Mobile Payments in China: Why Foreign Businesses Should Adopt a Strategy

Every country in the world has its own way of doing things, ranging from the type of food they eat to how they socialize with their friends to how they pay for things.

The way Chinese consumers pay for things has evolved dynamically and very differently from the experience of Western countries.

In most Western countries, the mode of making payments went from cash to checks to using credit and debit cards to contactless cards, and now slowly transitioning to mobile payments.

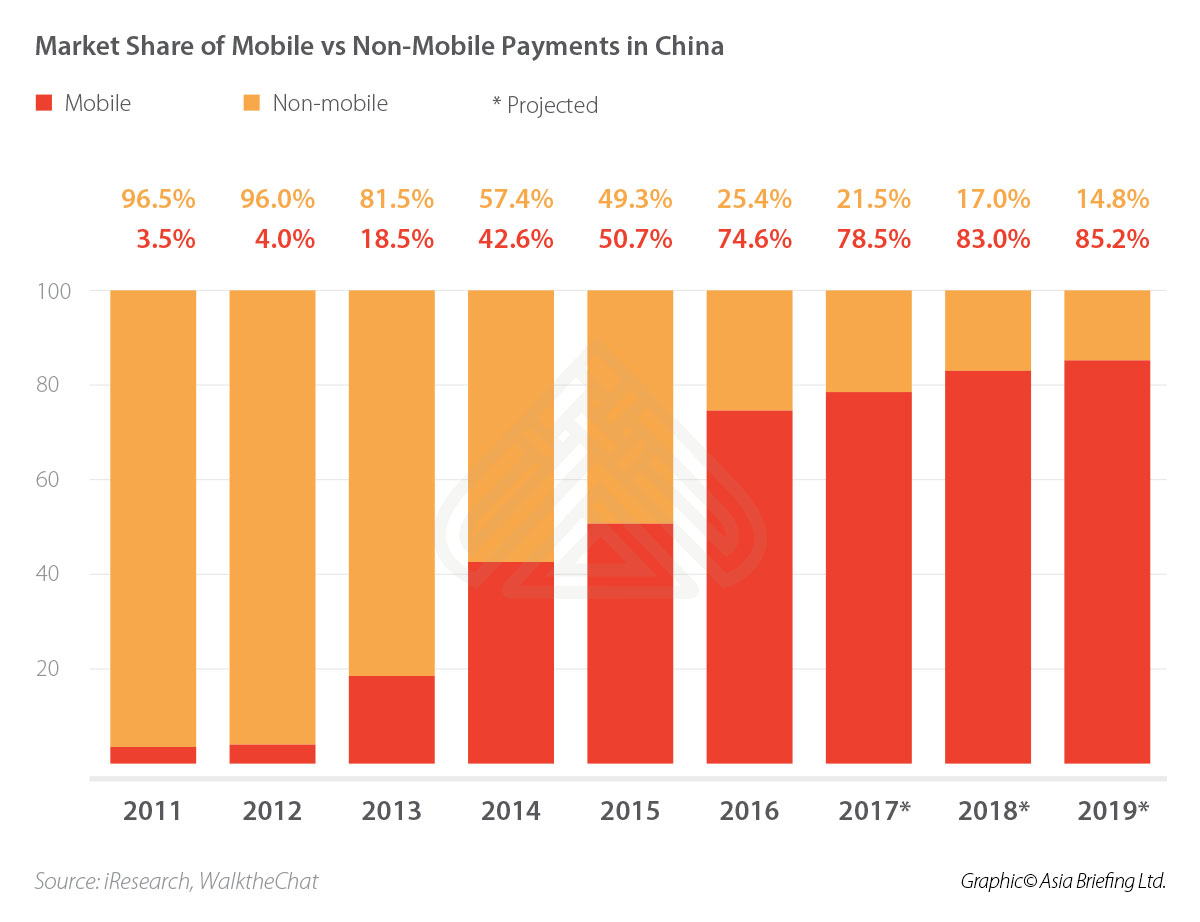

Compare this evolution to the experience in China, where in 2012, 96 percent of payments were still made in cash; growth in mobile payments only started in 2014. Fast forward to 2018, 85.2 percent of payments are made via mobile payment modes, which shows how quickly the Chinese market has evolved.

To put this into perspective, in 2016, mobile payments in China reached US$8.6 trillion compared to only US$63 billion in the US – a difference of nearly 140 times.

Given the prevalence of mobile payments in China, foreign investors would do well to develop a strategy to incorporate them into their businesses.

Major players

In China, two players dominate the mobile payments market – with a combined market share of 92 percent. They are Alipay, an Alibaba Holding Group Ltd. Subsidiary, and Ten Pay (or WeChat Pay), a Tencent subsidiary.

Alipay is used by Alibaba’s e-commerce network, in the same way that eBay uses PayPal.

The Ten Pay system was only launched in 2013 and since then has been quickly catching up to its big rival. Ten Pay is available through the app WeChat (or Weixin in Chinese), which is the most popular social media app in China with more than one billion users.

At the end of 2015, Ten Pay only had 15.9 percent of the mobile payments market share. In 2016, it managed to secure more than double that market share to reach 37 percent.

