Investing in China’s Medical Device Industry, Part 2

By Zhou Qian, Kyle Freeman and Matthew Zito

By Zhou Qian, Kyle Freeman and Matthew Zito

Investing in China’s Medical Device Industry, Part 1

Licensing regime

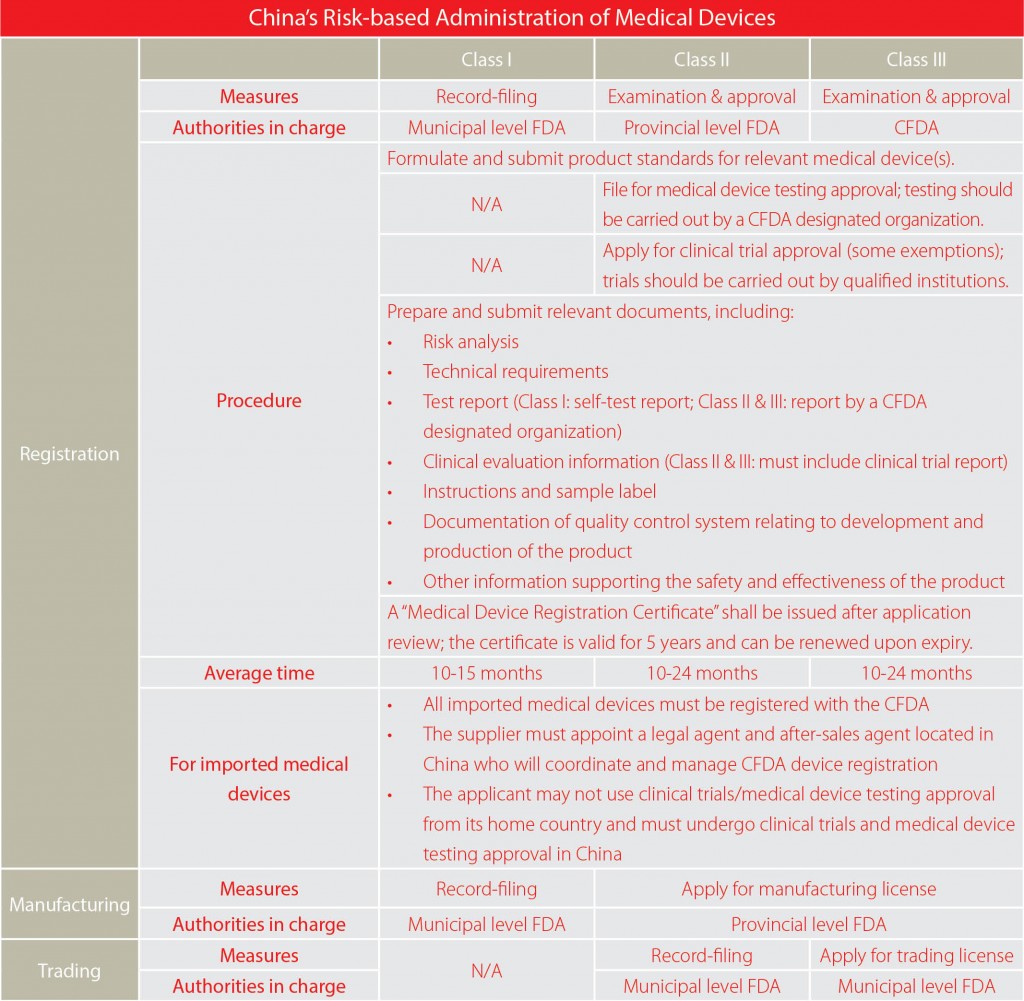

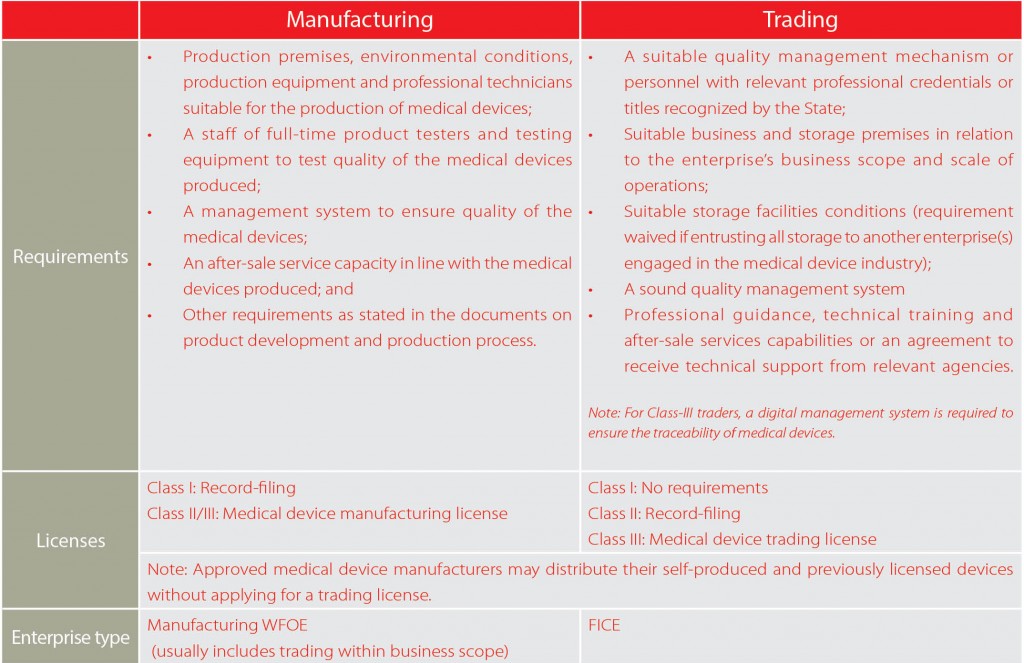

Generally, any business entity engaged in medical device manufacturing or trading must obtain specific licenses in addition to the normal business licenses, the procedures and requirements of which are quite different depending on the classification into which the device falls. In addition, all the medical devices are required to be registered with the relevant authorities. Following the amended regulation State Council Order No.650, applicants are no longer required to obtain a medical device manufacturing license before medical devices registration provided that they are fully in compliance with good manufacturing practices requirements during product design and development. That is to say, the R&D-based companies can apply for products registration without building up manufacturing facilities, which will save them a substantial amount of time and resources.

Considering the diversity and complexity of the administrative measures for three classes of medical devices, we develop the following charts to help you better understand the process.

Market entry by setting up new entities

Setting up a new entity is the most straightforward way to enter into the medical devices industry of China. According to the Guidance Catalogue for Foreign Investment Industries (2011), the previous restriction on the manufacturing of non-auto-disposable syringes, infusion sets, blood transfusion devices and blood bags has been removed. This is to say, foreign investors are currently allowed to manufacture and distribute any kinds of medical devices. Some high-ends devices are particular listed in the encouraged catalogue, such as electronic, fundus cameras, key components of medical imaging equipment, (3D) ultrasonic transducers for medical use, hemodialysis machines and hemofiltration machines. Foreign investors can either set up manufacturing entities in China to become a domestic player, or just begin a trading company to promote their products.

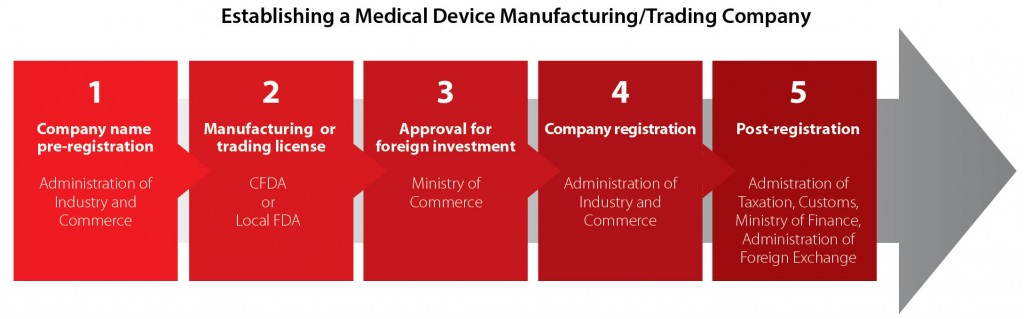

The flow chart below illustrates the general establishment process for a medical device manufacturing or trading company.

