Guangdong-Macao Intensive Cooperation Zone to Enjoy Free Trade Port Treatment

China has unveiled a masterplan for constructing the Guangdong-Macao Intensive Cooperation Zone at Zhuhai’s Hengqin island. The masterplan sets out a series of policies, many of which are similar to those implemented at the Hainan Free Trade Port (FTP). The policies include setting up a special customs supervision system as well as rolling out financial and tax incentives for corporates and individuals.

On September 5, 2021, the State Council released the Masterplan on the Construction of Guangdong-Macao Intensive Cooperation Zone (hereafter “masterplan”), in a move to diversify Macao’s economy.

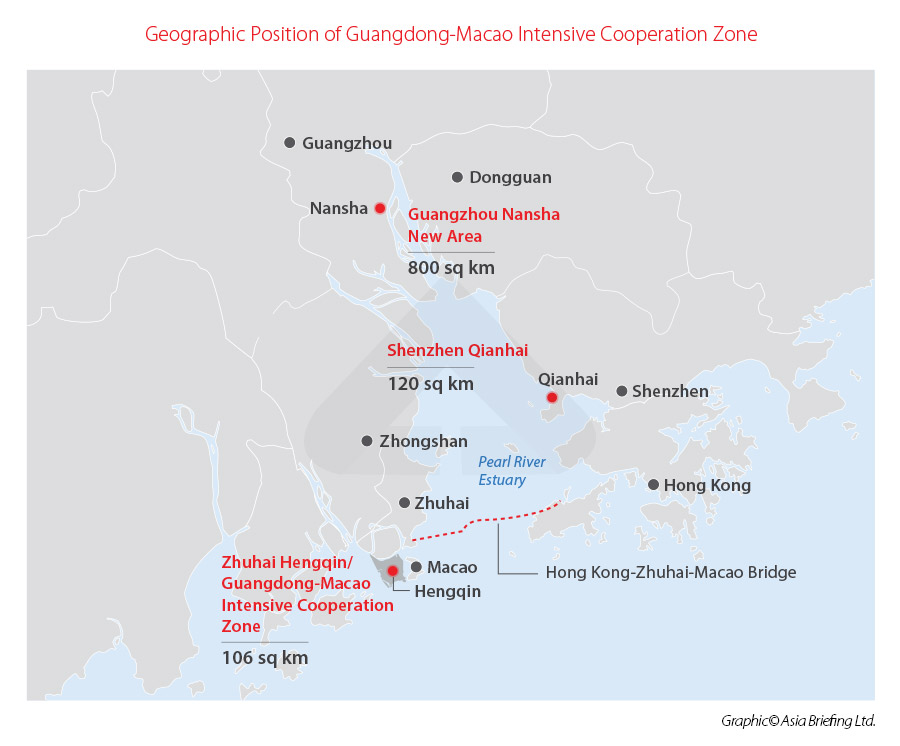

The Cooperation Zone is located at Hengqin – the largest island in South China’s Zhuhai city and in close proximity to Macao (separated by a river, Hengqin is only 200 meters away from the nearest point of Macao).

According to the masterplan, the Guangdong-Macao Intensive Cooperation Zone (ICZ) will be managed under special customs supervision between “two lines”. Eligible enterprises registered in the Zone will be entitled to a reduced corporate income tax (CIT) rate of 15 percent. Qualified talents and Macao residents working there will be subject to lower individual income tax (IIT) liabilities.

The idea of the Guangdong-Macao ICZ was initiated around the time of Macao’s 20th anniversary celebrations in December 2019, presided over by President Xi Jinping.

As one of China’s two special administrative regions (SARs), Macao’s economy is considered inferior to Hong Kong’s and highly relies on the gambling and entertainment industry. Macao SAR has a narrow land area of merely over 30 square kilometers and a population of over 600,000.

Therefore, Beijing hopes the neighboring Hengqin island, which covers 106 square kilometers, about three times the size of Macao, can foster new industries, contribute to Macao’s economic diversification, and provide a new home for Macao residents to live and work.

