A Guide to Franchising in China

China is one of the biggest franchise markets in the world and a key target for international franchisors with its vast middle-class consumer base.

To gain a foothold in the Chinese market, franchisors are advised to familiarize themselves with the country’s regulatory structure and consumer market preferences.

In this article, we explain China’s franchise market and highlight necessary legal precautions for foreign companies seeking a presence in this market.

China’s franchise market

Franchising in China has undergone rapid development over the last decade. In 2015, total sales of the top 100 franchisors in China reached a record high of RMB 434.5 billion (US$62.9 billion) before declining to RMB 330 billion (US$47.8 billion) in 2017, according to the China Chain Store & Franchise Association (CCFA).

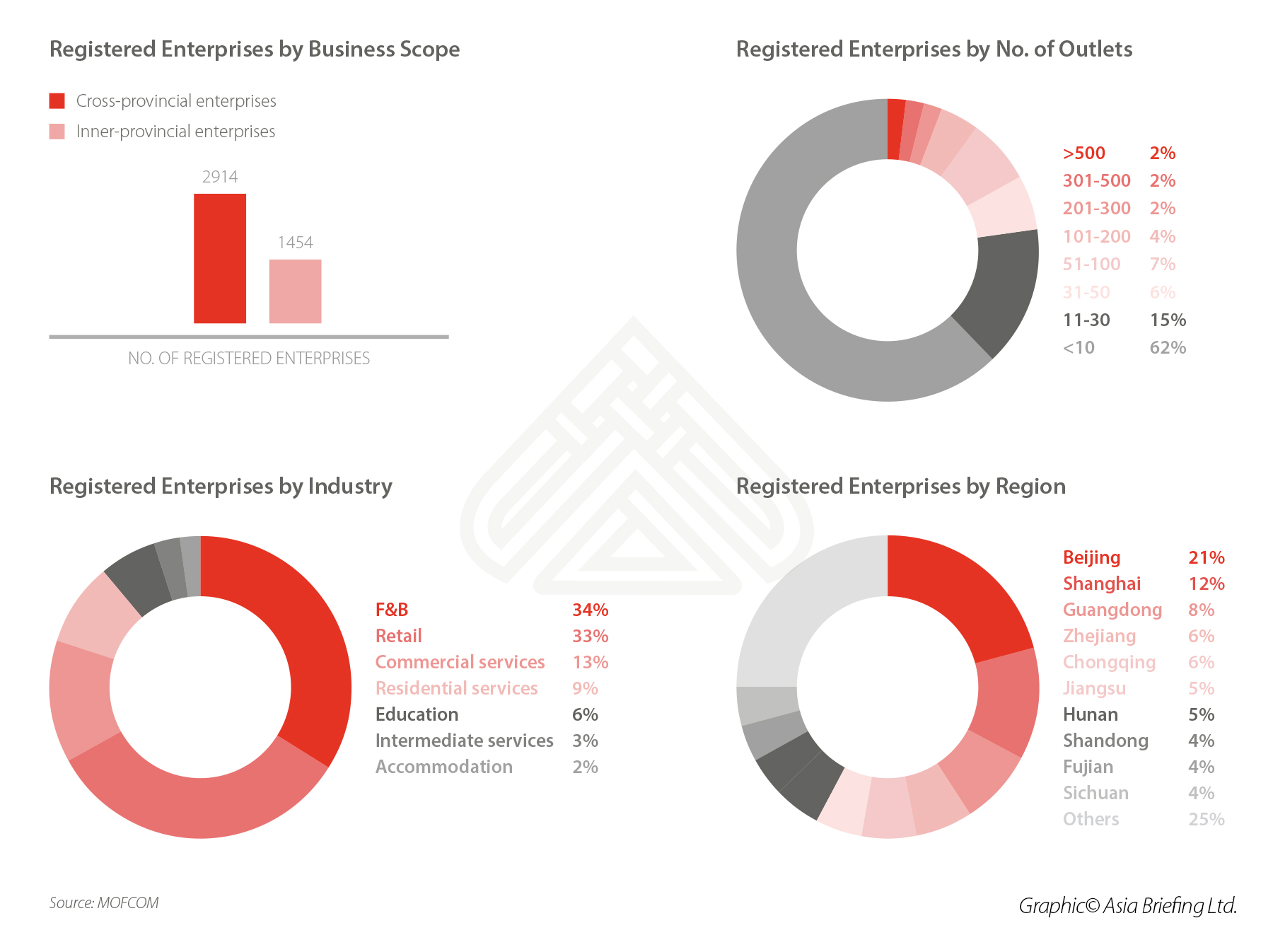

As of January 2019, 4,368 franchisors have registered with the Ministry of Commerce (MOFCOM), while unofficial statistics indicate that China already has over 4,500 franchises and chains with some 400,000 outlets in operation, making China one of the largest franchise markets in the world.

Among these franchises, many are domestic brands and small in scale, with an average of around 90 outlets per franchise system, compared to an average of several hundreds of outlets per franchise system in countries like the US and UK.

Key industries and sectors in the franchise market include food and beverage (F&B), retail, car rental, catering, education, beauty, health and fitness, and hospitality.

