Making Sense of China’s 2017 Economic Growth Target

By Alexander Chipman Koty

During the annual Two Sessions meetings last weekend, China’s political leaders announced their economic growth targets for 2017. The affair produced few surprises: the government predictably released an economic and political agenda that stressed the importance of stability and continuity.

Although the message was short on bold new policy announcements, the plan presented in Premier Li Keqiang’s annual Work Report – often likened to the State of the Union in the US – offers clues towards the direction and restructuring of the world’s second largest economy, as well as the obstacles China faces going forward.

Given the deliberately crafted nature of the Work Report, slight changes in the way the government presents issues over previous years can signal shifts in policies and priorities. While China’s 2017 GDP target appears like a logical continuation of recent growth objectives at first glance, its careful wording delicately recalibrates expectations for the economy’s performance for the coming years.

Economic growth target

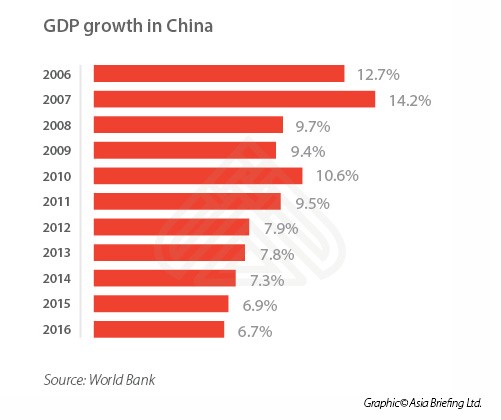

In the Work Report, Li pinned China’s 2017 GDP growth target at “around 6.5 percent, or higher if possible in practice”. This is a modest goal on the heels of 6.7 percent growth in 2016 – the lowest in 26 years.

While the 6.5 percent figure was widely anticipated, the added “or higher if possible in practice” provision was not. Notably, a more literal translation of Li’s Chinese-language speech stipulates that the government targets around 6.5 percent growth, but in practice “to try to achieve a better result”.

This remark may signal cautious optimism that China’s growth could rebound, or at least a subtle warning to officials not to be content with moderate growth. Taken this way, 6.5 percent sounds more like a baseline than a general approximation.

Alternatively, announcing that the government will merely strive towards higher growth rather than commit to it may be a signal for observers to temper their expectations.

Contextualizing 2017’s growth target

China’s leadership claims to be prioritizing long-term economic restructuring and minimizing financial risks over more superficial short-term growth indicators. The report repeatedly referred to the need to mitigate financial risks that could disrupt sustainable development, and more emphasis was given to ensuring employment rather than highlighting growth.

The ongoing reform and restructuring of the Chinese economy has been a persistent theme for several years. Still, posting impressive annual growth numbers remains an important concern for economic planners. While robust GDP growth rates add confidence to the Chinese economy, the slow pace of market-based reforms has frustrated many in the business community.

In 2015, the government put forward the “Two Doubles” project: to double the size of its 2010 GDP and per capita income in both urban and rural areas by 2020. Doing so requires an average of about 6.4-6.5 percent growth per year, and failure to meet this goal would be an embarrassing miscue for the government.

To help stimulate GDP growth, China has accumulated massive debt levels – particularly over the past two years. Li stated that the fiscal deficit for 2017 would remain at three percent of GDP, meaning an additional RMB 200 billion (US$29 billion) worth of debt. Though the same three percent target was set for 2016, the fiscal deficit ended up reaching 3.8 percent by the year’s end. In 2015, the deficit was pegged at 2.3 percent.

China’s leadership understands the necessity of deepening reform efforts to ensure stable growth, but additional stimulus spending may be on the cards for it to meet its medium-term growth goals. This may especially be the case if they expect growth to continue to decline and fall short of the 6.4-6.5 percent average needed to attain the ‘Two Doubles’.

![]() RELATED: Pre-Investment and Entry Strategy Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Entry Strategy Advisory from Dezan Shira & Associates

International trade and protectionism

Li’s Work Report vigorously re-emphasized China’s commitment to globalization and international trade, a reference to the protectionist rhetoric of US President Donald Trump, and rising anti-trade sentiment in Europe. China’s commitment to globalization was repeatedly affirmed, including the declaration that “economic globalization is in the fundamental interests of all countries.”

The comments echo President Xi Jinping’s defense of globalization at the World Economic Forum in Davos in January. Beyond political rhetoric, however, they point to the genuine uncertainty facing China’s economy as a result of potential trade barriers and heightened tariffs. Trump, for example, has threatened to slap taxes of up to 45 percent on imported goods from China.

Li further stated that “World economic growth remains sluggish, and both the de-globalization trend and protectionism are growing,” and added, “there are major uncertainties about the direction of the major economies’ policies and their spillover effects, and the factors that could cause instability and uncertainty are visibly increasing”.

The Work Report also referenced “profound changes in the international economic and political landscape” and “protectionism in its different forms”. While the risks certainly exist, ongoing emphasis on foreign protectionism may in the future be used to cover for disappointing domestic performance.

Despite China’s outward commitment to globalization, protectionism in China may also be on the rise. Germany’s ambassador to China recently said as much, while AmCham’s 2017 Business Climate Survey found that about 80 percent of surveyed companies feel that foreign companies are less welcome in China than in the past.

The consistency of China’s message on high-profile platforms – both at home and abroad – reveals a strategy to cultivate an image of a responsible protector of trade and internationalism. The message appears at odds with the experiences of foreign enterprises operating in the country, however, as they report experiencing the very trends of economic nationalism that the government publicly decries.

Key takeaways

Amid global uncertainty, domestic economic restructuring, and high profile leadership movement set to take place at the fall’s party congress, China’s economic targets in the 2017 Work Report emphasize cautious stability. The government has set moderate expectations for the economy’s performance, and seems intent on minimizing structural risks.

Although the Work Report stresses a continuation of the status quo, it also raises acknowledgement of the difficulties that China faces in maintaining resilient growth in the coming years. By declaring that the government will just try to achieve higher growth rather than promising it, and warning of the domestic and international challenges that might impede growth, the Work Report may be subtly resetting expectations for China’s short- to medium-term economic performance.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

An Introduction to Doing Business in China 2017

Doing Business in China 2017 is designed to introduce the fundamentals of investing in China. Compiled by the professionals at Dezan Shira & Associates in January 2017, this comprehensive guide is ideal not only for businesses looking to enter the Chinese market, but also for companies who already have a presence here and want to keep up-to-date with the most recent and relevant policy changes.

New Considerations when Establishing a China WFOE in 2017

New Considerations when Establishing a China WFOE in 2017

In this edition of China Briefing, we guide readers through a range of topics, from the reasons behind foreign investors’ preference for the WFOE as an investment model, to managing China’s new regulations. We discuss how economic transformations have favored the WFOE, as well as the investment model’s utility, and detail key requirements that businesspeople need to examine before initiating the WFOE setup process. We then walk investors through the WFOE establishment process, and, finally, explain the new and idiosyncratic “Actual Controlling Person” regulation.

- Previous Article Asia Investment Brief: Cambodia’s 2017 FDI Outlook, Indonesia’s Palm Oil Sector, and Transfer Pricing in Vietnam

- Next Article How China is Becoming a World Leader in Artificial Intelligence