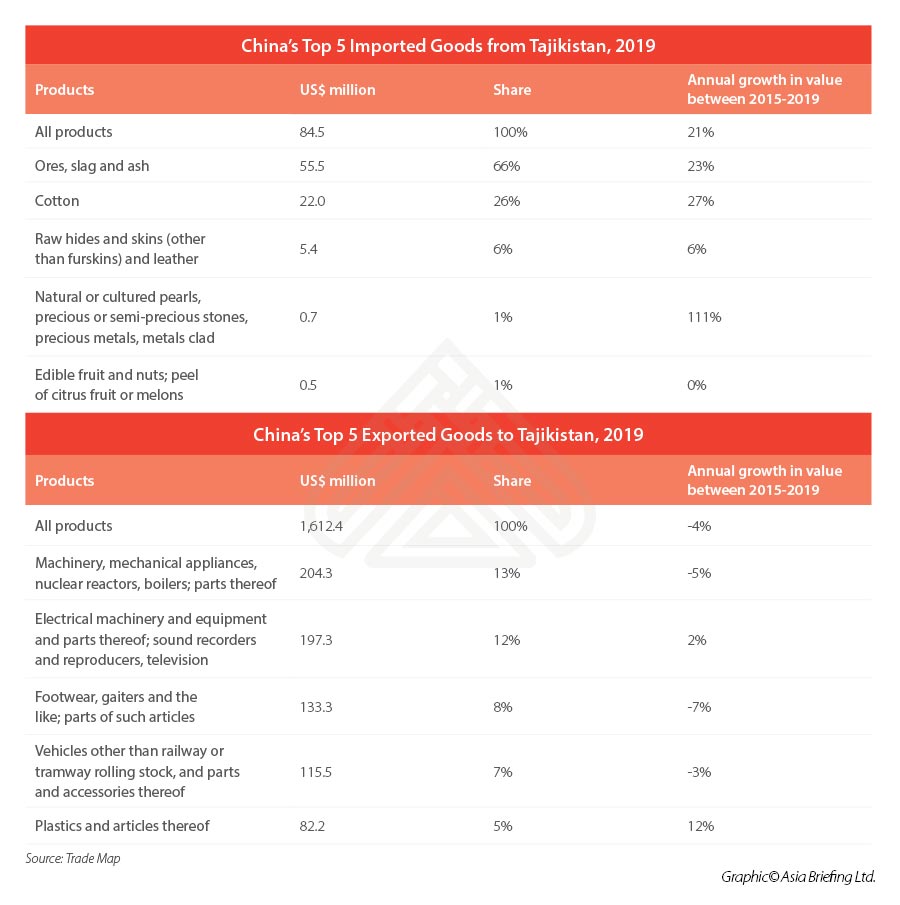

For imports, China is Tajikistan’s third largest trading partner, accounting for 18.2 percent of its total imports with a value of US$605 million. For exports, China is Tajikistan’s fifth largest trading partner, accounting for five percent of its total exports.

Although China is not Tajikistan’s top trading partner, in 2019, China become the country’s fastest growing export market (up 10.5 percent) and import market (up 13.1 percent).

Tajikistan main exports to the world include gold, raw aluminum, raw cotton, zinc ore, and other ores. Top export destinations are Turkey, Switzerland, Uzbekistan, Kazakhstan, and China.

The top imports of Tajikistan are refined petroleum, wheat, petroleum gas, aluminum oxide, and planes, helicopters, and/or spacecraft. The country imports mostly from China, Russia, Kazakhstan, Uzbekistan, and Turkey.

China-Turkmenistan

In 2019, Turkmenistan reached a GDP of US$40.76 billion. Its total exports amounted to US$9.33 billion and total imports US$3.2 billion.

