China Extends Pretax Deductions for Companies’ Advertising Expenses by Five Years

On December 9, 2020, the Ministry of Finance (MOF) and the State Taxation Administration (STA) released the Announcement about Pretax Deduction of Advertising and Business Publicity Expenses (MOF STA Announcement [2020] No.43), to be effective from January 1, 2021 to December 31, 2025.

This means that the current policy on pretax deduction of advertising and business publicity expenses (MOF STA Announcement [2017] No.41), which was supposed to expire on December 31, 2020, will be extended for another five years and continue to benefit enterprises engaging in cosmetics, pharmaceuticals, and beverage industry.

This article will introduce you to the policy and address frequently asked questions on pretax deduction of advertising and business publicity expenses.

Deduction cap for enterprises’ advertising and business publicity expenses

According to the MOF STA Announcement [2020] No.43, enterprises manufacturing or selling cosmetics, enterprises manufacturing pharmaceuticals, and enterprises manufacturing beverage (excluding alcoholic) can access the following benefit – their advertising and business publicity expenses are tax-deductible if the expenses do not exceed 30 percent of the sales (business) revenue of the current year. Further, expenses in excess of this figure can be carried over and be tax-deductible in the following years.

To be noted, tobacco advertising and publicity expenses incurred by tobacco companies are not eligible for any pretax deduction.

For other enterprises, advertising and business publicity expenses that do not exceed 15 percent of the sales (business) revenue of the current year can be deductible; the excess portion can also be carried forward to subsequent tax years for deduction, according to Article 44 of the Implementation Regulations for the Corporate Income Tax Law of PRC.

Calculation base of deduction cap for advertising and business publicity expenses

According to the STA Notice on Some Tax Treatment Issues During the Implementation of the Corporate Income Law (Guo Shui Han [2009] No.202), when calculating the pretax deduction cap for advertising expenses and business publicity expenses, enterprises should determine the sales (business) revenue – which should include main business income, other business income, and deemed sales (business) income stipulated in the Article 25 of the Implementation Regulations for the Corporate Income Tax Law.

Deduction of advertising and business publicity expenses under a sharing agreement with associated enterprises

In the case of associated enterprises that have entered into an advertising or business promotion expenses sharing agreement (hereafter the “sharing agreement”), the advertising fees incurred by one party, which do not exceed the pretax deduction cap, may be deducted by the said party, or may be transferred fully or partially to the other party in the sharing agreement.

When the other party computes its advertising and business publicity expenses for pretax deduction limit for corporate income tax (CIT) purpose, it may opt to exclude the aforesaid transferred amount in its advertising and business publicity expenses.

Advertising and business publicity expenses during enterprise preparation period

According to the STA Announcement on Several Tax Treatment Issues Relating to Taxable Income Amount for Corporate Income Tax Purpose (STA Announcement [2012] No.15), during the business preparation period, advertisement fees and business promotion fees incurred may be included into the enterprise preparation expenses based on the actually incurred amount and allowed for pretax deduction pursuant to the relevant provisions.

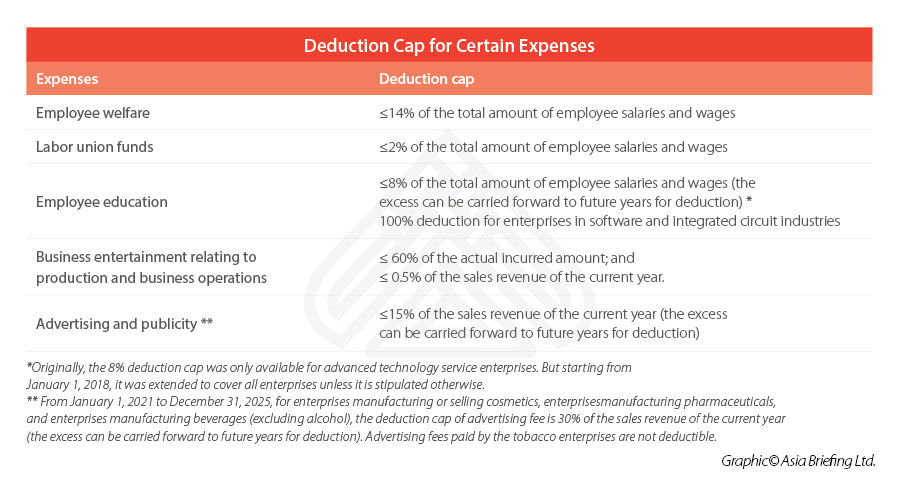

Deduction caps for other types of expenses

When calculating CIT taxable income, pretax deductions from a company’s gross income include reasonable expenditure incurred in relation to income received by an enterprise, such as costs, expenses, taxes (except CIT and VAT) and losses; charitable donations and gifts within 12 percent of the gross annual profit; reasonable depreciation of fixed assets; amortization of intangible assets; amortization of long-term prepaid expenses; inventory cost; net value of an asset transferred; and other deductions stipulated by laws and regulations, as shown in the following table.

For more information, you are welcome to download our guide on tax, accounting, and audit, or contact our tax professionals at tax@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Beijing Promotes the Application of Electronic Seals

- Next Article Common Errors in Accounting, Tax, Forex Management of FIEs in China