Business Relocation in China: How to Manage Legal, Tax, and HR Concerns

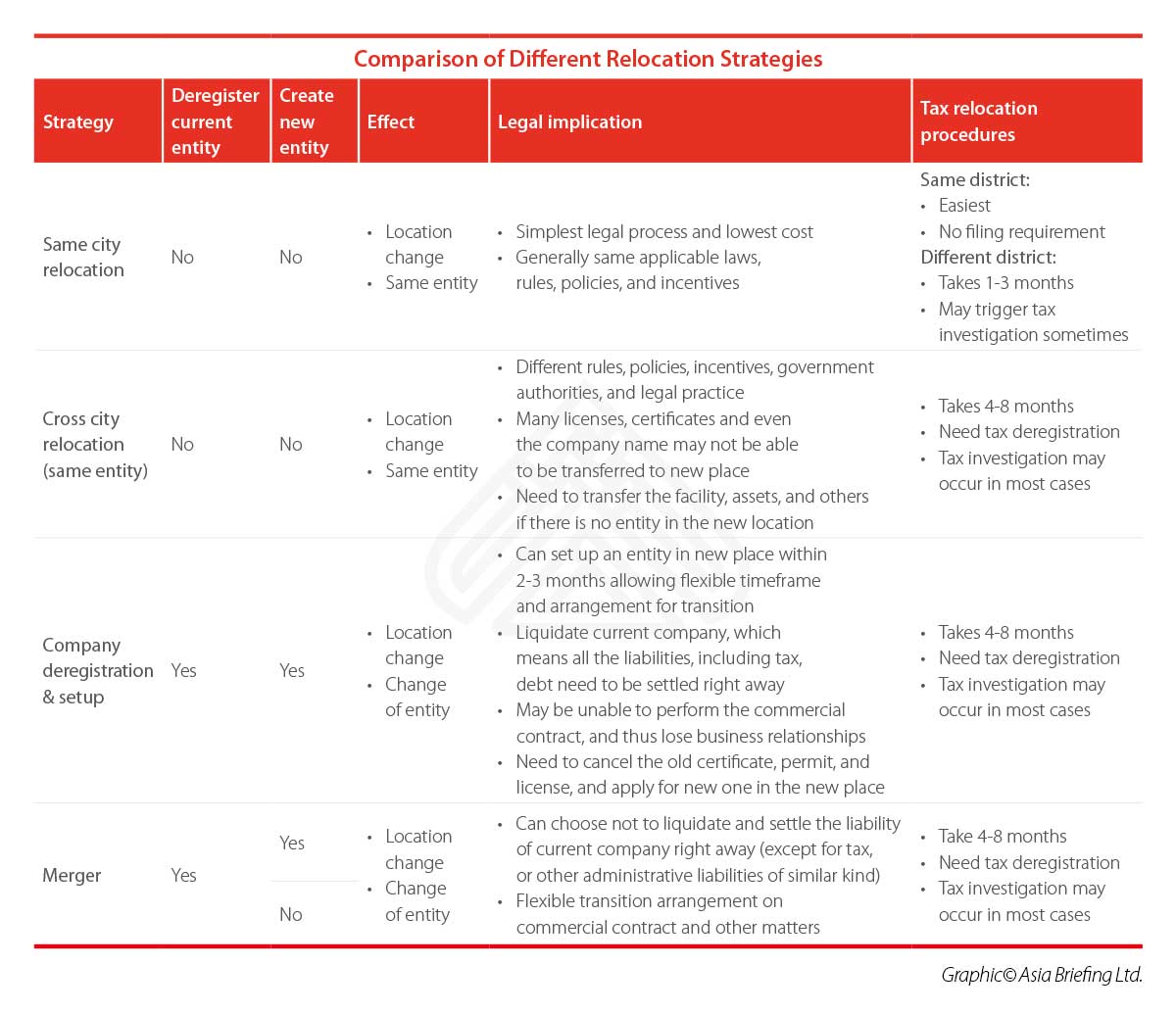

When a business decides to relocate, and picks a site after careful analysis and comparison, the next step is to develop a suitable relocation strategy on the operational level.

This entails a number of regulatory formalities and compliance issues that a business needs to treat carefully ahead of the relocation, namely in regards to legal, tax, and human resource (HR) considerations.