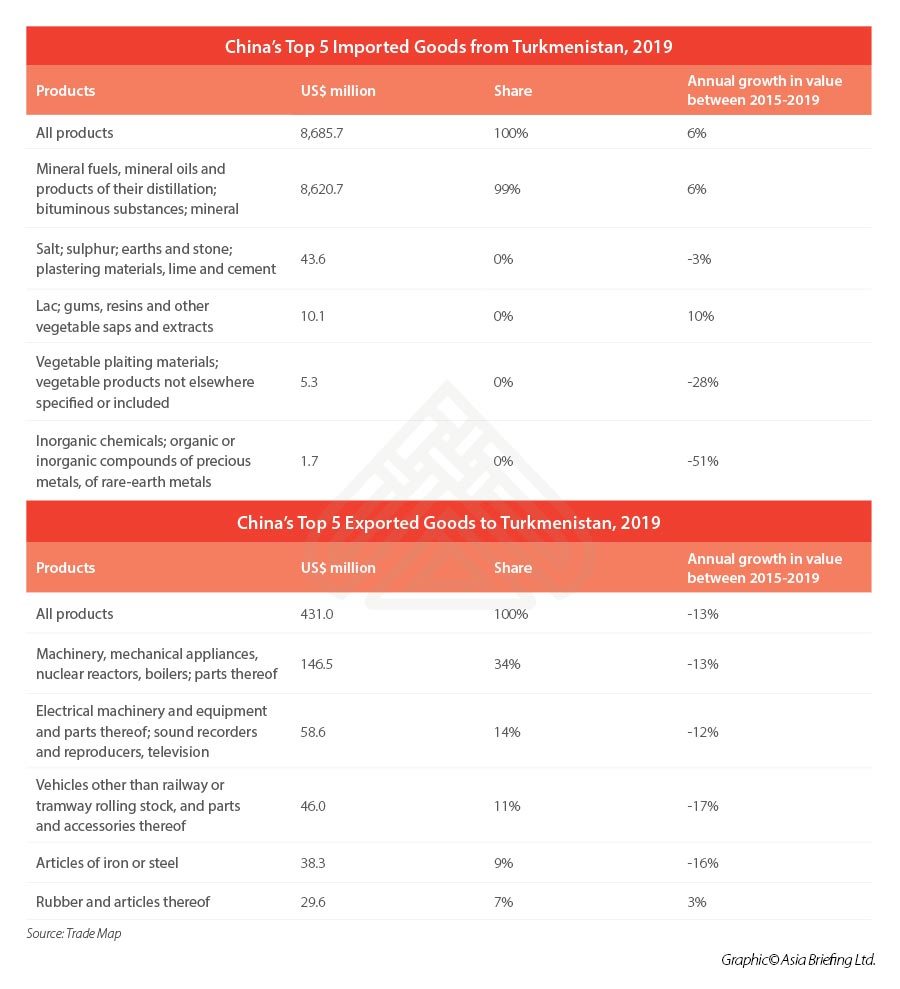

For exports, China is Turkmenistan’s largest trading partner, accounting for 80.2 percent of Turkmenistan’s total exports worth US$8,685 million in 2019. For imports, China is Turkmenistan’s third largest trading partner, accounting for 14.3 percent of its total imports.

The top exports of Turkmenistan are petroleum gas, refined petroleum, crude petroleum, non-retail pure cotton yarn, and nitrogenous fertilizers. Turkmenistan exported 94 percent of its rich natural gas production to China in 2017, up 50 percent from 2012. Turkmenistan supplies a significant amount (30 to 40 percent) of China’s natural gas; China has paid for all the pipeline infrastructure to bring this natural gas across four Central Asian states to China. Consequently, China has a major interest in ensuring stability in Turkmenistan to recoup its investment.

The top imports of Turkmenistan are large iron pipes, harvesting machinery, packaged medicaments, broadcasting equipment, and tractors, importing mostly from Turkey, Russia, China, United Arab Emirates, and Germany.

Future outlook is promising due to these growth drivers

Belt and Road Initiative

The launch of the One Belt One Road (OBOR) project, later designated as the Belt and Road Initiative (BRI), has enhanced the significance of Central Asia for China by connecting it with Europe and the Middle East.

