China Deepens VAT Reform to Combat Financial Complexity

By Moliang Jiang

China announced plans to deepen its value-added-tax (VAT) reform again on August 18 this year at a State Council executive meeting chaired by Premier Li Keqiang. The government’s newest move sets out to enhance the non-standardized tax rate structure, simplify the tax compliance system, and push forward VAT legislation.

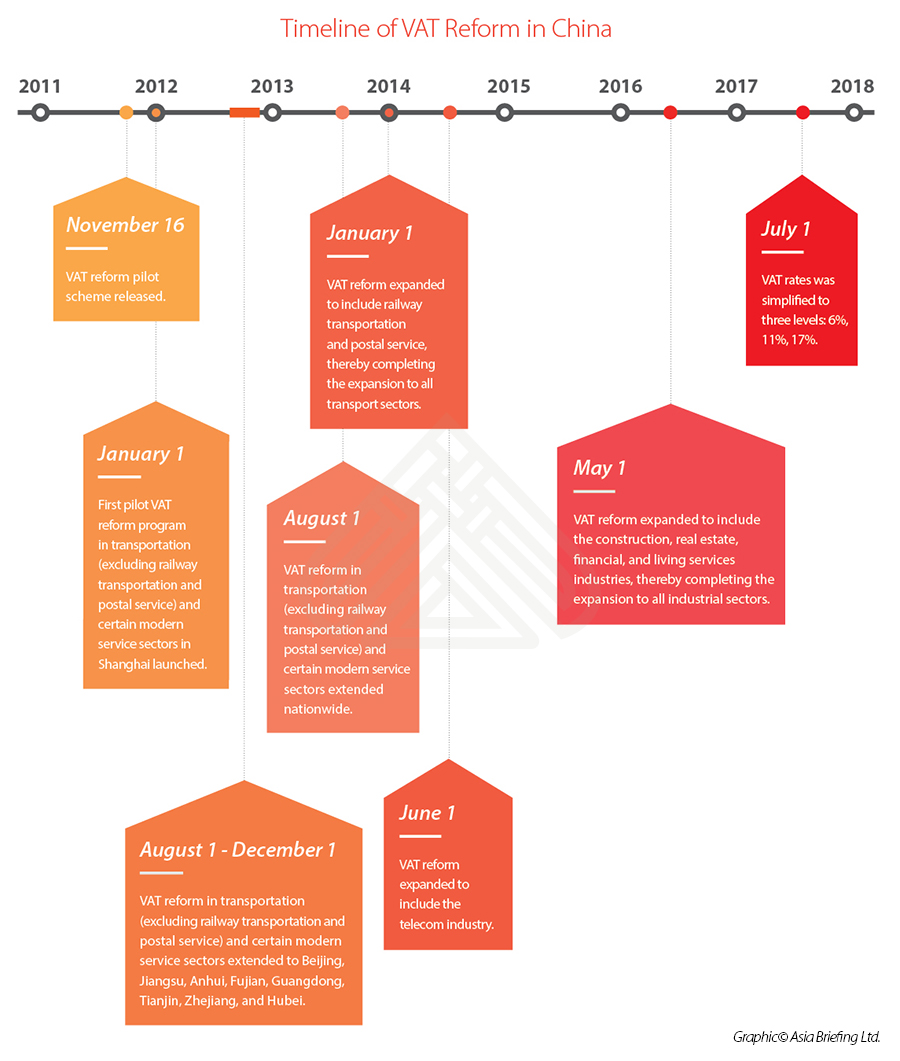

China’s VAT reform has been a continuous development that resolved to replace Business Tax (BT) with VAT, reduce corporate tax burdens, and increase the weight of the service sector in China’s economy. China first piloted the VAT reform in Shanghai in 2012, and later expanded it to other municipalities and various industries.

Starting from May 1, 2016, construction, real estate, financial, and consumer services sectors also switched to the VAT regime, marking that VAT officially replaced BT as the only indirect tax in China. Henceforth, China’s tax system aligns more closely with the international standard. According to the Ministry of Finance, from May 2016 until June this year, China has relieved tax burdens of mainland businesses by RMB 850 billion, equivalent to US$127.5 billion.

![]() RELATED: Tax, Accounting and Audit in China 2017

RELATED: Tax, Accounting and Audit in China 2017

The last phase of reform started on July 1 this year. China’s State Administration of Tax decided to decrease the four-tier tax system to three tiers, removing the 13 percent bracket and leaving the 17 percent, 11 percent, and six percent brackets. The change reduced tax rates for agricultural products, tap water, publications, and a number of other goods from 13 percent to 11 percent.

In the meeting last week, the government pledged to improve the tax compliance system in order to provide taxpayers with more efficient and convenient tax services. More specifically, the reform will encompass increasing digitization of the tax system, simplifying procedures of tax filing, promoting the use of electronic invoices in place of the physical fapiao, and improving tax services.

In the meeting last week, the government pledged to improve the tax compliance system in order to provide taxpayers with more efficient and convenient tax services. More specifically, the reform will encompass increasing digitization of the tax system, simplifying procedures of tax filing, promoting the use of electronic invoices in place of the physical fapiao, and improving tax services.

The meeting touched on other issues that will be put on the schedule. Companies can anticipate tax policies for the manufacturing, finance, and construction sectors being improved and legislation on the VAT rolling out. The government will also tackle the problem that a small number of taxpayers face a higher tax burden due to insufficient tax offsetting items.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

China’s business environment is known for its complicated tax and accounting system that leads to financial complexity. Foreign businesses that first enter the Chinese market usually find it difficult to comply with various regulations. Take China’s VAT invoice system as an example: businesses in China need to document all transactions on a fapiao, a legal receipt that monitors payment and prevents individuals and businesses from evading tax. Companies need to apply for a fapiao quota and purchase fapiao from the tax bureau. An increase in the quota requires companies to go through another lengthy application process.

As the government expresses interest to enhance multiple aspects of tax services and incorporate digital technology into the tax system, companies should expect the accounting procedures to become easier to navigate in the near future.

Despite progress made so far, China’s VAT reform is not fully-fledged and will further unfold in the future. Companies should build a tax structure around the reform and navigate the financial complexity under the reformed tax system.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

In this issue of China Briefing magazine, we provide foreign investors with best practices for implementing internal controls in China. We explain what makes China’s internal control environment distinct, and why China-based operations need to prioritize internal control. We then outline how to execute an internal control review to gauge organizational resiliency and identify gaps in control points, and introduce practical internal controls for day-to-day operations. Finally, we explore why ERP systems are becoming increasingly integral to companies’ internal control regimes.

- Previous Article Electronic Contracts in China Can Improve Efficiency with Strong Controls

- Next Article China Bans Weird, Long, and Sensitive Company Names