Consumption trends in China’s dynamic market

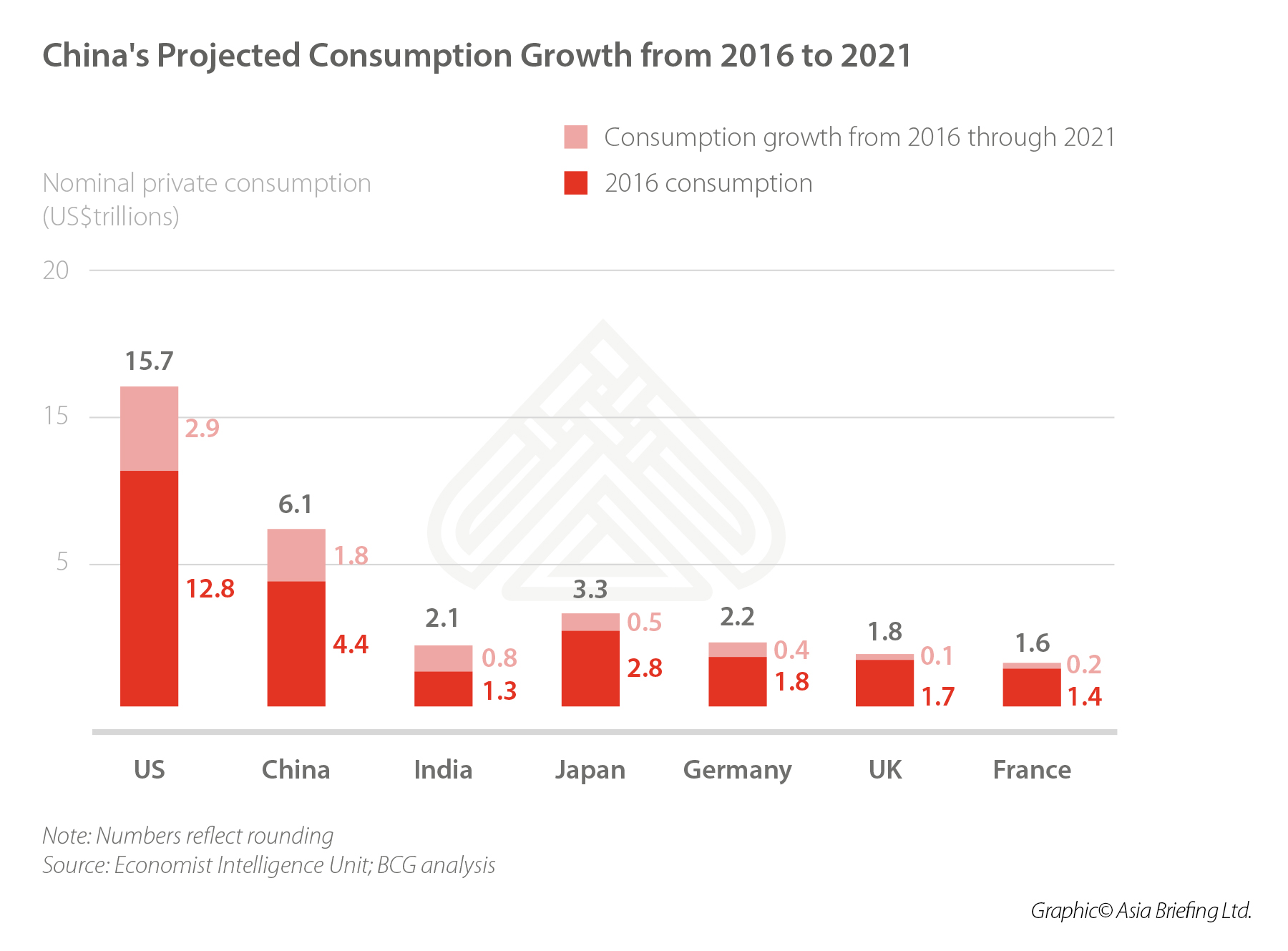

Despite the slowdown in economic growth, China will remain one of the world’s fastest-growing consumer markets for the foreseeable future.

Even if China’s overall GDP grows at less than seven percent a year, its consumption is projected to increase by more than 10 percent annually. This is mainly because the country’s structural reforms aim to transform China into a consumption-driven economy.

In the first three quarters of 2018, China’s consumption expenditure accounted for 78 percent of its economic growth, according to the National Bureau of Statistics.

A survey jointly published by Boston Consulting Group (BCG) and Alibaba estimates that even if we conservatively assume that the yearly growth of China’s GDP was only 5.5 percent (it was 6.6 percent in 2018) from 2016 to 2021, China’s consumer market could still reach US$6.1 trillion by 2021.

Investors will find ample opportunities in the Chinese market – foreign brands enjoy positive perceptions among Chinese consumers and the government has expedited the process to establish foreign-invested entities (FIEs) since October 2016.

However, the increased opportunities come with new challenges.

Higher incomes, a younger generation of consumers, and e-commerce not only boost China’s consumption, but also contribute to a far more heterogeneous consumer market.

We highlight some of the leading trends in the Chinese market below:

- Upper middle class and affluent households are trading up – buying higher-quality services in discretionary categories like travel and entertainment.

- Discerning and trend-conscious millennial shoppers – the new consumption power – are showing diverse and fast-changing preferences for characteristic or customized products and services.

- Chinese consumers show high preference for integrated digital shopping experiences due to the rise of online shopping and broader access to technology.

These trends and consumer preferences are influencing major industries in the franchise market.

