What US Goods Might Escape Chinese Tariffs?

China’s tariffs on US products don’t match US tariffs on Chinese exports. China Briefing asks what US goods might stay untariffed by the Chinese if the trade war escalates?

In July 2018, the United States implemented the first round of tariffs on a range of Chinese exports to the US, officially starting the trade war. Three months after the first tranche of tariffs was introduced, President Trump threatened to impose tariffs on almost all Chinese exports to the US.

So far, the Chinese have been retaliating to each tranche of US tariffs with tariffs of their own. However, analysts note that the value of China’s tariffs has not matched that of the US.

China’s tariffs range from five percent to 25 percent and cover only US$110 billion of US exports to China. By comparison, the US raised its tariffs to a uniform 25 percent on US$250 billion worth of Chinese exports to the US.

The uneven tariff exposure is due to the trade imbalance between the US and China – the US imports a lot more from China than China does from the US. However, the exact amount of goods China can still impose tariffs upon depends on whose trade figures are used.

As per China’s 2017 estimates, it still had around US$44 billion of untariffed goods. US data, on the other hand, shows about US$20 billion of untariffed goods.

Trump and Xi will have a chance to resolve the trade war when they meet on the sidelines of the G20 meeting in Osaka, Japan, held between June 28 and 29. However, commentators are skeptical that either side is willing to compromise.

As trade tensions continue to escalate between the two countries, we ask which US exports to China might escape Chinese tariffs even in the event of an all-out trade war.

What is left of China’s untariffed imports from the US?

According to China’s updated 2018 trade figures, Beijing can impose tariffs on a higher value of US goods – now US$52.9 billion.

