Hong Kong’s New SME Financing Guarantee Scheme: An Explainer

Editor: Dorcas Wong

The Hong Kong Mortgage Corporation Insurance Limited (HKMCI) is introducing a new 100 percent loan guarantee under the Hong Kong SME Financing Guarantee Scheme (HKSFGS) to absorb some of the economic shock felt by businesses in the last several months. This is according to Hong Kong’s 2020-2021 Budget, delivered on February 26, 2020.

Following the budget, the Anti-Epidemic Fund 2.0 announced by the Hong Kong SAR government on April 8 expanded on the measures previously announced by introducing a set of new enhanced terms for the 80 percent, 90 percent, and special 100 percent guarantee loans available for small and medium enterprises (SMEs).

Under the Enhanced 100 Percent Loan Guarantee Scheme, the guarantee commitment has been increased to HK$50 billion (US$6.5 billion). Eligible SMEs will receive a maximum loan amount of HK$4 million (US$520,000) and can benefit from the principal moratorium arrangement for the first 12 months.

This is expected to benefit around 20,000 to 50,000 households and will account for an additional HK$11.69 billion (US$1.5 billion) government expenditure, as well as an additional guarantee commitment of HK$30 billion (US$3.9 billion).

For SMES, these new measures could alleviate some of the burden of having to pay employees’ wages and rent, thereby helping minimize business closures and layoffs.

The HKMC Insurance Limited is expected to liaise with individual banks on the implementation details. Meanwhile, the Special 100 Percent Loan Guarantee program will be open for applications beginning April 20, with the application period extended from 6 months to a year.

Eligibility criteria for the loan scheme

Eligibility for the loan requires that enterprises have been operating for at least three months, as at the end of December 2019, and have suffered at least 30 percent decline in sales turnover – in any month since February 2020.

SMEs from all sectors are eligible to apply, particularly those most affected by the coronavirus outbreak – such as retail outlets, travel agencies, restaurants, cinemas, entertainment facilities, and transport operators. The total loan amount guaranteed by the government is HK$20 billion (US$2.6 billion).

The secured loans are to be taken out with participating lending institutions (PLIs) for the purpose of either acquiring business installation and equipment or meeting working capital needs of general business uses.