Online restaurant delivery platforms, e-commerce grocery sales, and restaurant chains in third-and fourth-tier cities are developing rapidly in F&B industry.

Digitalization driven by smartphone penetration, popularity of mobile commerce, and big data analysis is creating new marketing tools, sales channels, and improving the interaction between merchants and consumers in the retail industry.

New market segments are evolving in the services industry, such as healthy and fashionable lifestyle services, to cater to the tastes of younger consumers.

Global franchisors should be alert to these challenges, trends, and changes when strategizing their entry into the Chinese market, which is large but also highly dynamic and differentiated.

Advantages and disadvantages of the franchise model

Foreign companies enter the Chinese market through various ways, such as foreign direct investment (FDI), exporting, global sourcing, franchising, and licensing.

Franchising allows the franchisor to grant franchisees the right to use its business model, brand, know-how, intellectual property (IP), etc. to sell its branded products and services in exchange for fees, royalties, or other compensation. It has both advantages and disadvantages when compared to other business models.

On one hand, franchising enables franchisors to invest less money, to leverage franchisees’ local knowledge, and to internationalize quickly to many markets.

KFC and McDonald’s entered China in 1980 and 1990 and neither of them initially franchised their outlets.

KFC began granting franchises in lower-tier cities in 1992 and now have around 6,000 outlets in mainland China, more than twice the number of McDonalds’ outlets, who adopted franchising later in 2004.

Franchising can help brands expand in the local market faster – if they find the right partners. However, a down side is that franchisors can only maintain limited control over franchisees and its assets abroad and may face risks by creating a future competitor.

Are you qualified to start a franchise in China?