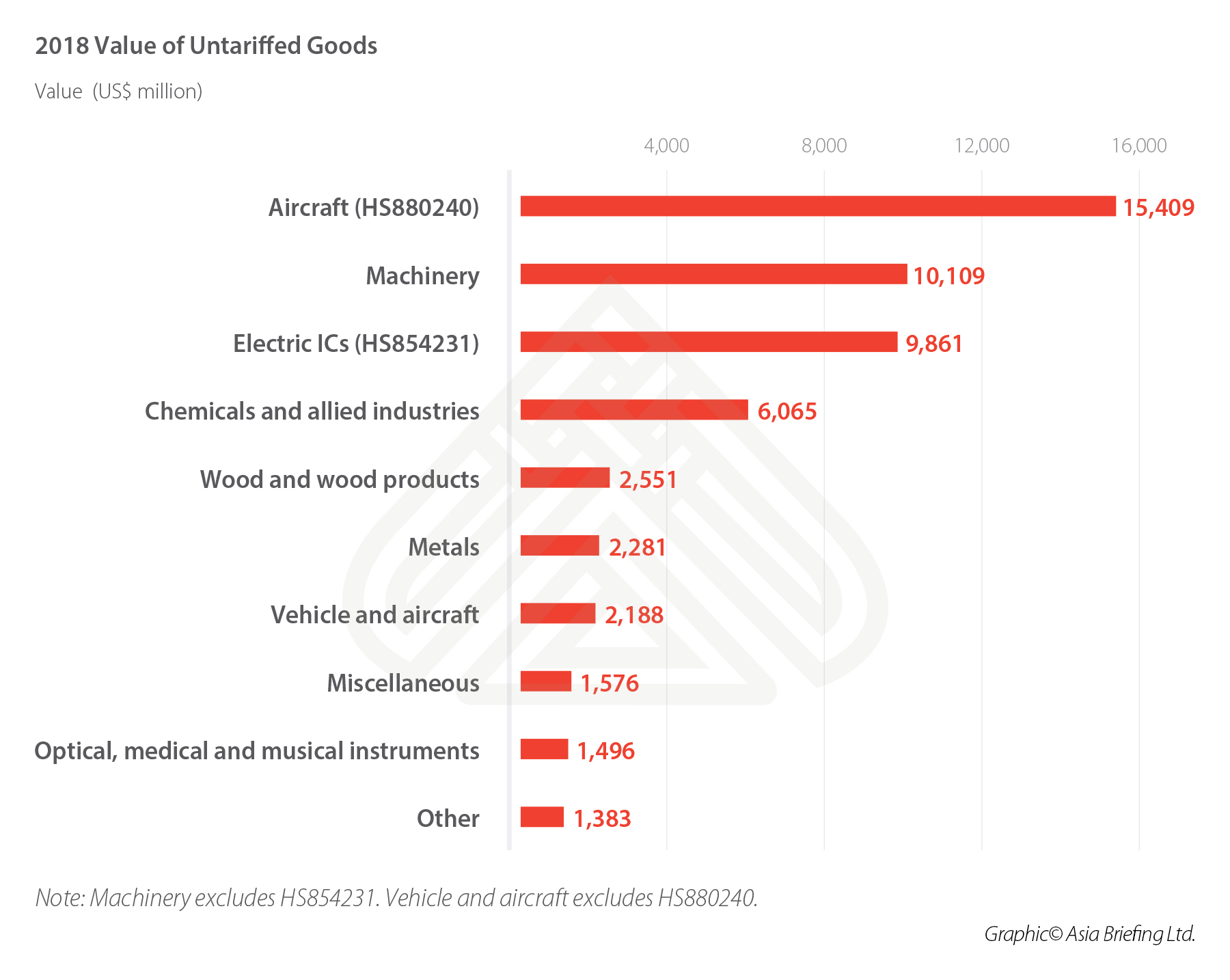

A recent article published in MacroPolo, an in-house think tank of the Paulson Institute in Chicago, shows that of the 1,400 untariffed items, two items made up a large proportion of the remaining value of untariffed goods in 2017.

These two items are aircraft (HS code: 880240) and electronic integrated circuits (ICs) (HS code: 854231). According to China’s 2018 data, imports of the two items are collectively valued at US$25.3 billion – 49 percent of all untariffed goods.

The sheer value of imported aircraft and electric ICs mean that both are less likely to be tariffed. However, China imported 57.2 percent of all its aircraft from the US in 2018, compared with only 7.7 percent of electric IC imports.

MacroPolo also points out in its analysis that China’s heavier reliance on the US for aircraft means that Beijing might be relatively more cautious about imposing tariffs on its aircraft imports than on the import of electronic ICs. However, they assume that China would likely tariff the rest of the currently untariffed goods if the trade war escalates further.

How does China decide to tariff goods?

Although important, the principles that Beijing will use to decide how to apply tariffs go further than just their raw import value. As MacroPolo themselves explain, if a tariff cuts off supply that cannot be replaced by local or overseas production, Beijing will be more cautious about implementing the tariff.

China Briefing analyzed China’s 2018 trade data and found that, on this principle, there are 15 other items that China might consider leaving untariffed. These items collectively have a value of US$14.7 billion – 28 percent of the remaining value of untariffed goods.

