What is ESG Reporting and Why is it Gaining Traction in China?

We explain the concept of ESG reporting (tracking environmental, social, and governance metrics) and China’s mandate for corporate compliance in this regard. We also discuss some of the challenges faced by corporates adapting to sustainable reporting standards in the country. Regardless of the current scope of practice, it is clear that Chinese authorities will become increasingly sensitive to corporate ESG reporting to fulfill key green economy policy goals. For example, on February 8, 2022, the Measures for Enterprises to Disclose Environmental Information by Law will come into effect. It will require five types of enterprises to disclose environmental information.

The concept of ESG reporting (environmental, social, and corporate governance), an emerging global trend, is now in the ascendant in China as the country seeks to green its economy and improve social equality.

After all, China’s ambition to reach peak carbon by 2030 and become carbon neutral by 2060 requires companies to start transitioning to a lower-carbon business model.

Corporate reporting on a complete set of ESG metrics will help regulators to timely adjust their policies, and guide capital flows; it also enables customers and investors to make informed decisions.

China’s ESG investment market, while small, has developed rapidly in recent years. There is a positive trend of voluntary ESG reporting in the country. In fact, several mainland-listed companies released their annual CSR/ESG reports for 2020. The number of ESG public funds also surged in 2021. Meanwhile, ESG queries from investors have noticeably increased.

In this article, we explain the concept of ESG, its development in China, some existing problems and challenges, and the outlook of China’s ESG market.

What are the ESG reporting criteria?

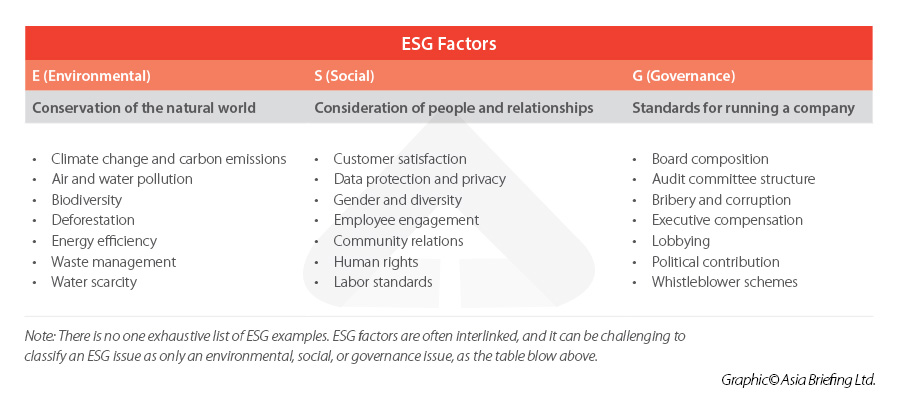

ESG stands for environmental, social, and governance – which represents the three main criteria for investors to quantify and evaluate a company’s level of sustainability.

Specifically, environmental criteria take into account a company’s performance in protecting the environment; social criteria examine how it manages relationships with employees, suppliers, customers, and communities; and governance criteria deal with a company’s leadership, executive pay, audits, internal controls, and shareholder rights.

ESG is a relatively new concept. The term was first coined in 2004 in a UN research report, Who Cares Wins, and its importance was reaffirmed in 2006 by the UN Principles for Responsible Investment (PRI) – an international organization that works to promote the incorporation of ESG into investment decision-making.

With COVID-19 and growing global awareness of climate issues, ESG investing that considers environmental, social and governance impact alongside traditional financial indicators is getting increasingly popular.

As of March 31, 2021, the PRI got 3,826 signatories (3404 investors and 422 service providers), an increase of 938 over the same period of the previous year. Assets under management (AUM) by the signatories surpassed US$100 trillion in 2020, an increase of 75 percent compared with 2015. More and more mutual funds and brokerage firms are now offering products that employ ESG criteria.

How is ESG developing in China?

The development of ESG in China is largely driven by policy incentives and regulations as the country seeks to achieve ambitious carbon goals and improve social equality.

It has been fast-tracked since 2016 when China introduced a green finance system, and recently gained momentum amid the country’s carbon peaking and carbon neutrality goals.

A brief timeline of the development of ESG in China

- In 2016, seven authorities, including the People’s Bank of China (PBOC, China’s central bank) and the China Security Regulatory Commission (CSRC, the country’s top securities regulator), jointly issued the Guiding Opinions on Building a Green Finance System, laying a foundation for the establishment of a mandatory environmental information disclosure system for listed companies.

- In 2017, the CSRC and the Ministry of Environmental Protection (MEP) signed the Cooperation Agreement on Jointly Developing Environmental Information Disclosure of Listed Companies.

- In 2018, the CSRC revised the Listed Company Governance Code, stipulating that listed companies have the responsibility to disclose ESG information. The Asset Management Association of China (AMAC) issued the first Green Investment Guide (Trial) and the Research Report on ESG Evaluation System for Chinese Listed Companies (2018), guiding fund managers to carry out green investment activities and promoting listed companies to improve information disclosure and corporate governance.

- In 2020, the PBOC issued a trial guideline to pilot financial institutions, which spelled out the framework and content for financial institutions’ environmental information disclosure.

The same year, Chinese President Xi Jinping announced that China aimed to hit carbon emission peak by 2030 and achieve carbon neutrality by 2060.

