GBA’s Shenzhen Qianhai Extends 15% CIT for Qualified Enterprises Until End of 2025

Qualified enterprises engaged in encouraged industries in Shenzhen Qianhai Area can enjoy a reduced CIT rate of 15 percent for five more years, to December 31, 2025.

On July 9, 2021, the Ministry of Finance (MOF) and the State Taxation Administration (STA) announced the Notice on the Continuation of Corporate Income Tax Preferential Policy in Shenzhen Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone.

From January 1, 2021 to December 31, 2025, qualified enterprises engaged in encouraged industries in Shenzhen Qianhai are able to enjoy a reduced CIT rate of 15 percent – China’s national CIT rate is 25 percent.

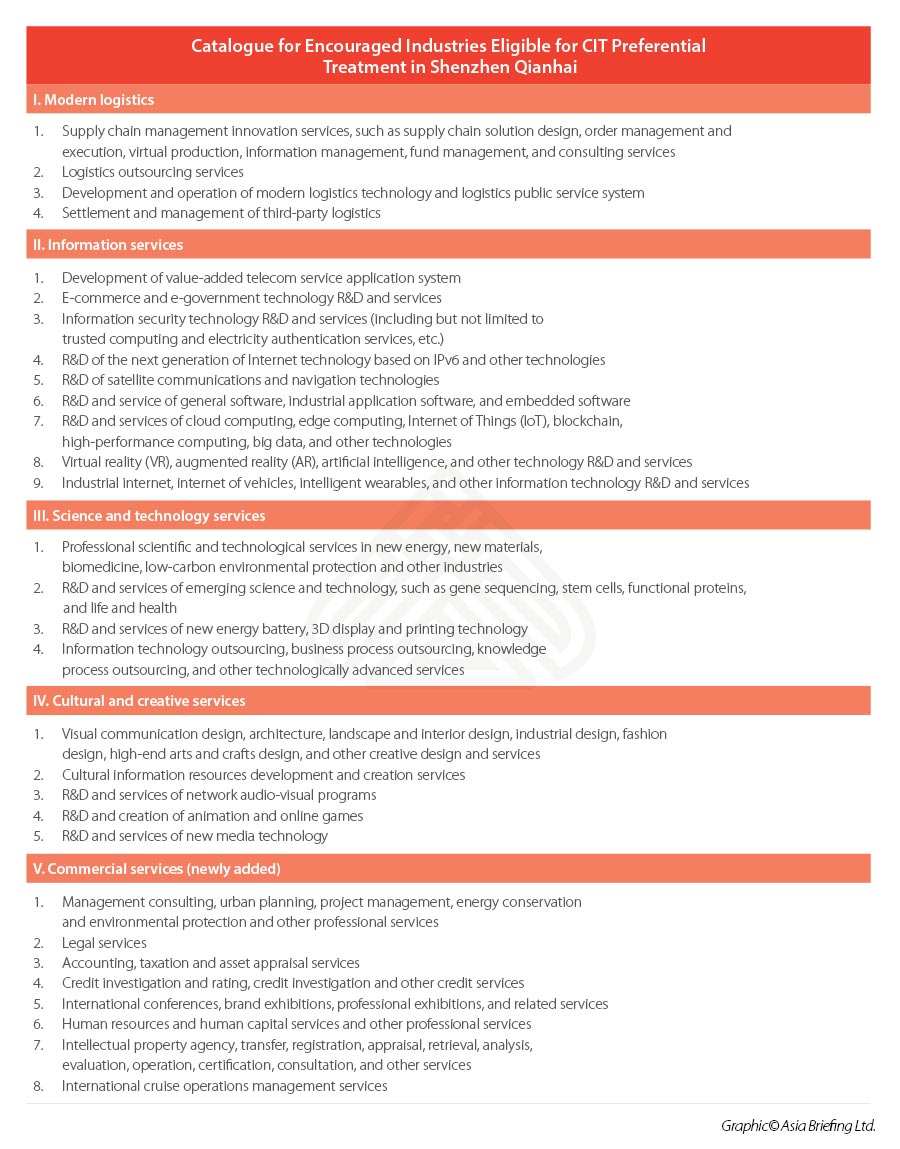

Foreign-invested enterprises (FIEs) can refer to the 2021 Version of the Catalogue for Encouraged Industries Eligible for CIT Preferential Treatment (“CIT Preferential Catalogue”) to check whether they are engaged in the encouraged industries.

In general, Qianhai’s new CIT Preferential Catalogue covers 30 sectors under five broad industry categories – modern logistics, information services, technology services, cultural and creative industries, and commercial services. The new version has been expanded from the previous 21 sectors under four broad industry categories.

Enterprises should first conduct a self-assessment to determine whether its main businesses fall under the above Catalogue. The Notice requires that the revenue from the enterprise’s main businesses must account for at least 60 percent of their total revenue.

Besides, where enterprises have established branches respectively in and outside the area, the preferential rate of CIT is applicable only to the revenue of the branches established within the area.

Previously, from January 1, 2014 to December 31, 2020, FIEs established in Shenzhen Qianhai Area, Zhuhai Hengqin Area, and Fujian Pingtan Area were eligible for a reduced CIT rate of 15 percent if they were engaged in the encouraged industries listed in the respective area’s Preferential CIT Catalogue, according to Cai Shui [2014] No.26. The revenue from the main businesses was required to make up at least 70 percent of the enterprise’s overall revenue.

Now, Shenzhen Qianhai Area has extended the validity of the CIT preferential treatment until the end of 2025, expanded the Preferential CIT Catalogue, and relaxed the requirement on the proportion of the main businesses.

China Briefing has been tracking the latest news on CIT incentives in the Greater Bay Area. Our parent company, Dezan Shira & Associates, has an experienced team of business intelligence consultants, tax accountants, and lawyers based in the GBA and can advice on options for investing in Qianhai as well as emerging and attractive sector-based opportunities. Please contact us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Latest Corporate Income Tax Update for Six Items: Q&A

- Next Article How to Protect Your Intellectual Property Rights in China?