The Commercial Franchise Administration Regulation (2007) lays out the qualifications for potential franchisors.

- First, only enterprises can engage in business as franchisors. The enterprise should have a mature business model as well as the ability to provide franchisees with long-term business guidance, technical support, and business training.

- Second, the enterprise should comply with a “2+1” rule, which means that it must operate at least two direct-owned outlets for more than one year in any part of the world – a local entity is not necessary.

- Third, franchises in China are subject to national network-based record filing. This requires the franchisor to file their records with the relevant commercial authorities within 15 days after initially signing a franchise contract with the franchisee.

Entry strategies you need to consider

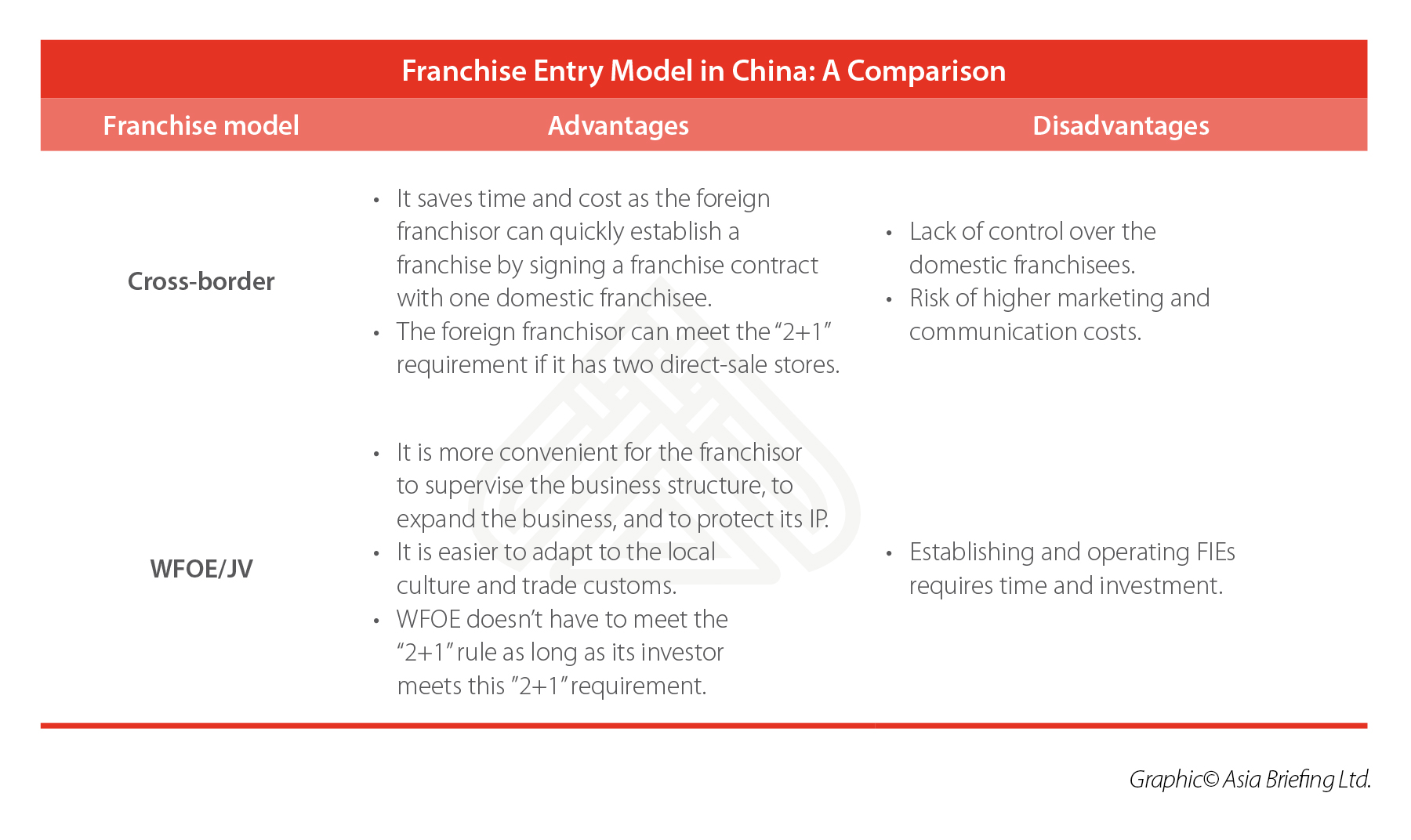

For foreign franchisors, there are two common ways to enter the Chinese market:

