Why HR Audits are Important for Foreign Companies in China

By Dezan Shira & Associates

Editor: Zolzaya Erdenebileg

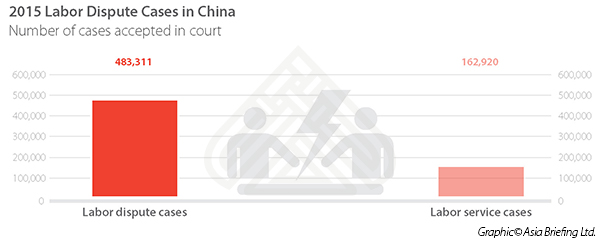

Foreign companies operating in China are increasingly finding themselves in the uncomfortable position of undergoing an internal investigation or encountering a potential labor dispute. According to national statistics released by China’s Supreme People’s Court (SPC), 2015 saw a sharp rise in labor disputes. New labor disputes, meaning disputes that arise during a contractual relationship between employee and employer, accepted by the Chinese courts totaled 483,311 – an increase of 25 percent from 2014. Labor service disputes, meaning disputes arising from “independent contractor” agreements with quasi-employment relationships, totaled 162,920 – an increase of 38.7 percent from 2014.

Labor disputes can be costly, both in terms of money and reputation. Oftentimes, and especially for foreign firms, the issue stems from a lack of HR oversight. An HR audit can reveal such inconsistencies and determine whether or not the company faces any employment-related liabilities.

What is a Human Resources (HR) audit?

Like a financial audit, an HR audit is an independent and objective evaluation of the current state of an organization’s HR policies, practices, documentation, and systems. An HR audit can alert a company about hidden HR-related problems and errors, as well as possible compliance issues against a backdrop of China’s ever-evolving rules and regulations. This can allow an organization to establish best practices, thereby protecting it against possible operational and legal risk.

An HR auditing process can be conducted in-house, but preferably should be carried out by a qualified independent and objective third-party, and should provide the following assurances:

- Compliance with all government regulations;

- Business talent requirements are being met;

- HR management risks are being managed;

- Human capital at the organization adds value to the overall operations of the company.

From the list above, it is clear that HR audits can go beyond ensuring compliance; they can also identify weaknesses in a company’s overall talent structure and streamline inefficiencies.

It is important to regard the HR audit as a diagnostic tool. It can help identify areas of improvement within an organization, but cannot prescribe solutions. The role of the auditor is to give professional advice, but the decision of how to solve the problems will be left up to the organization itself. To make the most of an HR audit, companies must be ready and willing to take the next steps to ameliorate any possible issues that are revealed.

Advantages of conducting HR audits

From carrying out an HR audit, an organization can gain two main advantages: compliance assurance and efficiency review.

- Compliance assurance

In many countries, there are a number of laws that affect each stage of the employment process, from recruitment to onboarding to dismissals. Nowhere is this more true than in the Middle Kingdom, where regulatory changes can happen quickly. As such, it is critical that employers conduct regular assessments of their HR policies and practices.

Additionally, the penalties for overlooking HR regulatory compliance can be costly. If an employer is found to be in violation of HR requirements, then they may face fines and potential HR blacklisting. If a company is blacklisted, it will be listed with the local authority as having had transgressions and could face more scrutiny when hiring, as well as be subject to impromptu checks by the labor authority.

- Efficiency review

An HR audit can also help ensure that company policies and procedures are being followed by HR staff. This is particularly important for foreign companies in China that decide to outsource part or all of their HR operations, and do not have complete oversight over the process.

An audit can reveal the strengths and weaknesses within the HR system. By knowing where the system can be improved, the organization can work to maintain or increase employee satisfaction and decrease costly turnover of staff. By one estimate, losing an employee can cost a company 50 to 150 percent of the said employee’s salary, in addition to the time and effort spent to replace that position.

Who conducts HR audits?

Who conducts HR audits?

An HR audit can be conducted in-house if the organization’s own HR staff have the necessary expertise and know-how. However, the organization should be aware that, if an audit is performed in-house or by outside consultants who are not lawyers, the results of the audit are subject to litigation. Therefore, it is recommended that the organization considers hiring outside legally-qualified counsel to perform the audit. By doing so, it can protect itself through the legal privileges against disclosure.

