VAT General Taxpayer Status: How and Why

VAT status in China crucial for pre-incorporation financial planning, especially for SMEs

Aug. 27 – One factor to consider when calculating the overall cost of China’s recent VAT reform is whether or not a company should become a general taxpayer or remain a small-scale taxpayer.

Although the VAT rate for small-scale taxpayers is much lower than that for general taxpayers – 3 percent instead of 17 percent (or 13 percent for the import of specific goods) – obtaining the general taxpayer status is still beneficial for companies with considerable annual business turnover, because the status will allow genuinely cost-effective operations by:

- Allowing companies to deduct the input VAT from output VAT; and

- Increasing companies’ range of potential clientele as well as credibility by allowing them to issue VAT receipts (fapiao).

Here, we discuss three questions about VAT general taxpayer status, namely:

- How do you qualify to be a VAT general taxpayer?

- What is the process to become a VAT general taxpayer?

- How can you keep your customers happy during the probation period?

1. How do you qualify to be a VAT general taxpayer?

To qualify to be a VAT general taxpayer, a company must pass the relevant estimated annual taxable turnover threshold, meet stipulated requirements, and meet “soft” unwritten requirements.

Pass the relevant estimated annual taxable turnover threshold

To qualify as a VAT general taxpayer, manufacturing enterprises (those engaged or mainly engaged in goods production or taxable service provision) must have an estimated annual taxable turnover exceeding RMB500,000.

Other types of enterprises (with at least 50 percent of income from wholesale or retail of goods) require an estimated annual taxable turnover exceeding RMB800,000.

Meet stipulated requirements

The State Administration of Taxation (SAT) document “The Management Method of VAT General Taxpayer Qualification Verification (SAT Decree 2),” stipulates that all applicants for general taxpayer status have to meet the following conditions to have their applications proceeding:

- Have fixed premises of production and operation

- Be able to conduct accounting as stipulated by the state

Meet “soft” unwritten requirements

In addition to the official written requirements, additional “soft” unwritten requirements are also commonly found to influence the local tax authority’s judgment on whether or not an applicant is eligible for general taxpayer status. These include:

- Office size/number of employees

- Warehouse (and warehouse location)

- Registered capital

2. What is the process to become a VAT general taxpayer?

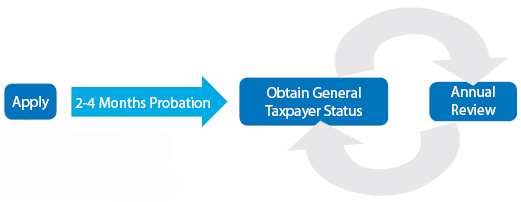

Applying to become a VAT general taxpayer includes an application form, interview and site inspection, a VAT general taxpayer verification form, and fapiao purchase license. Depending on the tax officer and local practice, there is typically a probation period of two to four months before obtaining general taxpayer status and, after obtaining this status, there is an annual review of a company’s eligibility as a VAT general taxpayer.

3. How can you keep your customers happy during probation?

The ability to issue fapiao is a key requirement for conducting business with many Chinese suppliers and clients. However, to conveniently issue fapiao, a company must have fully obtained VAT general taxpayer status.

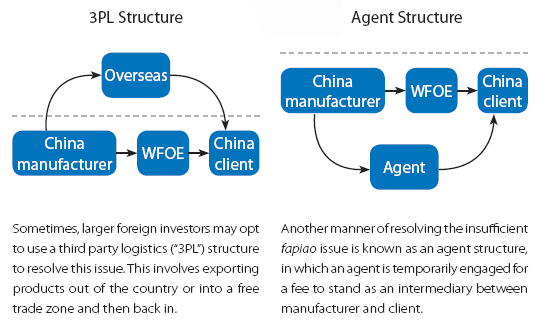

During the probation period for this status, an applicant company can purchase fapiao from the tax authority, but this can generally only be done in limited quantities and requires paying VAT on input VAT when purchasing. As a result, many companies need to find other ways to keep their Chinese suppliers and clients happy.

The best option to resolve the fapiao dilemma is to negotiate with clients to issue fapiaos at a later date. If this is not possible, two additional options are described below.

Portions of this article came from the July/August issue of China Briefing Magazine titled, “VAT Pilot Reform to be Implemented in Beijing and Other Regions from September</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/03/09/six-key-points-regarding-chinas-tax-reforms-in-2012.html" target="_blank">Six Key Points Regarding China’s Tax Reforms in 2012</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/06/20/vat-reform-rates-by-service-type.html" target="_blank">VAT Reform Rates by Service Type</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/06/04/foreign-trade-enterprises-can-still-apply-for-input-vat-credit-certificates.html" target="_blank">Foreign-Trade Enterprises Can Still Apply for Input VAT Credit Certificates</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/05/25/ten-cities-and-provinces-apply-to-participate-in-vat-reform-pilot-scheme.html" target="_blank">Ten Cities and Provinces Apply to Participate in VAT Reform Pilot Scheme</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/08/21/clarification-issued-on-general-taxpayer-recognition-under-vat-pilot-reform-in-beijing-and-7-other-regions.html" target="_blank">VAT Pilot Reform in Beijing and Other Regions: General Taxpayer Recognition</a>" target="_blank">Value-Added Tax Reform.” VAT reform is a confusing transition for many and introduces a number of additional questions, such as exactly what types of input VAT are now deductible. Confusion about the new laws may also allow opportunistic companies to charge higher prices and blame the increase on the tax reform. To add some clarity to the issue – and VAT in general – this issue of China Briefing takes a look at a number of VAT-related questions.

Portions of this article came from the July/August issue of China Briefing Magazine titled, “VAT Pilot Reform to be Implemented in Beijing and Other Regions from September</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/03/09/six-key-points-regarding-chinas-tax-reforms-in-2012.html" target="_blank">Six Key Points Regarding China’s Tax Reforms in 2012</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/06/20/vat-reform-rates-by-service-type.html" target="_blank">VAT Reform Rates by Service Type</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/06/04/foreign-trade-enterprises-can-still-apply-for-input-vat-credit-certificates.html" target="_blank">Foreign-Trade Enterprises Can Still Apply for Input VAT Credit Certificates</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/05/25/ten-cities-and-provinces-apply-to-participate-in-vat-reform-pilot-scheme.html" target="_blank">Ten Cities and Provinces Apply to Participate in VAT Reform Pilot Scheme</a> <a href=https://www.china-briefing.com/news/"https://www.china-briefing.com/news/2012/08/21/clarification-issued-on-general-taxpayer-recognition-under-vat-pilot-reform-in-beijing-and-7-other-regions.html" target="_blank">VAT Pilot Reform in Beijing and Other Regions: General Taxpayer Recognition</a>" target="_blank">Value-Added Tax Reform.” VAT reform is a confusing transition for many and introduces a number of additional questions, such as exactly what types of input VAT are now deductible. Confusion about the new laws may also allow opportunistic companies to charge higher prices and blame the increase on the tax reform. To add some clarity to the issue – and VAT in general – this issue of China Briefing takes a look at a number of VAT-related questions.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

VAT Pilot Reform to be Implemented in Beijing and Other Regions from September

Six Key Points Regarding China’s Tax Reforms in 2012

VAT Reform Rates by Service Type

Foreign-Trade Enterprises Can Still Apply for Input VAT Credit Certificates

Ten Cities and Provinces Apply to Participate in VAT Reform Pilot Scheme

VAT Pilot Reform in Beijing and Other Regions: General Taxpayer Recognition

- Previous Article Jiangsu Province Issues Guidance on General Taxpayer Recognition

- Next Article China Online – What to Read