Central Asia plays a key role in two of the three proposed belts that make up the Silk Road Economic Belt: The North belt goes through Central Asia and Russia to Europe; the Central belt passes through Central Asia and West Asia to the Persian Gulf and the Mediterranean; and the South belt runs from China through Southeast Asia and South Asia and on to the Indian Ocean through Pakistan.

Since its launch in 2013, the total trade volume between China and BRI countries has amounted to U$9.2 trillion from 2013 to 2020, while the combined investment by Chinese enterprises in these countries has reached US$136 billion.

As BRI development continues to proceed, multilateral trade between Central Asia and China can be expected to grow significantly with more frequent economic interactions and cooperation.

Double tax treaties

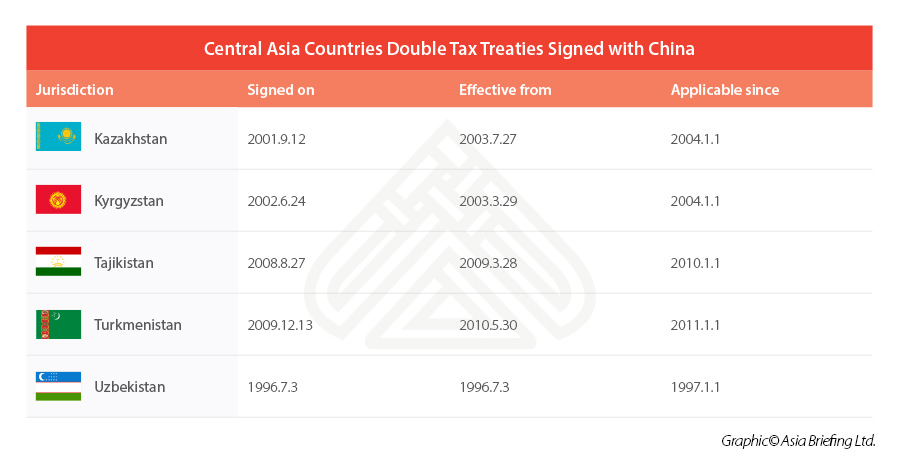

Double tax treaties or double taxation agreements (DTAs) are signed by jurisdictions to avoid or minimize double taxation of the same income of an investor by two countries. Although the DTA mainly applies to direct taxes, such as individual income tax and corporate income tax, it plays a significant role in trade promotion by contributing to the elimination of trade barriers and advancing the trade and investment cooperation between the states. By far, China has signed DTAs with all five Central Asian countries.

Currently, there are no free trade agreements (FTAs) between China and Central Asia. Nevertheless, with Central Asia growing more important to China’s development in the region, an FTA is expected by market watchers at some point in the near future.

China is progressively opening up its market

For decades, China has showed an appetite for Central Asian energy resources and a few commodities, but little else. At the most, it has been investing in infrastructure to ensure the uninterrupted energy supply from Central Asia. However, it appears that China is entering a new phase of economic engagement with Central Asia, and is even opening its markets to Central Asian countries’ fledgling food exporters. This potentially offers Central Asian food exporters access to 1.4 billion Chinese consumers will be a part of China’s strategy to ensure food security to its people – China has 20 percent of the global population but just five percent of global arable land.

China’s Foreign Minister Wang Yi called on China and Central Asia to enhance cooperation in modern agriculture and build a comprehensive agricultural science and technology demonstration park. China has signed phytosanitary agreements – approving a growing range of Central Asian foodstuffs – while helping firms secure export licenses and learn the ins and outs of Chinese e-commerce.

Summary

Central Asia and China are important trading partners for each other although this relationship has potential to grow and diversify.

Traditionally a connector between China and Europe, Central Asia is expected to soon play an outsize role in the region with BRI blueprints translating into concrete projects.

China’s continuous market opening also serves up opportunities for Central Asian exporters and businesses. Trade analysts and market watchers will keep an eye on developments in this region, as BRI infrastructure facilitates new investment opportunities and logistics support.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Pekings Investitionsmöglichkeiten für Investoren mit ausländischem Kapital

- Next Article Yuan digitale cinese: stato di sviluppo e possibile impatto per le imprese