Hainan FTZ Masterplan Released to Establish China’s Biggest Free Trade Port by 2035

On June 1, 2020, Chinese authorities released the Overall Plan for the Construction of Hainan Free Trade Port (“the Masterplan”), a large-scale plan to transform the entire island province into a free trade port (FTP) – making it the largest special economic zone in China.

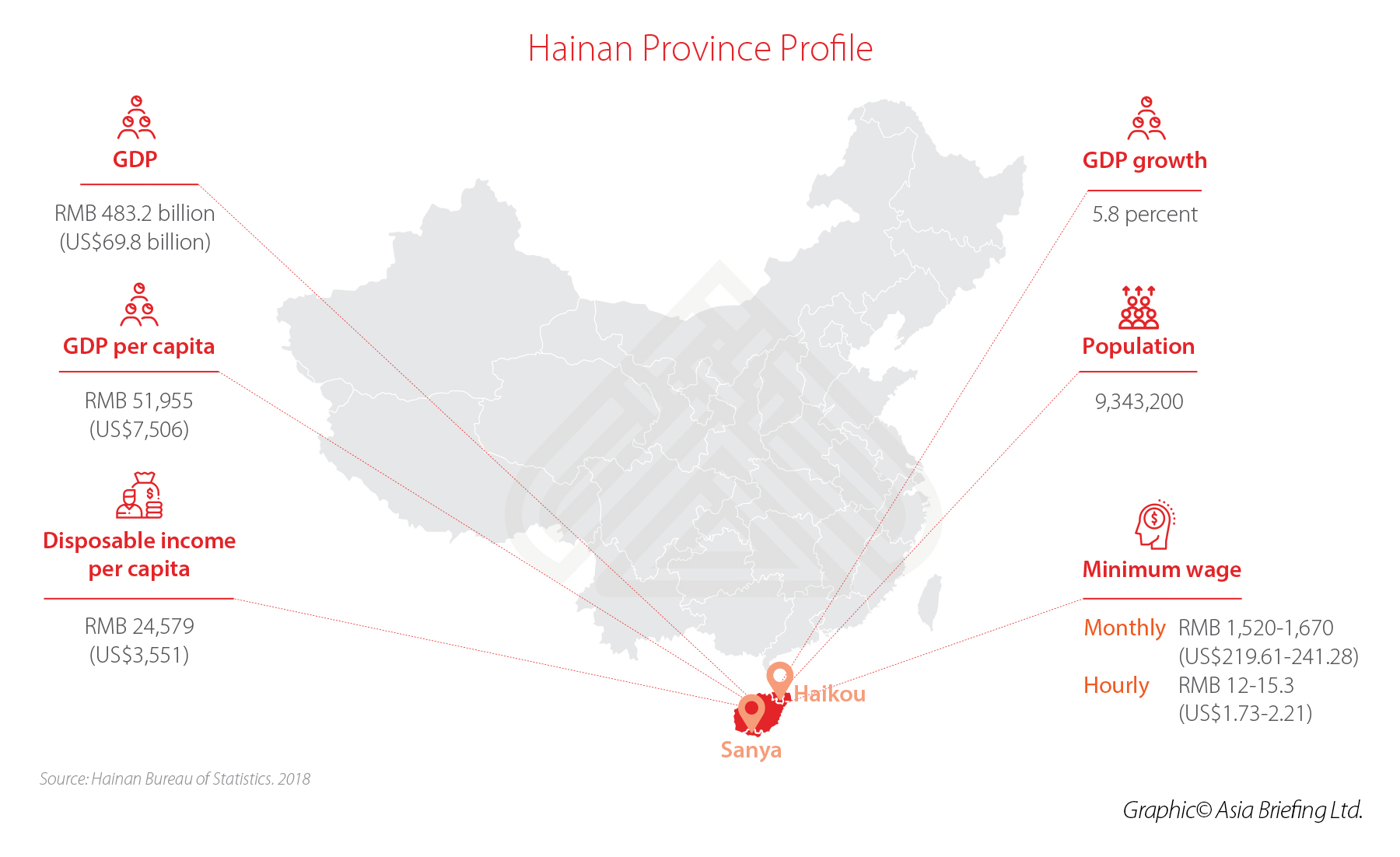

Hainan Province, an island at the southernmost point of China is best known for its sandy beaches and resort-lined coast. Due to its proximity with ASEAN nations, the Hainan FTP acts as a frontline to China’s integration with Southeast Asian countries. This has created new opportunities along China’s Belt and Road Initiative; Hainan will be an important node on what is referred to as the “Maritime Silk Road”.

