Mandatory Social Welfare Benefits for Chinese Employees

An overview of social welfare obligations and costs for employers of Chinese staff

By Adam Livermore

Feb. 21 – This week, China Briefing is running a special human resources theme concerning the employment of staff in China. We will be featuring topics such as regional industry clusters, minimum wage levels compared on a national basis, employee termination procedures and costs, in addition to looking at how to arrange employment for Chinese nationals overseas.

Feb. 21 – This week, China Briefing is running a special human resources theme concerning the employment of staff in China. We will be featuring topics such as regional industry clusters, minimum wage levels compared on a national basis, employee termination procedures and costs, in addition to looking at how to arrange employment for Chinese nationals overseas.

Today we look at the various issues that employers must consider when hiring permanent staff in China, and outline the full social security package that must be made to Chinese employees.

New Social Insurance Law

On July 1, 2011, China implemented its new Social Insurance Law (“new law”) with three main objectives in mind:

- Take more direct control over the funds contributed to the system;

- Tighten administration so that companies are compelled to make contributions in full; and

- Improve the overall social security safety net for Chinese residents.

Of these objectives, the third can be considered the ultimate goal and the first and second a means by which to meet this goal. The Chinese government is acutely aware that in the long term it cannot rely on foreign investment, a cheap labor force and heavy fiscal spending to continue to drive the economy. What is lacking is an appropriate amount of domestic spending by Chinese households.

One major reason that Chinese people are reluctant to spend is the lack of an effective safety net in the event something undesirable happens to them or to a family member, as well as a general distrust that funds contributed for mandatory pension will still be available when they reach retirement age. Instead they save, and a side-effect of this phenomenon is that, in the absence of alternative avenues to invest the money that is being hoarded by Chinese households, too much of the money is flowing into unsustainable real estate investment, creating a potentially dangerous bubble.

By overhauling the social security system, the government is making an effort to address the problems mentioned above as well as related issues affecting Chinese society in recent years. However, as always in China, the difficulty is in the implementation.

The Five “Insurances” Plus the Housing Fund

The five “insurances” covered by the mandatory welfare system refer to: pension, medical, work-related injury, unemployment and maternity insurances, which have been part of the existing social security framework in China for a number of years now. In addition, housing fund contributions are generally included within the scope of mandatory welfare because the additional costs are mandatory and come from both the employer and the employee.

Below, we look at the costs and benefits of the Chinese insurance system one by one. However, before commencing the analysis in detail we should point out an important concept that will largely influence the potential costs to both employer and employee.

The concept we refer to is the ceiling on the amount used when calculating social insurance contributions. At the time of writing this document, most cities in China implement a ceiling (or cap) on contributions. The calculation for the ceiling figure is usually the average monthly social salary over the previous year for that city multiplied by 300 percent. Therefore, the actual percentage contribution for employers and employees is lower than the percentages indicated below when the individual is a particularly high earner. As a general rule of thumb, the further the salary increases above RMB12,000, the lower the effective percentage that needs to be contributed.

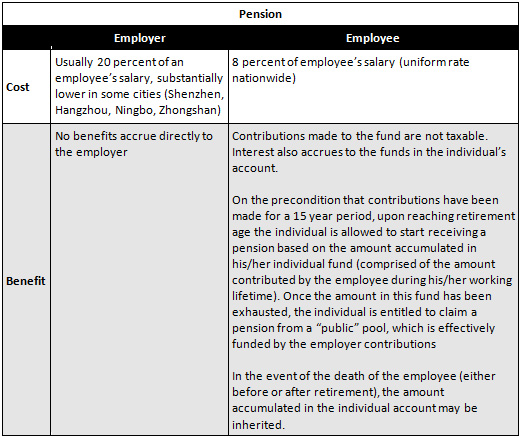

1. Pension

Interestingly, the new law makes a clear distinction between employers (who must make contributions based on the total wages paid to all their employees),and individuals (who make contributions based on their gross salary). There is speculation that the legislation has been drafted in a way to allow the removal of the employer’s contribution cap in the future. However, at the time of writing the effective contribution bases for both employer and employee remain identical

The new law also clarifies that employees who move from one jurisdiction to another will be able to transfer their pension funds, and that when they retire they will be able to receive a pension based on the entire amount of their accumulated funds. However, the specific method for calculation when “merging” these funds will be detailed in a separate piece of legislation that has not been finalized yet.