Legal considerations

Same city relocation

When enterprises want to move their operations to a more suitable site within the same city, for example, relocating from downtown to a suburb area, the procedure is quite straightforward.

If the new site is within the same district as the old one, the enterprise just needs to apply to the same government bureaus that they dealt with when establishing.

This includes the local branch of the Ministry of Commerce (MOFOCOM), the local Administration of Industry and Commerce (AIC), tax bureau, local branch of State Administration of Foreign Exchange (SAFE), and Customs (if they have import and export licenses) to make relevant amendments to their business certificates.

If the new site is in another district of the city in charged by different government bureaus, the company will need to apply to government bureaus in two districts to finish the relocation.

Although tax bureaus are often in competition with each other, and no tax officer wants to miss revenue by allowing a lucrative company to relocate to another tax district, the process is in most cases quite smooth, particularly if the enterprises has no bad tax records.

Cross-city relocation

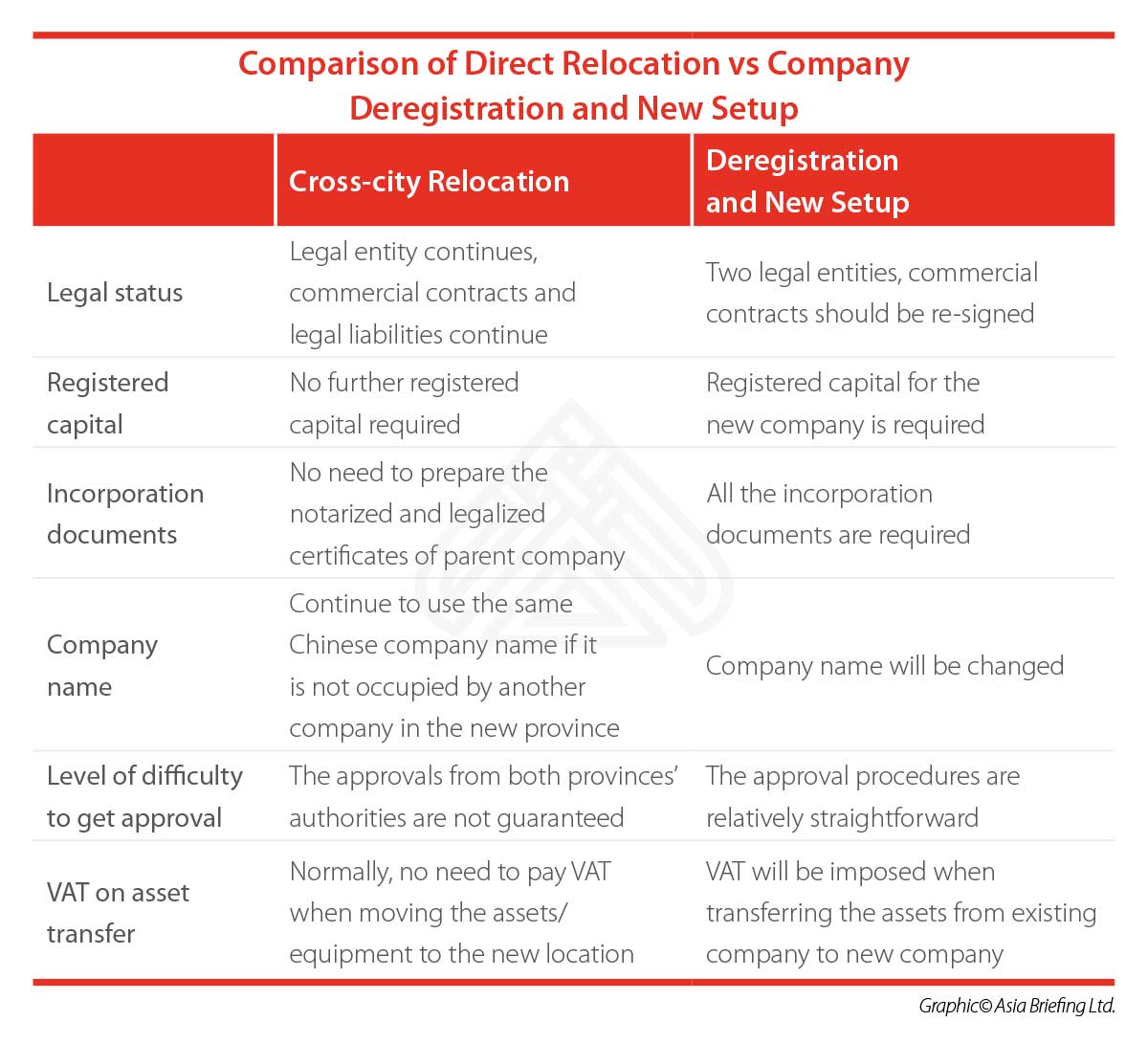

For cross-city relocation, it is more time consuming than moving within the same city. Enterprises should carefully think over what strategy to use to minimize disruption to business as usual.

Direct relocation