Alipay still enjoys a majority market share at 55 percent; the remaining eight percent is filled by smaller players like 1qianbao, Union Mobile Pay, and JD Wallet, among others.

How do these mobile payments work?

Quick Response (QR) codes dominate the Chinese mobile payment market – used mainly by Alipay and Ten Pay.

There are two different ways the QR payment can work, depending on the who the vendor is.

One way is for the buyer to scan the vendor´s QR code, which is usually printed and somewhere visible on the till. The payment app will recognize the vendor and the buyer enters the payable amount and completes the payment. This is a popular method if the vendor is a small local shop or taxi driver, as they won´t have the resources to invest in a QR reader.

The second way is for the vendor to scan the buyer’s QR code displayed on their smartphone. This QR code is generated through the payment app and when the vendor’s QR reader recognizes it, they will enter the payable amount that is then deducted from your mobile wallet. This method is used by bigger companies that have invested in a QR scanner.

QR payments have several benefits, the main one being that they will work with any smartphone. This is not the case with its Western competitor technology, Near Field Communication (NFC), which is used by Apple Pay and Samsung Pay – and works only with phones that are NFC technology-enabled.

This means that the growth potential of QR payments in emerging economies is much larger. In 2016, the mobile payment transaction volume grew by over 380 percent and industry experts expect this volume to grow at a rate of 68 percent over the next two years.

Even though the opportunities for QR payments in emerging economies are much greater, the requirement for internet connection limits their growth in some rural regions where the connection to internet is unstable or non-existent.

The differences in internet connectivity between regions in China are enormous. For example, in Beijing nearly 80 percent of the population is connected to the internet, whereas in Yunnan only 40 percent are connected to the internet.

How businesses can benefit from mobile payments

More than three quarters of Chinese consumers pay via their mobile phones, making it necessary for foreign businesses to adapt to this trend.

In the West, an app doesn’t yet exist that connects payments with social media. These platforms provide businesses with an opportunity to bridge the gap between attracting new consumers and engaging with existing consumers more efficiently.

And there is a lot of potential for foreign investors to take advantage of different mobile payments systems for Chinese consumers, and to maximize their profits through loyalty schemes and gifting schemes. Starbucks is a great example of a foreign company that has taken advantage of these strategies.

When a consumer pays for coffee at Starbucks via WeChat, for example, they get a notification of the amount spent along with an offer to sign up to their loyalty card scheme. These loyalty schemes are an effective way of retaining customers and encouraging them to come back.

The way the Starbucks loyalty scheme works in China is, that for every RMB 50 (US$7.33) you spend, you get awarded one star and the more stars you get, the more rewards you will receive.

Starbucks recently highlighted that China is its leading market for digital payments, where 80 percent of sales are cashless. According to Bloomberg, 15 percent of the company’s revenue comes from China and the Asia-Pacific.

Another way that Starbucks uses WeChat is that it allows WeChat users to gift Starbucks coffee to friends through the platform. Starbucks has tried this type of scheme through Facebook and Twitter previously, but to little success.

What made the WeChat scheme a success was the fact that it combined the attributes of being a social media platform like Facebook and Twitter as well as a payment platform through Ten Pay.

Chinese culture also contributes to the success of this scheme as the gift giving culture is very important in China, especially during the holiday season.

WeChat was quick to invest in this aspect, having started the digital gifting trend in 2014 where customers can send digital red envelopes containing cash (“hongbao”) to friends and family.

At least 46 billion digital red envelopes were sent over WeChat over the holiday months in 2017.

Understanding the main risks of mobile payments

Mobile payments have been positive for the Chinese economy. However, mobile payments bring along with them serious risk exposure that need to be considered by the government and businesses.

The Chinese government has so far taken a laid-back approach towards regulating these platforms over the last few years, which has fueled their rapid growth.

As the amount of money and data that goes through these mobile payment companies grows, so should the regulation regarding capital ratios and data protection.

Now, the government wants to bring oversight to these mobile payments by regulating them like banks. At the end of 2017, the People’s Bank of China (PBoC) set a reserve funds ratio from 20 percent to 50 percent and a cap on the amount that can be paid by scanning a QR code.

The main reason was because of problems that have already occurred.

In Guangzhou, a province in the south, RMB 14.5 million was reportedly stolen in QR code scams. QR codes make it very easy to scam consumers. Fraudsters just replace legitimate codes with fake ones and it is impossible for the human eye to detect whether the code is fake or not.

These fake codes can be used in a few different ways. One is to implement malware in the code so when the code is scanned, malware is downloaded onto your phone, which then steals private information like bank account information, passwords, and addresses.

The other way is simpler. When the code is scanned, it will direct the consumer to a fake payment page that mirror’s the real vendor and the consumer ends up transferring money into the fraudster’s bank account. This type of code is very popular in the multi-billion dollar bike-sharing industry.

Although mobile payments come with their own unique risks – and it is important to understand these risks well – they provide considerable opportunities for foreign businesses. Ultimately, the ubiquity and popularity of mobile payments in China demand that foreign business adopt strategies to use them effectively.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article When an ERP System Makes Sense in China

- Next Article L’Industrie de la Robotique en Chine