This aspect of the new Social Insurance Law addresses one of the most serious problems under the current system. The lack of transparency for individuals relating to treatment of their pension often dissuades them from transferring to jobs outside of the city they are living in. This in turn reduces the overall mobility of labor, which is a major problem in a society that lacks sufficient skilled workers across the country.

Implementation challenge for consolidation of pension funds nationwide

Merging pension pools under a central administration is going to be an arduous task. The groundwork has been done by the central government in passing and implementing this law, but cooperation and agreement between the innumerable local governments concerning the practicalities of these transfers will be time-consuming. It is unlikely that China will be able to realize the ambition of the central government to ensure a smooth transition of pension funds between jurisdictions for several more years.

The new law also refers to introducing a pension system for rural workers, even opening up the possibility of merging the system with the urban pension system in the future. This provision is aimed at reducing the effect of the hukou system, which limits the options available to the rural Chinese population and is a source of much dissatisfaction in China in recent years. Again, realization of an effective integrated system still seems a long way off, and the law provides only the direction without specifying tangible methods of reaching this ideal situation.

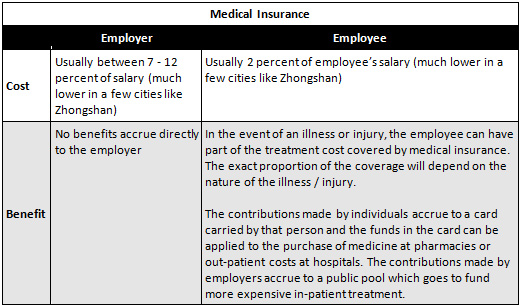

2. Medical Insurance

Similar to improvements mentioned in the pension system above, the government is intending to enhance the overall operation of the Chinese healthcare system. One particular point of note is that the medical insurance fund will be responsible for directly refunding medical expenses to the hospital that carries out the treatment, avoiding the situation that happens frequently where the patient has to first pay treatment fees in advance and later receive compensation from the fund.

The current system has a particular weakness in that when an employee travels and becomes sick or injured in an area remote from his/her administrative jurisdiction, there are considerable complications when paying for the treatment and getting reimbursed by the insurance fund. Article 29 specifically proposes to resolve this solution through creating administrative units to process such payments directly from medical funds to medical institutions. Once again, this may take a long time to realize in practice.

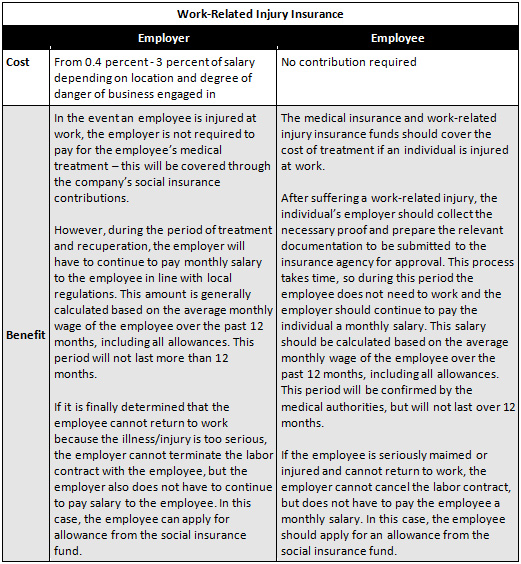

3. Work-Related Injury Insurance

The law mainly concerns itself with the circumstances under which compensation will be provided, and clarifies which payments will come from the work-injury funds and which payments from other funds, such as pension.