Direct relocation might be the most obvious strategy in cross-city relocation, which means just to modify the business address but keep the same entity.

Under this strategy, the enterprise can continue as the same legal entity, which means the commercial contracts it reached with others, and legal liability arising before the relocation will be continued as well.

The company can also continue to use the same Chinese company name in the new place, unless it has been occupied by another company.

Direct relocation follows a chronological order, which means the business must complete certain steps before the next step can be started. Accordingly, it’s unavoidable that there will be some business suspension before everything is back to normal.

Enterprises engaged in sectors that are not “restricted” by the government often follow the procedures presented below.

Company deregistration and new setup

An alternative strategy for cross-city relocation is to deregister the current entity and set up a new entity in the target location.

Under this strategy, the company needs to go through all the incorporation procedures again, and it cannot retain the same company name — all commercial contracts need to be re-signed.

But it allows for a more flexible timeframe because the setup of new entity and deregistration of the old entity can proceed at the same time.

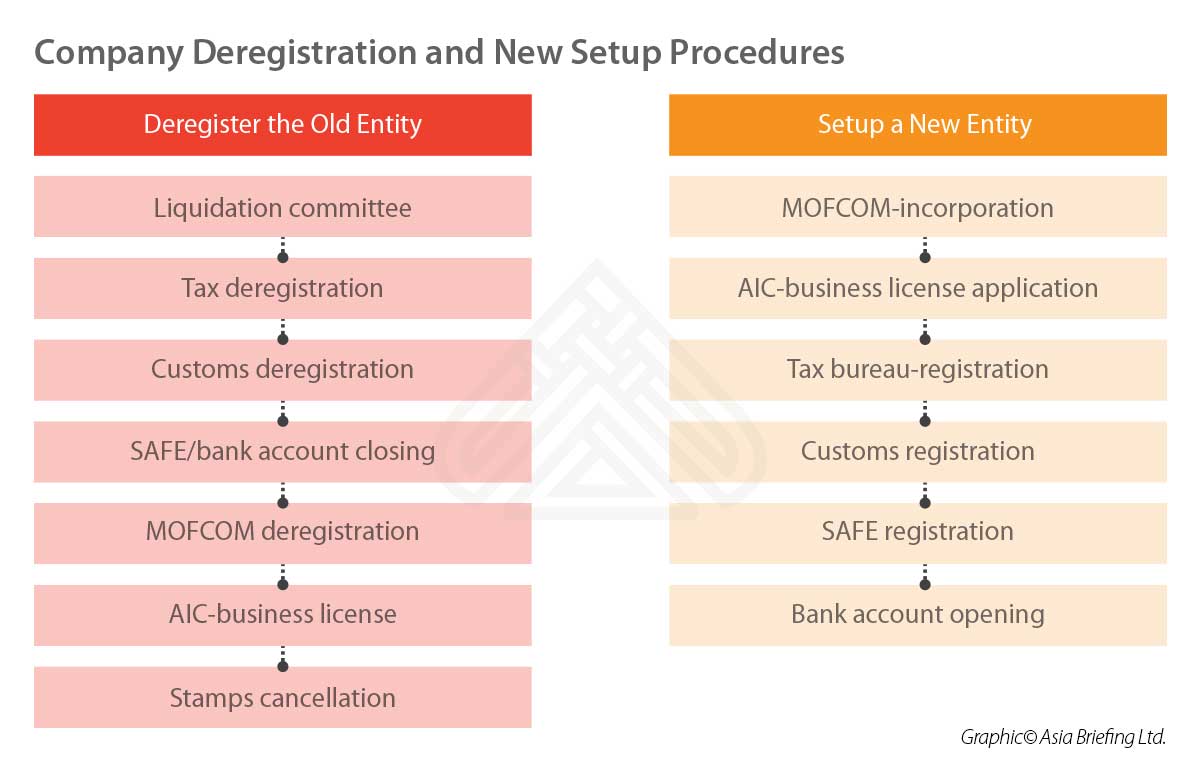

The general procedures are shown below.