At start of June, the Central Committee and the State Council jointly released the Masterplan, which laid out a series of special policies for Hainan – scrapping import duties, lowering income tax rates for high-level talent, capping company tax at 15 percent, and relaxing visa requirements for tourist and business travelers.

Collectively, the policies are designed to diversify Hainan’s reliance on traditional industries and to function as a strategic trade and investment destination in China.

For foreign firms, Hainan will provide broader market access – particularly for industries like telecommunications, tourism, and education – in addition to a phased plan for capital account opening and free flow of money between Hainan and overseas markets.

Below we summarize some of the key policies introduced by the Hainan FTP Masterplan.

What’s in the Masterplan?

The Hainan Free Trade Zone will make up the entire island province – being 35,000 km2 in size and encompassing a population of 9.5 million – dwarfing regional competitors Hong Kong and Singapore on both metrics.

The overarching theme of the plan is to liberalize the cross border flows of trade, investment, capital, personnel, transport, and data.

The Masterplan lays out a four-stage timeline for achieving different stages of development:

- By 2020:

- Become an operational FTZ;

- Significantly improve international openness;

- Investment and trade facilitation; legal environment regulation; financial services improvement; a first-class ecological environment; and

- Lay foundation for the construction of the Hainan Free Trade Port.

- By 2025:

- Have the free trade port system basically in place;

- Establish a leading business environment in China;

- Industrial competitiveness significantly improved and risk prevention and control strong and effective; and

- Gradual improvement of the law and regulations adapted for the construction of the free trade ports.

- By 2035

- Have a mature operation of the Hainan Free Trade Port;

- Free and convenient exchange of people, transportation and data;

- Establish a world-leading business environment; and

- Be at the forefront of socialist modernization.

- 2050:

- High-level free trade port with strong international influence established.

Key policies under the Masterplan that investors should pay attention to

1. Liberalization of trade of goods and services

One of the most significant features of the plan is the establishment of the ‘first-line’ and ‘second-line’ customs controls into China.

Goods coming from overseas countries into Hainan will be subject to the ‘first-line’ control system. Here, the Hainan Free Trade Port is responsible for developing a list of goods/articles that are prohibited / restricted from import/export.

Further to this, a catalog of goods will be formulate specifying the goods that will be subject to import duties when entering the free trade port. Goods outside of these lists will be exempt from tariffs and be able to exit and enter the province freely.

While these lists are yet to be established, the plan already specifies various categories of imported goods that will be exempt from import duties, import VAT, and consumption tax:

- Production equipment for enterprises own use;

- Operational vehicles and yachts;

- Raw and auxiliary materials imported for production; and

- Imported good purchased by island residents.

Goods coming from Hainan to mainland China will go through relevant procedures in accordance with relevant import regulations, and customs duties and taxes.

Encouraged industrial enterprises producing goods originating from Hainan that do not contain imported materials or contain imported materials (with added value exceeding 30 percent after domestic proceeding of imported intermediary products) are exempt from import tariffs when entering the rest of China.

For goods coming from mainland, transiting through Hainan and returning to the mainland, no customs processing is needed. They should be loaded and unloaded onto the customs supervised operations site in the free trade port but stored separately from other customs-supervised goods.

In addition to this, the plan says Hainan will establish more special custom supervision regions to help the island implement more flexible import-export management. The island will also establish a convenient and efficient “single window” while dealing with imports and exports with overseas countries.

2. Facilitation of investment, opening-up of key sectors

Equally, the plan prescribes a series of policies aimed at liberalizing the trade of services by implementing a ‘minimum approval’ investment system.

This system will comprise of a special market access list relaxing market access for the Hainan Free Trade Port, as well as a Negative List for foreign investment access.

Broadly speaking, the Masterplan puts in place a system where foreign firms gain broader market access in Hainan. It does so by implementing a new ‘market access commitment and entry system,’ which does the following:

- Establishes a comprehensive filing system;

- Relaxes the licensing and approval requirements for certain investment areas;

- Implements a pre-entry national treatment plus Negative List management for foreign investment – greatly reducing the prohibition and restriction clauses; and

- Encourages the development of an innovative investment management system focusing on streamlining supervision of process through methods such as electronic licenses.