The most important point relates to the government’s commitment to ensure provision of treatment for work-related illness or injury even in the absence of contributions made by employers. The law states clearly that it is the employers that must make the contributions, but in the absence of such contributions the employee can still claim the relevant treatment expense, the administrative agency is then obligated to chase up the employer for the cost of the treatment (as well as, presumably, outstanding work injury insurance contributions).

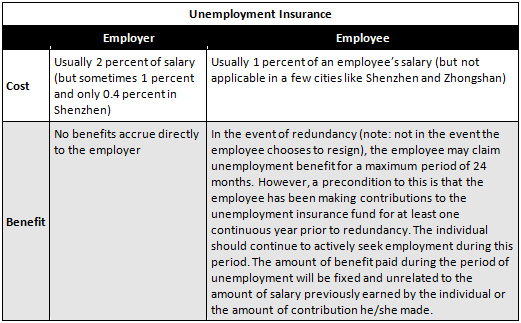

4. Unemployment Insurance

Most of the law is simply a generalization of previous laws and circulars. Key points include the length of time that unemployed people may claim benefit (depending on the amount of time they worked) and the amount they may receive (to be designated locally, but not related to the salary they used to receive / the premiums they paid while employed).

One point that has been included to resolve a particular problem is an obligation on the employer to provide the “termination of employment” evidence to the employee within 15 days of his/her release from the company. This is to resolve a particular problem whereby the employer refuses to release such a document for some reason, putting the terminated employee under unreasonable pressure because without this document they cannot start claiming unemployment benefit.

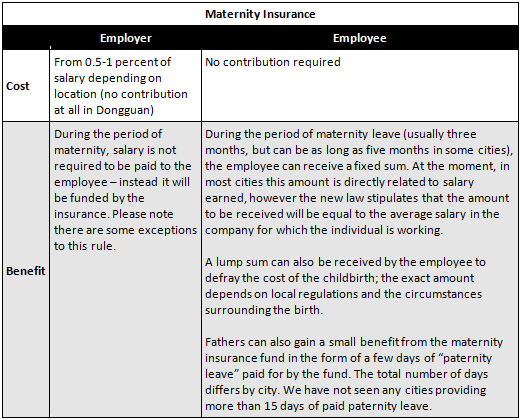

5. Maternity Insurance

There has been an important change to the rules here. Article 56 of the new law states that monthly payments from the insurance fund to women during their maternity leave will be made based on the average salary paid by the company to its employees. This is in contrast to the previous practice, where the woman on maternity leave received an amount equal to her salary (as defined by the social insurance contributions made by the company prior to her maternity).

This change will also have a couple of interesting side effects. The first will be that employees will become aware of the average salary paid in the company. This will cause issues of confidentiality (especially for small organizations) and also possibly encourage certain employees to seek salary increases to what they consider to be “fair” levels – no valued employee wants to know that they are earning way below the company’s average salary!

Secondly, this policy could encourage a trend of “maternity arbitrage,” where employees who expect to become pregnant in the near future consciously look for work at a company paying a high average salary. This situation is likely to be more prevalent in cities such as Dalian, which provides a total of five months of maternity leave to employees, as the financial benefit to an individual of taking maternity leave would be higher. We can take the case of an individual leaving a company paying an average salary of RMB3,000 and joining a company paying an average salary of RMB9,000. The switch would potentially benefit such an employee by RMB30,000.

More recently, Beijing’s Human Resources and Social Security Bureau released the “Circular on Adjusting the Municipal Maternity Insurance Policy for Employees (jingrensheyifa [2011] No.334)” on December 20, 2011, clarifying a few loose ends. Under the new calculation system, female employees working in the city will receive compensation according to the combined average monthly salary of all company employees during the previous calendar year. Furthermore, if a female employee’s actual monthly salary level is higher than the company’s combined average monthly salary, the company shall make up the difference in the two amounts; eliminating concerns over the possibility that senior-level employees may end up receiving less benefits during their maternity leave. Whether this policy is rolled out on a national basis remains to be seen.