Based on the the plan, the Zone will focus on the development of certain industries, including sci-tech research and high-end manufacturing, traditional Chinese medicine, culture and tourism, as well as modern finance.

Highlights of the Guangdong-Macao ICZ Masterplan

Innovative administrative system

Guangdong province and Macao SAR will jointly form an administrative committee for the Cooperation Zone. The administrative committee will be run under a “dual director” system, jointly led by the Governor of Guangdong and the Chief Executive of the Macao SAR.

An executive body will be set up under the administrative committee and the person-in-charge will be appointed by the Macao SAR government.

Special customs supervision system

According to the masterplan, for cross-border trade in goods, the Guangdong-Macao ICZ will set up “two lines” under different levels of customs control – the “first line” is drawn between Hengqin and Macao; and the “second line” is between Hengqin and the Chinese mainland.

Customs clearance procedures will be streamlined for goods crossing the “first line”. Except for goods and articles clearly stipulated by the State as items not exempt from tax (not bonded), all other goods and articles can enter the CIZ from Macao free from tax (bonded). Meanwhile, goods crossing the “second line” will be subject to stricter customs control.

Furthermore, for (a) goods that are manufactured by the in-zone enterprises without using imported materials and (b) goods that are processed in the CIZ and achieved an added value of not less than 30 percent of the original value, these goods can be exempt from import duties when being imported into the mainland territory from the Zone.

Preferential tax policies for enterprises

Eligible enterprises registered in the Guangdong-Macao ICZ will be entitled to a corporate tax rate of 15 percent on business income tax, benefiting all industries that facilitate Macao’s economic diversification.

The capital expenditure of businesses that meets the criteria will be allowed a one-off deduction before tax for the taxation period in which the expenditure occurred or accelerated depreciation and amortization.

Corporate income tax will be exempt on the newly added earnings from foreign direct investment (FDI) into the tourism, modern services, and high technology businesses set up in the Cooperation Zone.

Preferential tax policies for individuals

The Cooperation Zone also mulls a policy similar to the individual income tax (IIT) incentives implemented at the nine Guangdong cities in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) as well as in the Hainan FTP.

Overseas and domestic high-end talents and shortly needed talents working in the Zone may be exempt from paying the portion of income tax that exceeds 15 percent of their taxable income.

Moreover, for Macao residents working in the CIZ, they may still be eligible for Macao’s IIT rates.

Other supportive measures

In addition to the above measures, the Guangdong-Macao CIZ will explore innovative cross-border monetary control, achieve the free inflow and outflow of cross-border capital, and promote capital account convertibility.

To boost the modern financial service industry, the masterplan suggests establishing a financial services platform between China and Portuguese-speaking countries, develop cross-border RMB settlement, bond market, wealth management services, and financial leasing. The Zone will lower the market access threshold for Macao-invested financial institutions to set up banking and insurance institution.

In the sci-tech research and high-end manufacturing industries, the Zone will mainly focus on developing integrated circuit (IC), big data, artificial intelligence (AI), Internet of Things (IoT), and biomedicine industries. High standard industry-academia-research demonstration bases and a technological innovation and transformation center are to be built here. To support sci-tech research, the Zone also considers carrying out trials to manage the security of cross-border data transmission and achieve cross-border connectivity of scientific research data.

To relax investment restrictions, it will formulate special measures to ease market access and adopt a “committed market access system.”

Hengqin island, also known as Hengqin New Area, which has about 53,000 residents, has introduced several supportive measures in recent years that allow Macao companies to operate on the island or across borders. By the end of June, more than 4,300 Macao investment companies were registered on the island, up 20.5 percent from the end of 2020, with registered capital reaching 135.7 billion yuan ($21 billion), according to the local market regulator.

Dezan Shira & Associates has been paying close attention to the development of the special economic zones in the Greater Bay Area and the preferential policies on trade facilitation, import and export duties, customs supervision, and financial reforms. For more information, please contact us for assistance at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Bilateral Trade Between Brazil and China

- Next Article Comércio Bilateral entre Brasil e China