Hong Kong’s Employment Support Scheme: Second Tranche of Subsidies Open

- The Employment Support Scheme (ESS), a key component of Hong Kong’s Anti-epidemic Fund 2.0, enables HK employers to retain their employees and provide wages.

- Private employers have to contribute to the Mandatory Provident Fund or set up an Occupational Retirement Scheme and agree not to lay off any staff during this period – to be eligible for the ESS.

- Applications for the second tranche of subsidies will end September 13, 2020, covering the period of September to November 2020.

In April 2020, the Financial Committee of the Hong Kong Legislative Counsel approved the Employment Support Scheme (ESS) — a financial lifeline for employers to be able to continue to pay staff wages and retain employees.

The ESS is part of Hong Kong’s colossal Anti-epidemic Fund 2.0, rolled out in reaction to the COVID-19 outbreak.

To be eligible for the ESS, private employers must have already been making regularly payments to the Mandatory Provident Fund or have set up an Occupational Retirement Scheme in Hong Kong.

In addition, they must provide an undertaking that they will not lay off any staff during this time.

The first tranche of the subsidies was distributed during the period of June to August 2020. The application for the second tranche of the subsidies will be for the period of September to November 2020.

Applications for the second tranche of subsidies have opened from 31 August 2020 to September 13, 2020.

What are the eligibility criteria?

Broadly speaking, eligible HK employers are those who meet the following two conditions:

- Have been making Mandatory Provident Fund (MPF) contribution for employees; and

- Provide an undertaking that they will:

- Not lay off any workers during the subsidy period; and

- Use the full amount of the subsidies to pay their employees’ wages.

However, where an employer violates this commitment for the subsidy, the employer concerned must return the amount of subsidy not used to pay wages to the government and/or pay a fine to the government

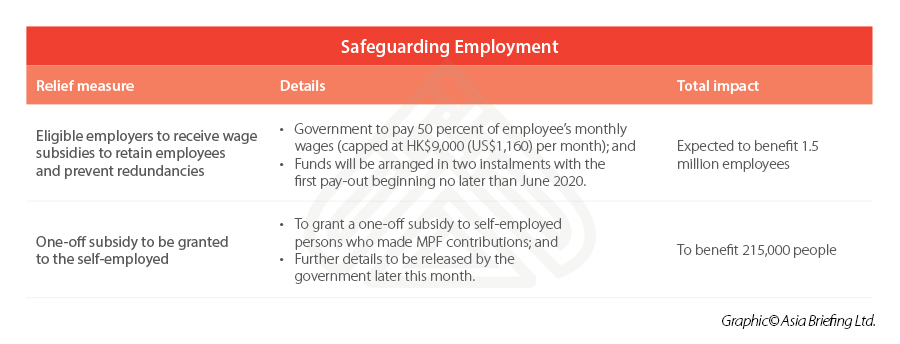

What is the wage subsidy?

Generally speaking, the allocated wage subsidy is 50 percent of an employee’s monthly salary, capped at HK$18,000 (US$2,322) for a period of six months. In this case, the amount of the wages to be paid by the government under such subsidy is at a maximum of HK$9,000 (US$1,160) per employee, per month. For self-employed person(s) contributing to MPF will receive a one-off subsidy of $7,500 (US$968).

When applying for the subsidy, the employer needs to select a month within a specified period leading up to the subsidy period – this will be the ‘designated month’ and will be used to guide the MPF trustee to provide the applicant with the number of employees and relevant income for that month as a basis for calculating the subsidies.

Roll-out of Hong Kong’s Employment Support Scheme

In April this year, the outbreak of COVID-19 against the backdrop of prolonged periods of social unrest had put Hong Kong’s businesses in complete disarray.

In response to this, the Hong Kong SAR Chief Executive unveiled the Anti-Epidemic Fund 2.0 – the third and largest stimulus package in 2020, which amounted to HK$137.5 billion (US$18 billion), and earmarked HK$80 billion (US$10 billion) for the Employment Support Scheme.

According to information released by the ESS Secretariat, the first tranche of subsidies received a total of 168,799 applications from employers and 259,860 applications from self-employed persons.

And as of the end of June, the Secretariat had approved an amount totaling HK$19.1 billion (US$2.46 billion) of wage subsidy, benefiting over 836,000 employees – with the current approval rate standing at around 53 percent. For self-employed persons, the Secretariat disturbed 74,000 one-off subsidies, worth about a total of HK$556 million (US$71.8 million).

With the ESS entering its second tranche of applications, businesses must act quickly to determine their eligibility and submit their application for the subsidies before September 13, 2020.

For further enquiries about this scheme, please contact us at hong kong@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Antrag auf ein Sondervisum und Einreise nach China: 3 Fallstudien

- Next Article How to Open a Bank Account in China: Stricter Requirements After COVID-19