Paying Foreign Employees in China: Individual Income Tax & Salary Planning

By Dezan Shira & Associates

Editors: Steven Elsinga and Zhou Qian

China’s Individual Income Tax Law features a special regime for stock options and annual bonuses. By intelligently making use of stock options and annual bonuses, an employer may offer a valued employee a higher remuneration package, at no extra cost to the company. Drawing from our December magazine, this article examines the tax benefits that are available.

Year-end Bonuses

Chinese tax law allows a yearly one-off lump sum bonus to be calculated and taxed separately from other taxable salary income, according to the following formula:

Tax payable on year-end bonus = Taxable annual bonus amount x Applicable tax rate – Quick deduction

You can arrive at the applicable tax rate and quick deduction by dividing the bonus figure by twelve, and entering that amount into the individual income tax rates table above. For example, the applicable tax rate for an RMB 120,000 bonus is 25 percent (RMB 120,000 ÷ 12 months = RMB 10,000).

In most cases, deductions are not permitted to be applied to one’s taxable bonus income, as these will have already been offset against the individual’s normal monthly salary.

This separate calculation can only be done once a year per individual employee. Bonuses other than the annual bonus, such as half-year, quarterly, over-time, advanced employee, and work attendance bonuses, must be considered as part of the employee’s monthly salary.

If an employee is not employed in China for the full twelve months of the year, the part of his/her annual bonus attributed to the months during which the employee was not present in China may be excluded from his/her taxable income.

Stock Options

Stock options are a type of remuneration where companies that are listed on a stock exchange give their employees the right to buy stocks in the company at a certain price. After one year, the options become exercisable and the employee may choose to buy

the shares at the set price. It is a method of compensation that lets the company’s interests align with the employee’s.

Like with annual bonuses, tax on stock options is calculated separately from normal monthly income. The grant of stock options becomes taxable on the day the employee exercises the options, i.e. buys the shares. The taxable income is the difference between the option price set in the contract, and the market price of the shares at the end of that day. As with annual bonuses, you can arrive at the tax rate and quick deduction by dividing the taxable income by twelve.

Taxable income = (Market price of shares – Option price in contract) x Number of shares

Tax payable = (Taxable income ÷ Employee’s number of months in China x Applicable tax rate – Quick deduction) x Employee’s number of months in China

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

Tax Planning

An optimal compensation package allows an employee to take home the most value while staying within the parameters set by China’s tax laws. This can be achieved by careful tax planning, making use of a combination of permitted allowances, annual bonuses, stock options and other strategies that allows the employee to minimize his or her tax burden.

Tax planning should always be based on the individual’s personal circumstances. To give you a better understanding of the options available, we provide you with some specific examples below.

Example

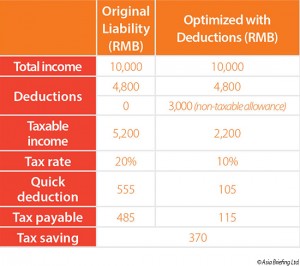

Mr. J is an expat who works for a foreign-invested enterprise in Shanghai. His employment income is fully taxable in China and his individual income tax is borne by himself. In January 2014, his income is RMB 10,000. Suppose he receives a housing allowance of RMB 3,000 in total and no other deductions. Below, we compare his original income tax liability to an arrangement with deductible fringe benefits.

One thing to be noted is how much of a foreign employee’s salary can be allocated to allowances. This is something that is not clearly defined by the law, which only stipulates that the allowances should be “reasonable.” In practice, many companies adopt a proportion of 30 percent of the total salary of the foreign employee and classify

this portion as allowances. There is always the possibility that the tax office will challenge the company on this issue, so we recommend that the proportion of allowance should be set at or below this level.

Tax Planning via Year-end Bonuses

Tax Planning via Year-end Bonuses

A year-end bonus is a helpful tool to reduce an employee’s tax burden, as it is calculated separately from his or her salary income. An employer can therefore choose to pay out some of the employee’s salary as a bonus to reduce the employee’s tax burden. As described above, the appropriate tax rate is determined by dividing the bonus by twelve

and applying the monthly tax rate and quick deduction figures.