The decision between setting up a manufacturing company or a trading company is by no means straightforward. Foreign investors need to consider many issues, normally including tax, governmental procedures and permits, IP protection, legal liability. In the following part of this article, we present most relevant information of setting up a medical device manufacturing company and trading company, to help you have a better understanding of how to invest in China’s medical device industry. Note that a manufacturing WFOE can have a trading scope, but trading companies face different issues than manufacturers because they typically import products.

Conclusion

As China’s population ages and its living standards improve, the demand for medical devices is only set to increase. One of the many ways the Chinese government aims to improve healthcare is by encouraging the production and development of medical devices. With local manufacturers still lacking the know-how to produce a large part of the country’s needs, China offers fantastic opportunities for foreign investors in the medical sector.

This article is an excerpt from the November issue of China Briefing Magazine, titled “China Investment Roadmap: The Medical Device Industry.” In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond. This article is an excerpt from the November issue of China Briefing Magazine, titled “China Investment Roadmap: The Medical Device Industry.” In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond. |

![]()

China Retail Industry Report 2014

China Retail Industry Report 2014

In this special edition of China Briefing, we provide an overview of the retail industry in China and the procedures for setting up a retail shop, focusing specifically on brick-and-mortar physical retail stores. Further, we have invited our partner Direct HR to offer some insights on the talent landscape in the retail industry, as well as tips for recruiting retail personnel in China.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

Revisiting the Shanghai Free Trade Zone: A Year of Reforms

In this issue of China Briefing, we revisit the Shanghai FTZ and its preferential environment for foreign investment. In the first three articles, we highlight the many changes that have been introduced in the Zone’s first year of operations, including the 2014 Revised Negative List, as well as new measures relating to alternative dispute resolution, cash pooling, and logistics. Lastly, we include a case study of a foreign company successfully utilizing the Shanghai FTZ to access the Outbound Tourism Industry.

- Previous Article China Compliance Issues For Foreign Investors

- Next Article China Announces Official 2015 National Holiday Schedule