It is also important to note that the organization is responsible for ensuring HR compliance, and is therefore ultimately responsible for any liabilities that may arise.

RELATED: Payroll and Human Resource Services

RELATED: Payroll and Human Resource Services

Common difficulties encountered during an HR audit

- China’s new legal developments

An audit is a comprehensive and time-consuming task. In China, it can be particularly formidable, given the dynamisms of the country’s legal environment that requires HR professionals to be constantly aware of new regulations. If performing the audit in-house, the main obstacle will be surveying the legal landscape and ensuring that the organization is compliant with all relevant and necessary requirements. Given these difficulties, an outside party may be best placed to objectively review the current status of compliance, and bring additional expertise to the audit.

- Documentation

A particularly prominent issue in China is sufficient record-keeping. For example, since 2008, it has been mandatory in China for employers to keep written contracts with their employees. However, China continues to lack a uniform legal standard for collection, processing, and use of personal information. This can lead to uncertainties in a court of law when it comes to alleged employee misconduct. Additionally, many foreign companies in China keep contracts under the Chinese name of their employees, but daily work is conducted using their English names. If an investigation of such an employee is necessary, it would be very difficult to keep track of that person’s identity.

To aid the process, organizations should be prepared to provide a number of documents and internal policies, as well as feedback from selected members of staff, such as managers and HR personnel. The total amount of effort and time spent on an HR audit will depend on the size and scope of the organization, as well as the availability of necessary documentation. It may be the case that HR documentation is lacking or disorganized. In these cases, the audit will be delayed.

Remember, in China, the burden of proof lies with the employer in the event of a dispute. Therefore, it is imperative that detailed records are kept.

- Company cooperativeness

If the audit is being conducted by an outside source, the HR staff members may feel that they are under scrutiny. In China, this feeling may become magnified in connection to the idea of face, or of reputation and dignity. Some managers may be particularly afraid of losing face, or of facing embarrassment and damaging their reputation, if the audit fi HR irregularities. To avoid this, they may try to cover up existing issues by denying access to information, documentation, or even the company facilities. Additionally, they may try to mislead the auditor about the management styles or procedures that are typically followed at the company.

Frequency of HR audits

It is recommended to conduct HR audits on an annual basis. This may seem infeasible, but in actuality, the regularity of the audit lessens the time and effort needed.

Firstly, the amount of HR documentation needed to be found, compiled, investigated, and analyzed will be lessened if the time between audits is shorter. Secondly, it is less likely that the company will need major changes to its HR policies and procedures if a well-run and efficient audit had been conducted earlier.

HR audits, while time-consuming, can decrease costs, minimize legal liabilities, and streamline the HR processes that a company depends on. In China, where foreign firms must take on many responsibilities in an employer-employee relationship, and where labor disputes are on the rise, reviewing the compliance and efficiency of HR workings can go a long way.

This article is an excerpt from the December issue of China Briefing Magazine, titled “Navigating HR Audits in China.” In this issue of China Briefing magazine, we provide a guide for conducting HR audits in China. We analyze why the HR audit is especially important for foreign companies operating in the country, and then detail the different HR audit models and procedures that are available to firms. This article is an excerpt from the December issue of China Briefing Magazine, titled “Navigating HR Audits in China.” In this issue of China Briefing magazine, we provide a guide for conducting HR audits in China. We analyze why the HR audit is especially important for foreign companies operating in the country, and then detail the different HR audit models and procedures that are available to firms. |

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Human Resources and Payroll in China 2016-2017

Human Resources and Payroll in China 2016-2017

A firm understanding of China’s laws and regulations related to human resources and payroll management is absolutely necessary for foreign businesses in China. This edition of HR and Payroll, updated for 2016/17, navigates China’s laws and regulations related to HR and payroll management – essential information for foreign investors looking to establish or already running a foreign-invested entity in China.

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016, produced in collaboration with the experts at Dezan Shira & Associates, explores the establishment procedures and related considerations of the Representative Office (RO), and two types of Limited Liability Companies: the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV). The guide also includes issues specific to Hong Kong and Singapore holding companies, and details how foreign investors can close a foreign-invested enterprise smoothly in China.

- Previous Article Navigating China’s Temporary Driving License

- Next Article China Market Watch: Holiday Outbound Tourism Surge and the Steel Sector’s Restored Growth