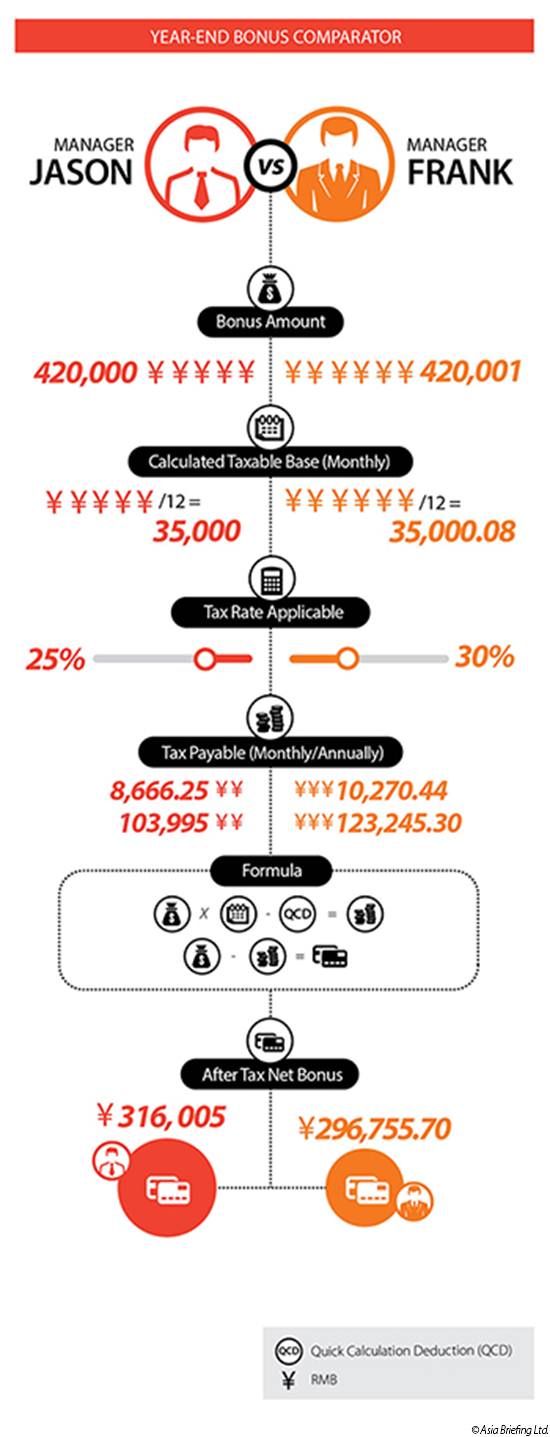

There are two major issues that an employer should keep in mind when planning year-end bonuses: firstly, employers should be wary of tax bracket threshholds. As illustrated below (click to enlarge), a small difference in the bonus amount can lead to vastly different tax outcomes.

Frank’s tax liability turns out to be much higher than Jason’s, despite the fact that Frank’s bonus was only one yuan higher. This is because tax on year-end bonuses is calculated differently from regular income. Therefore, in certain circumstances, a higher bonus can actually result in the employee taking home a smaller reward.

Secondly, it is important to remember that using an annual bonus will only be effective up to a certain point. Roughly speaking, once the annual bonus amount equals or exceeds the employee’s annual salary, it is no longer an effective tool to reduce income tax.

To optimize your foreign employee’s compensation package, it is advisable to consult a tax advisor prior to implementing a tax-efficiency plan. This can ensure that the arrangements are in compliance with the PRC individual income tax laws and regulations and that the related IIT liability is properly and legally minimized.

Earlier articles excerpted from our December magazine covered the expat makeup in China, work visa applications and paying income tax for expats. Our final article will discuss remitting salary earned in RMB abroad.

This article is an excerpt from the December issue of China Briefing Magazine, titled “Employing Foreign Nationals in China“. In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad. This article is an excerpt from the December issue of China Briefing Magazine, titled “Employing Foreign Nationals in China“. In this issue of China Briefing, we have set out to produce a guide to employing foreign nationals in China, from the initial step of applying for work visas, to more advanced subjects such as determining IIT liability and optimizing employee income packages for tax efficiency. Lastly, recognizing that few foreigners immigrate to China on a permanent basis, we provide an overview of methods for remitting RMB abroad. |

![]()

Human Resources and Payroll in China (Third Edition)

Human Resources and Payroll in China (Third Edition)

A firm understanding of China’s laws and regulations related to human resources and payroll management is essential for foreign investors who want to establish or are already running foreign-invested entities in China. This guide aims to satisfy that information demand, while also serving as a valuable tool for local managers and HR professionals who may need to explain complex points of China’s labor policies in English.

Tax, Accounting, and Audit in China 2015

Tax, Accounting, and Audit in China 2015

This edition of Tax, Accounting, and Audit in China, updated for 2015, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Using China’s Free Trade & Double Tax Agreements

In this issue of China Briefing, we examine the role of Free Trade Agreements and the various regional blocs that China is either a member of or considering becoming so, as well as how these can be of significance to your China business. We also examine the role of Double Tax Treaties, provide a list of active agreements, and explain how to obtain the tax minimization benefits on offer.

- Previous Article China’s Fiscal Revenue Growth Slows to 23-Year Low

- Next Article China Investment Roadmap: The Entertainment Industry – New Issue of China Briefing Magazine