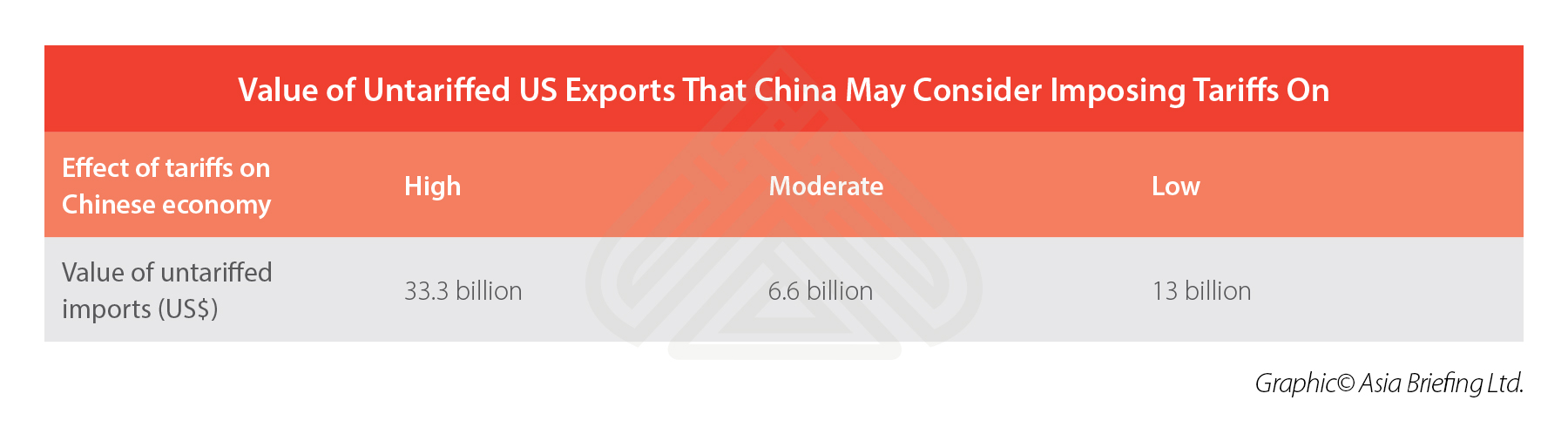

After an individual assessment of each item, China Briefing determined that the Chinese could tariff US$13 billion of all untariffed US exports without any large effect on its domestic economy.

However, tariffs on an additional US$6.6 billion of goods would likely have a moderate impact on the economy, because the Chinese are more reliant on them to meet supply.

Imposing tariffs on a further additional US$33.3 billion of goods was found to have a high impact on the Chinese economy. About US$25.3 billion of these imports come from the previously mentioned two categories – aircraft and ICs. The other US$8 billion worth of imports come predominantly from goods also related to aircraft and ICs.

What items will China consider leaving untariffed?

Aircraft parts

Turbojets and parts thereof are less likely to be tariffed given that the share of import from the US is over 50 percent.

The large trade deficit of these goods – which is the value China imports from all countries minus the value it exports to all countries – also makes a tariff more unlikely. This is because a large deficit indicates China is more reliant on international trade to meet local demand.

Under-carriages and aircraft parts could remain tariff-free. But, as the deficit is not as low as turbojets and the value of the import is also lower, domestic and international supply could meet Chinese demand.

Semiconductors and electronic ICs

If China slaps tariffs on US$9.9 billion of electronic ICs imported from the US, it is possible that items in the three categories above (see table) will not be included. The imports in these categories are used in China’s domestic production of semiconductors and electric ICs.

In case China does tariff ICs, domestic production will have to ramp up to replace supply from the US. For that to happen, imports of items that are needed to manufacture ICs (the three categories mentioned in the table) will have to increase. Thus, if China anticipates this rise in demand and worries about sourcing from elsewhere – they might not raise tariffs on items in these three categories.

Yet, if we were to break down the likelihood of Beijing implementing tariffs on items in these categories – machines for manufacturing ICs have a much lower chance of being tariffed due to a much higher overall deficit and higher overall import value.

Medicines and chemicals

Beijing is also more likely to avoid implementing tariffs on medical imports as it values maintaining the standards of its healthcare system as a priority.

For example, China imports antisera from the US, Germany, and Switzerland, who dominate global production. (Antisera is used to spread passive immunity to a range of diseases.) Here, China’s reliance on the US for antisera indicates that the item has a higher chance of remaining untariffed.

Human vaccines, however, may be easier to tariff. Historically, almost all category-one vaccines, which are mandatory for all Chinese citizens, were supplied domestically, indicating that domestic supply could ramp up again. A similar principle applies for veterinary vaccines too.

In the case of items that come under the category of “range of medicaments”, China runs an extremely large deficit, and imports a relatively large amount (in terms of total import value) from the US.

The caveat here is that the category includes a wide range of goods from antidepressants to laxatives. Thus, theoretically speaking, Beijing could choose to tariff some of the goods in this category and not others. The same principle also applies to the “range of chemical products” category in this section.