Hong Kong’s financing schemes for small businesses

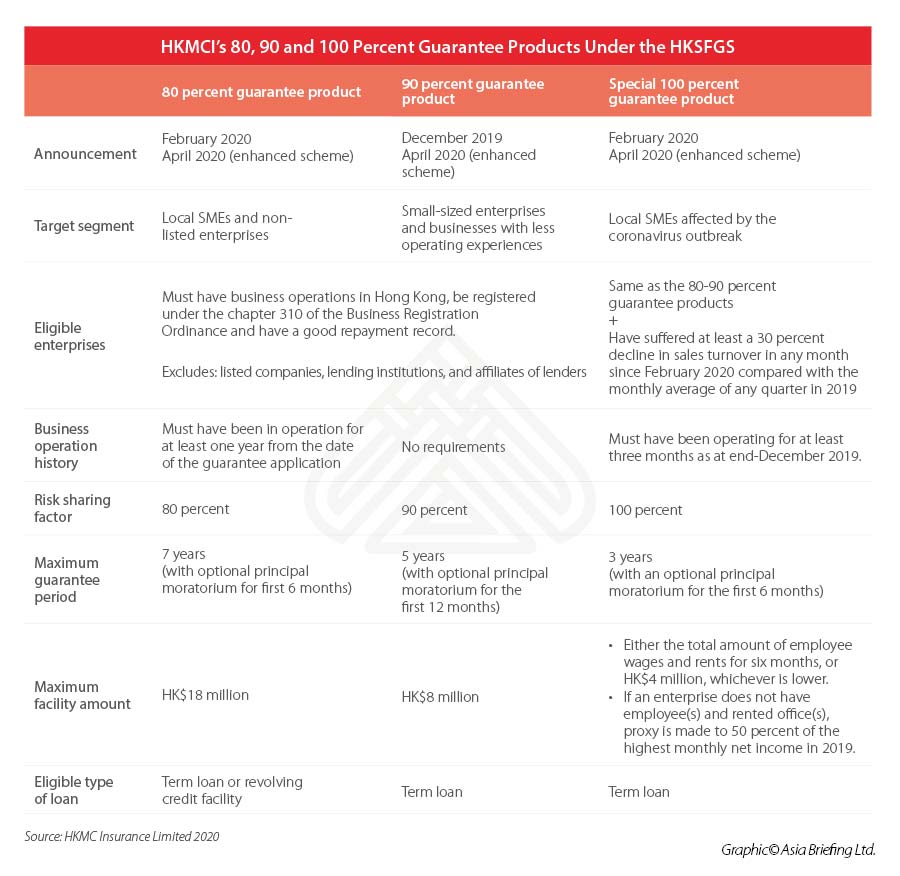

So far, the HKMC Insurance Limited has released guidelines for three different Guarantee Products.

The following table details the most updated information available as of April 21, 2020.

Hong Kong banks roll-out financial relief programs

Participating lending institutions (PLIs) are those financial institutions authorized by Hong Kong’s Banking Ordinance and have chosen to participate in the SME Financing Guarantee Scheme. Various banks, on the PLI list have introduced their own relief measure programs. Some examples are listed below.

The bank policies are subject to change, and the information below was updated on March 20, 2020.

Hang Seng Bank

- SMEs are eligible to an 80 percent guarantee product (including instalment loan, term loan, revolving loan, overdraft facility, and trade facility) – up to HK$15 million (US$1.9 million) – for a maximum period of 7 years; and

- SMEs are eligible to a 90 percent guarantee product (instalment loan, term loan) – up to HK$8 million (US$1 million) – for a maximum period of 5 years.

These measures are available to eligible enterprises from February 6 to June 30, 2020.

HSBC (Hong Kong and Shanghai Banking) Corporation Limited

- 6 months interest rebates on loans under SME Financing Guarantee Scheme (“SFGS”) or SME Loan Guarantee Scheme (SGS);

- New applicants of SFGS 90 will receive a subsidy on guarantee fee – 100 percent subsidy for the first year and a 50 percent subsidy for the second year; and

- The handling fee will also be waived for the entire loan tenure.

Standard Chartered Bank (Hong Kong) Limited

- Application handling fee waived;

- Fast-track application process;

- Loan amount up to HK$3 million (US$390,000);

- A 50 percent subsidy of full tenor guarantee up to HK$5,000 (US$645) for all new SFGS customers, up to 6 months interest only period which is renewable, subject to a maximum of 12 months;

- Account maintenance fee waiver for startups, business instalment loan, SFGS and SGS customers; and

- 30-day extension of maturity date for eligible trade finance loans that mature between 24 February 2020 and 31 March 2020, with no additional fee or penalty interest.

How to apply for the loan scheme

Application procedures can vary in accordance with the bank at which you are applying for a loan, but generally the procedure is as follows:

- SME applies with bank for loan, and the bank will request the relevant forms and documents to send to HKMCI.

- HKMCI will issue a notification of results / issuance of guarantee.

- If approval is obtained, the SME will pay the Guarantee Fee to the bank, which will be passed onto the HKMCI.

- The guarantee will be effective once the payment is received.

SMEs should prepare the following documents for their application:

- Application form for SME financing guarantee scheme;

- Latest copy of business registration certificate;

- Company search report;

- Copies of identity documents of each director, shareholder, sole proprietor, or partner (as the case may be); and

- Copy of the facility letter from the lender.

For more information about how your business can benefit from Hong Kong’s SME Financing Scheme, please contact Jennifer Lu at jennifer.lu@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China Plus One Series: Understanding Malaysia’s Appeal to Foreign Investors

- Next Article How to Tap into China’s Plant-Based Meat Market: Key Considerations