- On March 1, 2021, Shenzhen started implementing the Regulations on Green Finance of Shenzhen Special Economic Zone, which fleshed out requirements on the subjects, basis, time, and form of environmental information disclosure.

- On June 28, 2021, the CSRC revised format standards for annual reports and semi-annual reports of listed companies, which separated relevant provisions on environmental and social responsibility as an independent chapter to highlight the environmental protection and social responsibility of listed companies.

- In 2021, China’s carbon peaking and carbon neutrality goals were written into the Government Work Report – this means that the central government has officially put reducing carbon emissions on its agenda. In November, China released an action plan for reaching carbon emission peak before 2030. China and the EU published the “Common Ground Taxonomy – Climate Change Mitigation,” a list of economic activities conducive to fighting climate change recognized by both sides.

- On December 21, 2021, the Ministry of Ecology and Environment released the Measures for Enterprises to Disclose Environmental Information by Law to regulate enterprises’ disclosure of environmental information by law. The Measures, which will come into force from February 8, 2022, require five types of enterprises to disclose environmental information. The five categories of enterprises are: key pollutant-discharging enterprises; enterprises that are subject to mandatory review for clear production; listed companies and their subsidiaries at all levels; enterprises that issue enterprise bonds, corporate bonds, and debt financing instruments for non-financial enterprises; and other enterprises that should disclose environmental information under laws and regulations.

Propelled by government encouragement and regulations and to adapt to the opening capital market, many Chinese companies are already voluntarily reporting information related to ESG.

By mid-2020, 1,021 Chinese A-share companies (that is, companies listed in RMB on the Shenzhen and Shanghai stock exchanges) had published annual ESG reports (including those labeled as “sustainability”, “corporate social responsibility (CSR)”, etc.), up from 371 companies in 2009. Of these, about 130 A-share companies have dual listings in Hong Kong, where ESG reports are required. (The Hong Kong Stock Exchange (HKEX) has required listed companies to issue ESG reports since 2016.) In 2020, more than a quarter of A-share companies published their annual CSR/ESG reports.

Bigger companies are more proactive about releasing their ESG information, with 86 percent of CSI 300 constituents (the 300 largest and most liquid A-share stocks) producing ESG reports in 2020, up from 49 percent in 2010, according to J.P. Morgan.

In the first three quarters of 2021, the number of ESG public funds surged in China, with 48 new ESG products being released, close to the total of the previous five years. As of September 2021, the total assets under management of ESG public funds jumped to nearly RMB 250 billion (US$39.3 billion), almost double the size of the same period of the year earlier, according to a white paper released by Caixin.

As of September 2021, a total of 74 institutions in China have signed the PRI – the number of signatories increased by about 20 compared with 2020.

Challenges

China’s ESG disclosure and scores remain low, and the ESG market remains small.

According to the World Economic Forum, Chinese companies and industry sectors are spread across a range of ESG performances. MSCI (a global provider of financial analysis tools) has assigned ESG ratings to around 700 Chinese companies. Between 2018 and 2020, the MSCI ESG ratings for Chinese companies improved, but the majority were still at the lower end of the seven-tier AAA-CCC rating scale.

As known by many ESG investors, ESG investment strategy employs a variety of analytical approaches and data resources to address investment considerations. Measurable and comparable data is crucial. However, the availability and quality of such ESG data are a major challenge for foreign investors investing in China. Overall, ESG data disclosed by Chinese companies is still insufficient.

According to Zhang Bohui, a professor at the Chinese University of Hong Kong, Shenzhen, at present, China has no unified ESG information disclosure standard for domestic listed companies. It has not yet issued integrated ESG legal documents, only some relevant laws and regulations mainly focused on environmental protection and social responsibility.

Due to the lack of unified ESG information disclosure standards, the ESG information of listed companies is incomplete or not credible. The quality of ESG report disclosure of listed companies appears poor.

While some domestic third-party ESG rating providers have emerged, including Wind, SynTao Green Finance, RANKINS CSR Ratings, etc., the ESG ratings cannot accurately reflect the enterprise’s true ESG performance. The availability and reliability of the data are insufficient to support a sound Chinese ESG evaluation system.

Additionally, overseas investors without local language resources may struggle to get the full picture as companies that are only listed on the onshore market tend to report in Chinese only.

Looking forward – the future of sustainability reporting in China

For China, sustainability reporting remains an important entry point to achieve its carbon peaking and carbon neutrality goals and improve social equality. The Chinese government is now rapidly improving its corporate reporting landscape and striving to help enterprises pivot their businesses to a low-carbon model.

Despite the existing challenges, Chinese companies are approaching somewhat of a “leapfrog moment” in ESG measurement and reporting. With a stronger push from regulators and investors, it can be expected that more Chinese companies will disclose more and better ESG data over time. In turn, more implementing guidelines and clarity from regulators can be expected in the near term, as China has set three major carbon milestones for 2025, 2030, and 2060.

For companies, an ESG Report is a good way to provide a standardized and comprehensive set of data to boost investor confidence about its long-term growth potential. Chinese companies have been dealing with the consequences of a prolonged COVID-19 economic crisis and are seeking to lure domestic and foreign capital. With the global consensus on corporate responsibility, a concrete, comparable, and financially relevant ESG report will help companies ensure better access to financing and maintaining public and social licenses for their operations.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China Merges Three Rare Earths State-Owned Entities to Increase Pricing Power and Efficiency

- Next Article Explainer: What’s Going on in China’s Property Market?