The Masterplan taps into growing opportunities for investors in traditional industries, as well as opening new industries for early development.

Preferential policies for industries have so far come in various shapes and forms. For example, the plan states that by 2025, income acquired from new FDI in tourism, modern services, and high-tech industry enterprises will be exempt from corporate income tax (CIT).

Further, the following industries are said to be subject to opening-up and additional support in establishing within Hainan:

- Telecommunications – remove restrictions on foreign equity ratio on value-added telecommunication services, allow entities to conduct online data processing services with the FTP and internationally and then gradually expand to nationwide, open up basic telecommunications services, roll-out international Internet data exchange pilot projects, build international submarine optical cables and landing points, and set up international communication gateways;

- Financial + insurance industry – support financial institutions to carry out business, such as policy financing, warehouse receipt pledge loan, account receivable pledge loan, intellectual property pledge financing, etc. under the premise of legal compliance and effective prevention of risks;

- Medical insurance – support more financial institutions and overseas institutions to develop cross border medical insurance products;

- Education – allow overseas high-level universities and vocational colleges specialized in science, engineering, agriculture, and medicine to open branch schools independently in Hainan, and assist well-known foreign universities and domestic universities with working together to set up Chinese-foreign cooperatively run schools with independent legal entities; and

- Tourism – proposes the construction of pilot zone for the cruise tourism industry and the yacht industry.

The Masterplan also takes steps to create a better environment for businesses in general, including to strengthen intellectual property right protections and the creation of a more open, fair, and predictable investment environment for all market players.

The document proposes that an internationally competitive taxation system should be established, sticking to the principles of zero tariffs, low tax rates, and simplified taxation systems.

As a way to attract more business operations to Hainan, the Masterplan has rolled out a preferential 15 percent income tax rate for eligible individuals, while CIT for encouraged enterprises will also be capped at 15 percent.

Qualified capital expenditures of enterprises are allowed to be deducted fully in the current period, or enjoy accelerated depreciation/amortization prior to the calculation of the tax payment.

3. Free exchange of people, capital, and data

The Masterplan also makes efforts to ensure the cross border flow funds, through further opening the free trade port’s financial sector and supporting the setup of trading venues for financial products related to energy, shipping, property rights, equities, as well as clearing centers.

Logistics flow was also a key priority in the document. Under the plan, transport flows will be eased in the in the following ways:

- Trial policy of tax rebates to be implemented for the departure of goods through the Yangpu Port for final departure to China;

- Flights and ships to be allowed to refuel with bonded aviation fuel when coming in and out of Hainan; and

- Export tax rebates to be introduced on domestically built ships that are registered at Yangpu Port of China and engaged in international transport.

More accommodating traveling regulations will also be released to encourage talent in high-end industries to stay, reside, or work in the free trade port.

For example, the entry-exit bureau will be tasked with improving the international talent evaluation mechanism, using an individual’s salary level as the main indicator to categorize talents.

A negative list management system will also be implemented in order to regulate the inflow of foreign personnel into the port, guided by a more relaxed entry-exit policy.

The Masterplan will also broaden the effect and scope of the current visa-free entry policy – allowing for the more widespread implementation and extension of the visa-free duration.

On the flow and security of data, China will expand the opening-up of the data field, innovating institutional design, and cultivating and developing the digital economy in the FTP.

Hainan has signaled that it plans to carry out international internet data exchange pilot programs to expand its communication resources and bolster its business landscape.

Hainan Free Trade Port by 2035: The countdown begins

The concept of the Hainan FTP was first proposed in 2017, with the province gaining approval for the draft plan later in 2018.

In the lead up to the Masterplan, an ambitious new medical tourism zone was created in 2019 revitalizing local tourism – a dominant industry in the province.

In 2020, the much-anticipated plan appears to be finally set in motion. Foreign investors can look through the slew of new policies, pilot projects, and wide-scale plans that the government says will be implemented as per a stipulated schedule. The goal being, the establishment of a fully functional Free Trade Port by 2035.

Investors can use the Masterplan as a guidance document to assess which industries will be prioritized for growth and how they can tap into tax incentives and preferential policies.

Businesses should stay updated on the latest developments in Hainan FTP as we expect that further implementation documents will likely be released in coming months to support the policies unveiled in the Masterplan.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Shanghai Free Trade Zone to Pick Up Hong Kong’s US Business if Trump Ditches the Territory

- Next Article China’s Greater Bay Area: Looking Beyond its Flagship Cities