- Offering franchise to Chinese enterprises from abroad (cross-border franchising), or

- Establishing a local entity, usually in the form of a wholly foreign-owned enterprise (WFOE) or a joint venture (JV) to grant concession to other Chinese enterprises.

Franchise regulations in China you need to know

China adopted its first franchise law in 1997, but foreign franchising remained mostly a gray area at that time until a new law was announced in 2005, which eliminated legal restrictions on foreign investment in franchising.

Now, China’s franchise law is clearer by virtue of the 2007 law, a revision of the 2005 law.

Laws that impact the franchisor and franchisee relationship in China

Primarily, all contracts in China must conform to the general principles set out in the Contract Law of the PRC. In addition, franchise relationships are governed by the following regulations and administrative measures in China:

- The Commercial Franchise Administration Regulation (商业特许经营管理条例,2007);

- The Commercial Franchise Registration Administrative Measures (商业特许经营备案管理办法, 2011);

- The Commercial Franchise Information Disclosure Administrative Measures (商业特许经营信息披露管理办法, 2012); and

- The Administrative Measures for Foreign Investment in Commercial Fields (外商投资商业领域管理办法, 2004).

Other laws that may affect franchisors include: the Labor Contract Law (劳动合同法), the Anti-unfair Competition Law (反不正当竞争法), the Anti-monopoly Law (中华人民共和国反垄断法), the Trademark Law (商标法), and the Copyright Law (著作权法).

The record filing system

As mentioned above, franchisors need to file with commercial authorities within 15 days from the date of the execution of the initial contract with the franchisee.

For the filing authorities, if the franchisor is registered within Chinese territory, record filing should be made with the relevant commercial department at the provincial-level government.

However, if the franchisor is registered overseas, record filing should be made with the MOFCOM’s head office in Beijing.

When filing with the relevant commercial authority, a franchisor should submit the following documents and materials:

- A duplicate copy of its Business License or of its enterprise registration (filing) certificate;

- A sample franchise contract;

- Franchise operation manuals;

- A marketing plan;

- A written undertaking and relevant supporting documents showing that the franchisor meets the requirements of having a mature business model and complying with the “2+1” rule; and

- Other documents and materials as stipulated by the relevant commercial authority of the State Council.

If any of the above documents are prepared outside of China, it should be notarized by a notary institution in the country in which it was prepared (with a Chinese translation attached) and be certified by the Chinese embassy or a consulate.

In case a franchisor fails to do so, a fine of RMB 10,000 (US$1,500) to 50,000 (US$7,300) may be imposed by the government. If the franchisor fails again to pay the fine within a certain time, it will be fined RMB 50,000 (US$7,300) to 100,000 (US$15,000), and a public announcement will be made.

You may download the filing materials from the government website.

Reporting requirements, processing time

After submission, the filing authority will handle the filing and make a public announcement on the website of the MOFCOM within 10 days from the date of the receipt. Supplementary documents and materials may be requested within seven days if the submission is incomplete.

If there is any change in the franchisor’s filing information, in the information on business resources or in the distribution of stores of all franchisees within the territory of China – the franchisor should, within 30 days from the date of the change, apply to the filing authority for a change.

Moreover, the franchisor should, before March 31 in each subsequent year, report to the filing authority the conclusion, cancellation, termination, and renewal of the franchise contract in the previous year.

The pre-contractual disclosure system

According to the Administrative Measures for Commercial Franchise Information Disclosure (2012 Revision), a franchisor has an extensive information disclosure obligation towards a prospective franchisee.