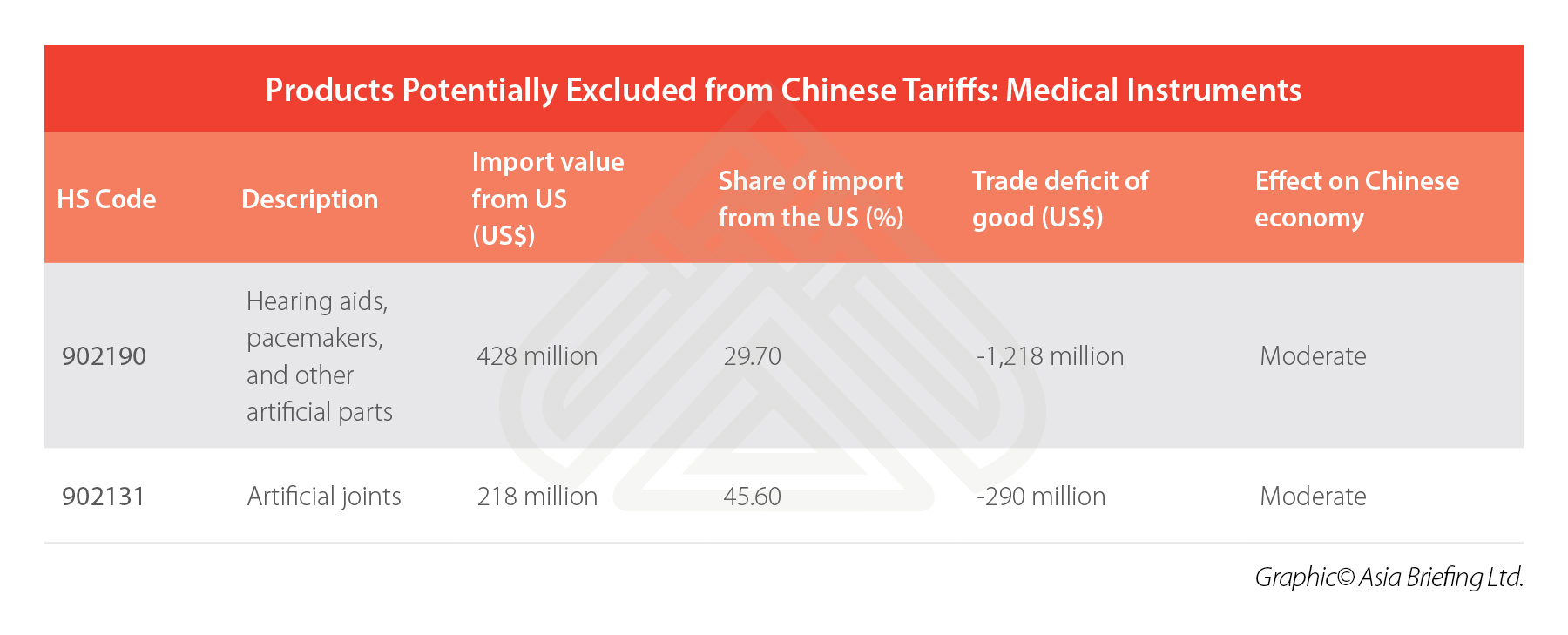

Medical instruments

China’s large share of imports of hearing aids, pacemakers, and other parts from the US and the large total deficit indicates a higher likelihood of these items remaining untariffed.

The US also supplies China with artificial joints, but the deficit here is not as large – indicating that domestic supply could more easily supplement any supply that is hindered by tariffs.

Wood

Chinese timber production is expected to shrink in the coming years after restrictions were announced in 2017 on the commercial cutting of natural forests.

China’s reliance on timber imports already stood at 56.4 percent in 2017. Nevertheless, it is possible that other types of wood could supplement the types in this category.

China will have to rely on non-tariff measures

If the trade war continues to escalate, China will, simply put, run out of goods to tariff in retaliation to any additional US tariffs. Once this happens, Beijing is most likely to turn to non-tariff measures.

Multiple factors will shape China’s final decision to tariff or not tariff, including the impact on the Chinese economy, sourcing challenges, financial burden on affected sectors or business conglomerates, and the status of affected industries or sectors vital to national security and well-being.

This means that even in a worst-case scenario of an all-out trade war, some goods could escape tariffs altogether.

Note: All the analyses are based on data acquired from www.trademap.org, which makes its Chinese trade calculations based on General Customs Administration of China statistics.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Shanghai Businesses to Comply with New Waste Management Norms from July 1

- Next Article The R&D Sector in India and Investing in Vietnam’s Quang Ninh – China Outbound