Merger

Merger

Another strategy to achieve cross-city relocation is to merge the current entity with an entity in the targeted location.

Under this strategy, the company can choose not to liquidate the current entity right away.

In this case, it can take time to transfer its asset, manage its business relationships, as well as settle its liabilities such as debts and employees. The whole transition process will be quite flexible as a consequence.

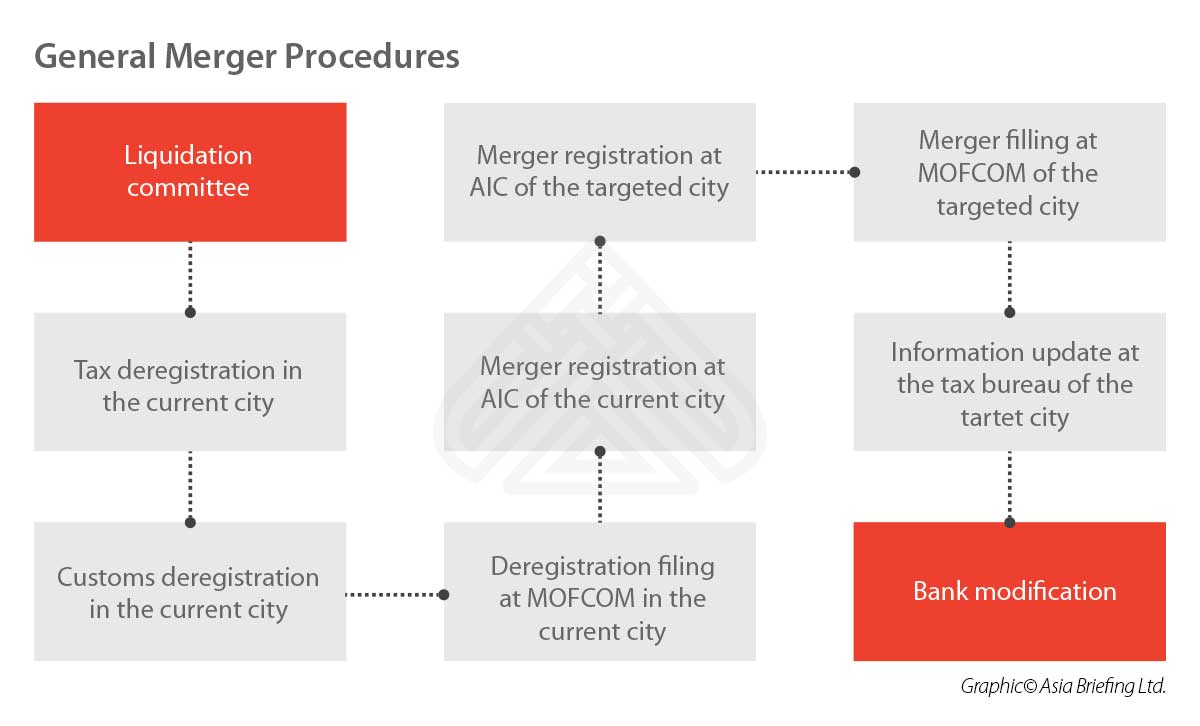

The general merger procedures are below.

Tax considerations

The challenges involved in relocation are largely related to taxation, which is decentralized in China.

Taxes are managed directly by local tax bureaus, and transferring to a new tax district requires the foreign investor to actively coordinate between bureaus in both districts.

Knowing the potential tax issue can make the enterprise better prepared.

Timing of tax deregistration and registration

For enterprises relocating from one tax region to another, it is very important to plan the timing of deregistration with the old tax bureau and registration with the new one.