The franchisor needs to provide the following required information in writing to the franchisee at least 30 days prior to the conclusion of the franchise contract:

- The franchisor’s name, domicile, legal representative, registered capital, business scope, and the basic situation of franchising activities;

- Basic information of the franchisor’s registered trademarks, corporate logos, patents, proprietary technology, and business model;

- The type, amount, and method of payment of franchise fees (including whether the margin deposit is required and the repayment details of the margin deposit);

- Prices and conditions for the provision of products, services, or equipment to the franchisee;

- The content and implementation plan for the provision of continuous business guidance, technical support, and operation training to the franchisee;

- Specific methods of supervising and guiding the operation activities of the franchisee;

- The estimate budget of investment for franchise outlets;

- The number, geographical distribution, and business conditions assessment of existing franchisees;

- The last two years’ briefs of financial accounting report and auditing report as audited by an accounting firm;

- The last five years litigation and arbitration results related to franchising;

- Any serious illegal business records of the franchisor or its legal representative; and

- Any other information prescribed by the commercial administrative department.

Failure to disclose such information may incur a fine of up to RMB 50,000 (US$7,300). Further, if the franchisor conceals information or provides inaccurate information that affects the performance of the franchise, the franchisee may have legal grounds to terminate the agreement.

Franchise contracts and agreements

The franchise contract forms the heart of a franchise and provides the basis of the cooperation between the franchisor and the franchisee.

As stipulated by current regulations, a written contract should be signed by both sides and the term of the franchise stated in the franchise contract should not be less than three years unless the franchisee agrees to a shorter term.

A franchise contract shall include the following main content:

- Basic information of the franchisor and the franchisee;

- Contents and duration of the franchise;

- Types, amounts, and payment methods of the franchise fees;

- Specific contents and provision methods of the operational guidance, technical support, business training, and other services;

- Quality and standards requirements, as well as guarantee measures, for the products or services offered by the franchised business;

- Promotion and advertisement of the products or services offered by the franchised business;

- Arrangements for protection of consumer rights/interests and undertaking of liability for compensation in the franchising activities;

- Amendments, rescission, and termination of the franchise contract;

- Liability for breach of contract;

- Methods of dispute resolution; and

- Other matters as agreed upon by the franchisor and the franchisee.

Further, franchise agreements must contain a cooling-off period in which the franchisee may unilaterally terminate the agreement to avoid risks such as being inexperienced or acting on impulse. The length of the cooling-off period is negotiated by the parties in good faith.

Due diligence and legal precautions

Most franchising activities are not restricted in China, but certain industries are closed to foreign investment: banking, telecommunications, and compulsory school education, among others.

Make sure the business scope is not targeting an industry that is in the government’s Negative List.

Background investigation on prospective franchisees is essential. Usually, information about a corporation can be found online in major urban areas, including the companies’ shareholders, registered capital, management, affiliates, and past litigation.

In addition, proper research and understanding of the different customs and cultures between different regions and ethnic groups in China is also crucial for certain business, like fast food and catering – for them to successfully adapt to local markets and maintain competitiveness.

IP protections

It is to be noted that franchising is a common source of IP infringements.

Before entering the Chinese market, franchisors must ensure that their IP is established under Chinese laws and that the franchise agreement contains clear clauses on how their brand name, designs, and trade secrets such as production techniques should be applied.

Breach of these clauses should be punishable by penalties and the immediate termination of the franchise by the franchisor.

Protect your brands under Chinese laws

Trademark infringement happens a lot in China. It is critical not to forget to register the trademark under the Chinese law.

The Starbucks trademark infringement case is a precedent – a local coffee store chain violated Starbucks’ trademark by nearly duplicating its name and logo. Since Starbucks only registered its trademark in Taiwan instead of mainland China, it cost time for Starbucks to win this lawsuit.

You can always register your trademarks in China before you start to establish your business here. However, it is common for local companies to register your logo and brand name in Chinese before you do. Foreign cosmetic brands like Hera, Coppertone, KIEHL’s have all suffered from this.

Be careful to protect your brand when disclosing information to franchisees. Sign the confidentiality agreements, through which the confidentiality obligation and responsibility should be clearly stipulated in written form.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article Jiangsu Tax Cuts, Other Incentives for Private Sector Businesses

- Next Article Cómo abrir una cuenta bancaria en Hong Kong