6. Housing Fund

China’s housing fund, although in the strictest sense not a kind of social welfare, is generally included within the scope of social security because the contributions are mandatory and come from both the employer and the employee (apart from in some special areas like Shenzhen, where the employee does not need to make a contribution).

As its name suggests, the housing fund is designed to ensure that workers save some money in order to purchase a house or an apartment. The employer will usually have to contribute between 7 percent and 13 percent of the employee’s salary. In many cities, the employee matches this contribution with an equal contribution of their own, although certain cities have different policies.

It is possible in many cities to make housing fund contributions in excess of 300 percent of the local social average salary for an employee. The limit is generally 500 percent, although some cities do not set a limit at all. The portion over 300 percent will be deemed as taxable income of the employee. The key point for employers to note is that if you hire employees earning a salary of higher than 300 percent of the local social average salary, you should make sure to clarify in the offer letter that both employee and employer contributions will be limited by this cap. This can avoid potential problems in the future if the employee claims that higher contributions should be made.

When the employee wishes to purchase a house, the money in the housing fund can be used to pay the initial down-payment on the house, and it can also be used to subsequently pay back the loan to the bank. Furthermore, by producing evidence that funds have been accumulated in an individual’s housing fund, the bank may provide a lower rate of interest on the loan. Upon retirement, any remaining balance in the housing fund account can be withdrawn and used for any purpose by the individual.

Final Thoughts

The above summary covers the main scope of the first 56 articles of the new Social Insurance Law. The remaining 42 clauses relate mainly to methods of strengthening collection and the responsibilities and liabilities of the various government organs that collect and handle these funds. These clauses reflect the importance the government attaches to transparency. They realize that there is general public distrust relating to the current usage of funds, and have addressed some of the issues in this law.

For instance, Article 80 is quite interesting. It proposes that committees be setup consisting of employers, social insurance participants and trade unions, legal experts and economic experts to oversee the management of these funds as supervisory bodies. That sounds very promising in theory. How these committees are formed in practice will determine how much transparency is injected into the system.

Despite all the legal provisions aimed at enhancing transparency and creating a more healthy system, the law can be accused of lacking teeth. For instance, Article 87 and Article 88 impose punishments for organizations or individuals that make fraudulent claims or forge documents. However the fines imposed on such organizations or individuals are restricted to 200 percent to 500 percent of the amount of the claim made, hardly a punitive punishment. There may be organizations and/or individuals that come to the conclusion that the punishment does not adequately fit the crime, and will continue to abuse the system.

Dezan Shira & Associates is a specialist foreign direct investment practice and can advise international companies investing in China on the country’s complete legal, tax and operational issues. The firm was established in 1992 and maintains 12 offices throughout China, in addition to practicing in Hong Kong, India, Vietnam and Singapore. The firm’s China-based HR Director Adam Livermore can advise on all matters of China HR, payroll and costs. Please contact the firm at china@dezshira.com or visit our web site at www.dezshira.com.

Related Reading

China’s Social Insurance Law

China’s Social Insurance Law

A summary of some of the key points in the newly implemented Social Insurance Law, which covers a great deal more than just incorporating foreigners into the system. We explain the costs and benefits of participation by foreign employees to both companies and individuals as well as take a look at some of the trends across the country relating to the implementation of the law.

Human Resources in China

Human Resources in China

Specifically designed to cover the most important issues relating to managing a Chinese workforce, this guide details the HR issues that both local managers in China and investors looking to establish a presence on the mainland should be aware about.

Calculating Overtime Payments in China

China Vows to Increase Wages and Improve Employment

Shenzhen, Beijing Raise Minimum Wage Standards

Zhejiang New Minimum Wage Standards to be Set in line with GDP Per Capita

Migrant Workers in China Demand More from Employers

Meal Breaks and Days Off as Part of China Wages?

- Previous Article SAT: Overtime Payments are Subject to IIT

- Next Article Local Governments Reduce Tax Burdens for Entertainment Industry