Guangdong Revises Minimum Wage Levels

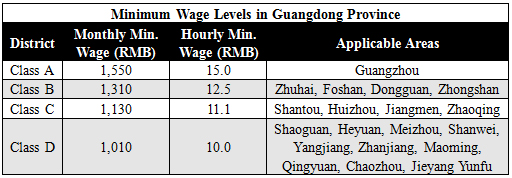

Mar. 6 – The People’s Government of Guangdong released the “Notice on Adjusting Minimum Wage Levels for Employees in Guangdong Province (efuhan [2013] No. 27, hereinafter referred to as ‘Notice’)” on February 25, which raises the minimum wage levels across the province by an average of 19.1 percent from May 1, 2013. Detailed information can be found below.

According to the Notice, the new monthly minimum wage in Guangdong’s capital city of Guangzhou will jump by 19.2 percent from RMB1,300 to RMB1,550. At the same time, Guangzhou’s minimum hourly wage will increase from RMB10.5 to RMB15.

Minimum wages in “Class B” cities such as Zhuhai, Foshan, Dongguan and Zhongshan will rise to RMB1,310 a month and RMB12.5 per hour, while “Class C” and “Class D” cities will see their minimum wage levels increase by 19 percent to RMB1,130 and RMB1,010 respectively.

According to Han Zhipeng, a member of the Guangzhou People’s Political Consultative Conference, the Guangdong government has actually violated the central government’s requirement to raise the minimum wage at least once every two years. The last time Guangdong adjusted its minimum wage level was March 2011, which means that these updated wage levels should have come into effect from March this year, not by May.

Officially announcing the minimum wage increase news right after the Spring Festival is part of the local government’s efforts to attract migrant workers back to the region. The early-February Spring Festival sent an estimated 10 million migrant workers from Guangdong back to their hometown, which accounts for roughly 60 percent of all the migrants in the province.

Guangdong Province is currently facing a labor shortage of 1.2 million workers. The demand for workers in the province grew by 15.2 percent year-on-year at the end of last year, and it will continue to rise in the short-term with the stabilization of the economy.

However, with rising costs and the recent labor shortage in Guangdong, it has been reported that Foxconn and several of its chief competitors, including Quanta Computer, Pegatron, and Wistron, are considering opening new plants in western China and elsewhere in emerging Asia.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Expanding Your China Business to India and Vietnam

Expanding Your China Business to India and Vietnam

The March/April issue of Asia Briefing Magazine discusses why China is no longer the only solution for export driven businesses, and how the evolution of trade in Asia is determining that locations such as Vietnam and India represent competitive alternatives. With that in mind, we examine the common purposes as well as the pros and cons of the various market entry vehicles available for foreign investors interested in Vietnam and India.

Trading With China

Trading With China

This issue of China Briefing Magazine focuses on the minutiae of trading with China – regardless of whether your business has a presence in the country or not. Of special interest to the global small and medium-sized enterprises, this issue explains in detail the myriad regulations concerning trading with the most populous nation on Earth – plus the inevitable tax, customs and administrative matters that go with this.

Human Resources and Payroll in China (Third Edition)

Human Resources and Payroll in China (Third Edition)

A firm understanding of China’s laws and regulations related to human resources and payroll management is essential for foreign investors who want to establish or are already running foreign-invested entities in China. This guide aims to satisfy that information demand, while also serving as a valuable tool for local managers and HR professionals who may need to explain complex points of China’s labor policies in English.

Social Insurance and Payroll

Social Insurance and Payroll

In this issue, we take a “back to basics” approach to China’s mandatory benefits. Where, exactly, is that extra 35-40 percent on top of an employee’s salary going? What are social insurance contribution rates, base amounts, and tax exemptions? How does all of this figure into the payroll process? We next look at mandatory benefits as a piece of the larger payroll puzzle, with highlights on two very China-specific pieces: FESCOs and hukou, China’s “domestic passport.”

A Complete Guide to China’s Minimum Wage Levels by Province, City, and District

Mandatory Social Welfare Benefits for Chinese Staff

China Initiates New Round of Minimum Wage Increases

Update: Foreigner Participation in China’s Social Insurance Scheme

- Previous Article New Issue of Asia Briefing: Expanding Your China Business to India and Vietnam

- Next Article Qianhai Launches Qualified Foreign Limited Partner Pilot Program