A company has to return all the unused invoices to the current tax bureau during tax deregistration and cannot issue any kind of new invoices before registration with new tax authorities.

Considering invoices are important evidence to show relevant taxes on transactions have been paid, all on-going transactions will be frozen during this period, and no new transaction can proceed, since no invoice can be issued to the buyers.

If timing of the tax deregistration and reregistration is not planned carefully, the company may run into cash flow issues.

Companies are also advised to pay additional attention if the relocation is planned to start at the end of the year.

If any unforeseeable delay causes the relocation to be completed after December, both suppliers and buyers will likely have difficulties in recording the relevant transactions in the appropriate financial year.

This will affect accounting and tax reporting to a large extent.

Tax health check

The onerous tax deregistration process will be further prolonged if there is any issue spotted by the tax bureau in-charge.

To avoid such risk, enterprises are advised to conduct a tax health check either by internal teams or third-party professionals, before they submit the tax deregistration materials to the tax bureau.

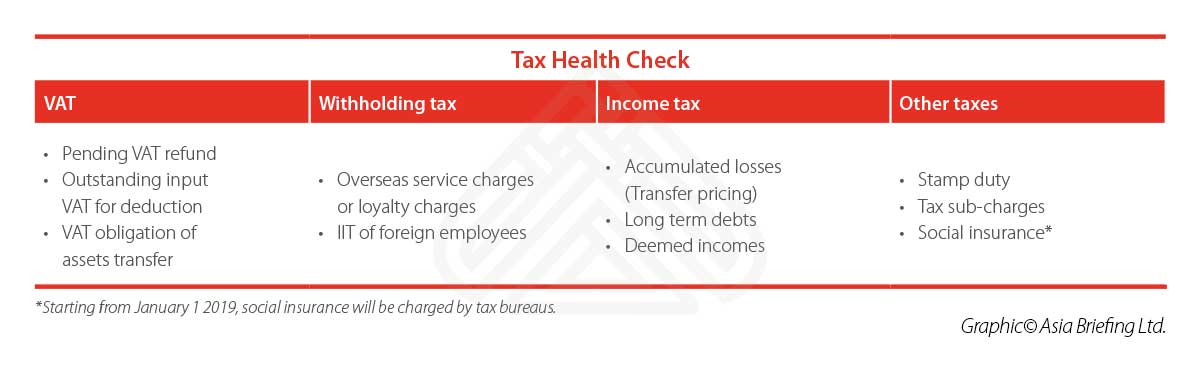

Generally, companies should pay attention to the aspects in the below table.

HR considerations

Based on the relocation strategy adopted by the company, current employees could be managed in different ways.

A company may want to continue the employment relationship to save the hassle of recruitment during same city relocation, which is generally achieved by providing necessary support for new commutes, and amending labor contracts.

A company may want to transfer some employees who they don’t want to lose, or who are too expensive to “lose”, to the new entity under cross city relocation, under which the old labor contract should be terminated and a new labor contract should be signed.

Where the company doesn’t want to bring the current employee to the new place (especially those relocating to a low labor cost area), or the employees are not willing to work in the new place, termination will apply.

In each case, labor disputes may arise, which may bring significant challenges, including:

- Production tasks may not be completed during the interim period if employees do not cooperate;

- Employees might complain to local HR authorities, which can trigger a stringent administrative inspection;

- Employees may complain to company’s business partners, which will impact the business relationship; and,

- Disgruntled management may try to take control of original certificates and seals of the company to disrupt business activities.

Given these risks, we advise companies consider the following:

- Anticipate problems in advance and seek to mitigate risks;

- Draft a good announcement and choose a right timing to release;

- Follow legal stipulations and go through all the legal procedures;

- Compensate employees higher than mandatory requirement;

- Be open and react quickly to employee’s claims during the whole process;

- Ensure the company chops, certificates, and important documents are in safe place, cooperate with government bureaus (if needed); and,

- Pay more attention to the employees who have special conditions, including but not limited to employees on maternity leave, employees with medical treatment period, and employees on a non-fixed term contract.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article China’s 2019 Negative Lists and Encouraged Catalogue for Foreign Investment

- Next Article China’s 5G Roll-Out: What Should Foreign Investors Expect