Post VAT Reform: Defining Small Scale and General Taxpayer Status in China

By Jake Liddle

China fully implemented the business tax (BT) to value-added tax (VAT) reform on May 1, 2016. The State Administration of Taxation (SAT) issued an announcement in April 2016 regarding the VAT reform, clarifying the calculation and determination of small scale taxpayers and general taxpayers, and changes to the terms of application for general tax payer status. As a general tax payer, entities may enjoy VAT deductions; therefore, it is important for companies to ascertain if they are qualified to apply for general taxpayer status.

The announcement provides that the threshold of small scale taxpayer/general taxpayer is RMB 5 million annual taxable sales amount. 12 months is the longest operation timeframe in which enterprises must calculate annual sales amount in order to ascertain general taxpayer status. However, if an enterprise surpasses RMB 5 million sales in a shorter timeframe, general taxpayer status must be applied for in the following month, and should not be delayed until the 12th month.

For calculation of annual taxable sales for taxpayers prior to the pilot scheme, the following formula applies:

Annual taxable sales amount of the taxable acts = total turnover of the taxable acts over not more than 12 consecutive months ÷ (1 + 3%)

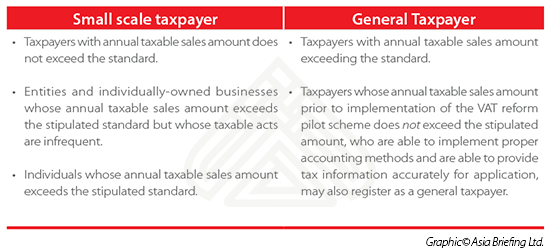

The following table details the taxpayer status designated to different entities:

Changes to terms of VAT general taxpayer status applications

Taxpayers or entities who fit the requirements for general taxpayer can register with the relevant tax authority. As shown in the above table, an exception is made for pilot scheme taxpayers whose annual taxable sales amount, prior to implementation of the VAT reform pilot scheme, does not exceed RMB 5 million. Those taxpayers are able to register as a general taxpayer, given they implement proper accounting methods and are able to provide tax information accurately for application.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

It must be noted that once general taxpayer status has been obtained, the transition back to small scale taxpayer is not possible, unless otherwise stipulated by the SAT. Pilot scheme taxpayers who obtained general taxpayer status prior to implementation of the VAT reform pilot scheme are not required to register for general taxpayer status again.

Conclusion

China’s tax system is evolving rapidly and, as a result, can prove hard to navigate for foreign companies. It is important for companies to be aware of the risks associated with non-compliance, to know what category of taxpayer they fall into, and what advantages they have by gaining general taxpayer status.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Human Resources and Payroll in China 2015

Human Resources and Payroll in China 2015

This edition of Human Resources and Payroll in China, updated for 2015, provides a firm understanding of China’s laws and regulations related to human resources and payroll management – essential information for foreign investors looking to establish or already running a foreign-invested entity in China, local managers, and HR professionals needing to explain complex points of China’s labor policies.

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016, produced in collaboration with the experts at Dezan Shira & Associates, explores the establishment procedures and related considerations of the Representative Office (RO), and two types of Limited Liability Companies: the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV). The guide also includes issues specific to Hong Kong and Singapore holding companies, and details how foreign investors can close a foreign-invested enterprise smoothly in China.

- Previous Article China’s New Advertising Law: Key Considerations and Implications for Online Advertisers

- Next Article China Announces Seven New Free Trade Zones, Signaling Intent to Diversify Economy