China’s Second Tier Cities? The Third and Fourth Tiers are Catching Up

Op-Ed Commentary: Chris Devonshire-Ellis

Oct. 26 – The much lauded phrase “second tier city” has been around for much of the past decade as a descriptive factor, especially in China, when it came to dealing with business opportunities and investments outside the principal cities of Beijing, Shanghai, Guangzhou and Hong Kong. A decade on, and locations such as Chengdu, Dalian, Nanjing, Qingdao, Shenzhen, Suzhou and Tianjin and so on are well established locations with plenty of infrastructure, international airports, (Suzhou aside, which is so close to Shanghai it doesn’t require one) metro systems and all the mainstream conveniences one could possibly want.

A good indicator of how a city progresses is the internationalization aspect; and that is easily measured by numbering the English language social web sites run from such locations. Just for the seven above we can refer readers to expatriate blogs and sites for each:

Chengdu

Dalian

Nanjing

Qingdao

Shenzhen

Suzhou

Tianjin

The city list goes on and on. There’s even an expat web site in far flung Urumqi, while expatriates looking for a full China spread can visit our China Expat web site with all its regional guides and national commentary and cultural pieces.

However, where there are enough foreigners living in a city to justify such English language infrastructure, prices also tend to rise. Add in the inevitable international schools and hospitals, regional international flights, daily connections to Beijing, Shanghai and Hong Kong, and China’s second tier cities are in fact main stream. All good, however with those come increased overheads. Simply put, China’s second-tier cities no longer represent the “out of tier one” bargains that they used to. While expatriates have a habit of making themselves comfortable in their new home – and nothing wrong with that – the pencil sharpeners of corporate accounts are always looking at the pros and cons of operating in increasingly expensive cities. One thing is for sure though, China is getting more expensive, and the minimum wages payable in these cities is also increasing. We’ve chosen eight second-tier cities below, spread on a national basis, and all have increased their salaries and employee welfare payments annually over the past few years. Their current average salary and welfare overheads are below:

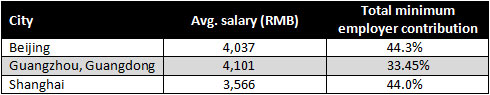

Now let’s compare those with the first-tier cities:

(Source: China Briefing, “Employment Overheads in China’s Social Security System”)

Now the comparison is rather random, and one can add or subtract as many second tier cities as one likes. But the eight second-tier cities selected are a reasonable assumption for what such a location is. They bring us then an average of RMB2,448 in salaries, plus an average 35 percent in mandatory welfare. First-tier cities will always be more expensive, but the three chosen average out at RMB3,901 in salary, and 40.5 percent in welfare. It works out, as an example, that the average second tier city are now at 62 percent of salary and 86.4 percent of welfare compared to their big city rivals. That’s far from the saving it used to be, (wages in the second tier used to be around 30 percent of the first tier) and it means the beneficial cost margin by moving into second tier cities is now being eroded. Essentially, having made a good job of attracting investment, the second tier city governments are now looking for increases in tax revenues – and that includes income tax from the local workforce as well as profits tax from businesses. The local governments are responsible for raising the annual minimum wage, and in all the cases above they have progressively done so, to an extent that they now come considerably closer to that of their tier one rivals. The process will continue, and I estimate will do so until an average second-tier city will represent a discount in salaried overheads of only about 20 percent against tier-one locations.

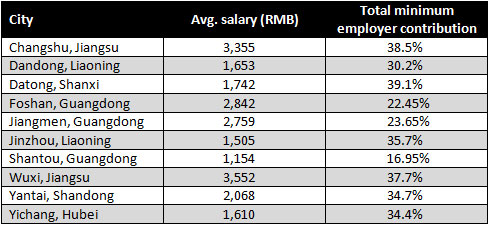

However, let’s compare this with the real third-tier cities. For these, I think the correct definition should be the second or third largest city in a specific province. This, happily, fits right in with central government policy to move manufacturing inland. Here are a handful of third-tier cities, again spread out on a national basis:

Here, we see an average salary come out at RMB2,224, and mandatory welfare at 31.33 percent. That, in percentage terms, is 90.8 percent of average salary and 89 percent of welfare of our selected second-tier cities.

In terms of savings and an assumption of 100 employees, it works out like this:

Providing us with a total annualized (rounded up) saving per annum of a shade under RMB460,000, or about US$68,900, per 100 employees. Surprisingly, that doesn’t sound a great deal, and indicates again that China, in terms of labor, is indeed spreading the wealth around and progressively becoming more expensive on a national basis as a result. The need to relocate a factory from a second-tier city to a third-tier city based upon the savings in salary and welfare alone are probably not enough to justify the difference, although for a new to China business, especially a new SME, that US$68,900 could be very useful, especially given thin margins elsewhere.

It means then that the driver for looking at China’s remote locations – those third and fourth tier cities – needs to be examined quite carefully to dig out the bargains. Shantou, for example in South China, a major port itself, possesses an average income of less than half the labor cost of Wuxi. It pays then to shop around. Land costs will also need to be factored in, and investment incentives negotiated with government. Even China’s third and fourth-tier cities are catching up as China’s government spreads the nation’s wealth about, and the costs of land and labor need to be evaluated carefully prior to making decisions. Whether remaining in China, and sifting through the bargains, or considering relocating in Southeast Asia is a choice that is rapidly coming to a head for the international investor.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates, establishing the firm’s China practice in 1992. The firm now has ten offices in China, five in India, and two in Vietnam. For advice over China strategy, trade, investment, legal and tax matters please contact the firm at info@dezshira.com. The firm’s brochure may be downloaded here.

Chris also contributes to the Asia Briefing publications India Briefing, Vietnam Briefing, and 2point6billion.com.

Related Reading

China Taxes, How Do They Stack Up Against Emerging Asia?

China Profit Margins Shrinking as Investors Reconsider Asia

Relocation Costs from China to India and Vietnam

![]() China’s Emerging Second and Third Tier Cities

China’s Emerging Second and Third Tier Cities

Fifty emerging Chinese cities, investment zones, incentives and demographics, 217 pages, US$40

- Previous Article Relocating Your China WFOE: It’s a Settlement Deal

- Next Article China to Redefine SMEs Giving Small Firms Wider Access to Gov’t Funding