China’s New Deed Tax Law: What Does it Mean for Businesses?

China’s new Deed Tax Law is about to come into force on September 1, 2021. Foreign companies are subject to deed tax if they acquire real estate and/or land use rights in China, and this often occurs when the company reorganizes. Fortunately, China has extended deed tax exemptions to support certain types of corporate restructuring and reorganization.

China announced the elevation of the deed tax regulation into national law on August 11, 2020. The new Deed Tax Law is going to take effect on September 1, 2021, repealing the Interim Regulations on Deed Tax promulgated in 1997.

Deed tax is a tax levied on the assignees of land use rights and real property ownership. For businesses, it often applies when there is company restructuring and reorganization (including merger, split-up, transfer of assets, etc.).

For qualifying restructuring and reorganization of enterprises and public institutions, China granted deed tax exemptions. The exemption policies, previously extended to December 31, 2020, were further extended until December 31, 2023.

What is deed tax?

According to the Deed Tax Law, any organization or individual to whom the title to the land use rights or the real properties has been transferred within the territory of China should pay deed tax.

The transferee bears the tax obligation, under any of the following three scenarios:

- Acquisition of granted land use rights from the State;

- Transfer of granted land use rights (“土地使用权”), either by sale, exchange, or gifting – excluding the transfer of land contracting management right (“土地承包经营权”) and land management right(“土地经营权”); or

- Purchase and sale, exchange, or gifting of real property situated on the land.

For transfer of title to the land use rights or real properties by way of conversion into investment (equity participation), debt payment, allocation, reward, and the like, the deed tax shall also be levied pursuant to the provisions of the law.

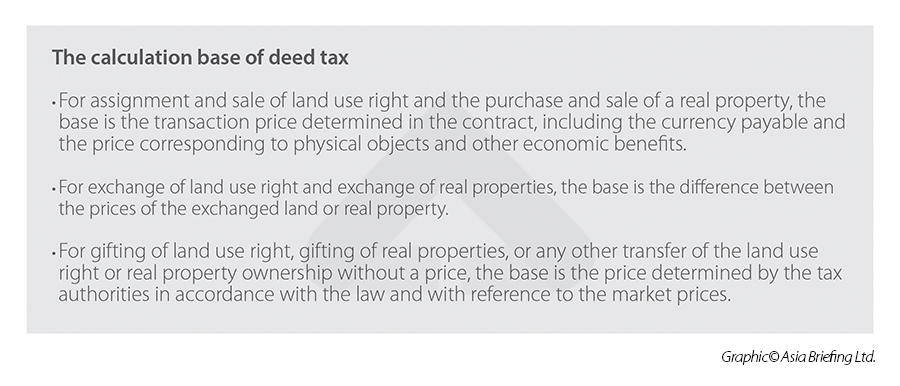

How deed tax is calculated?

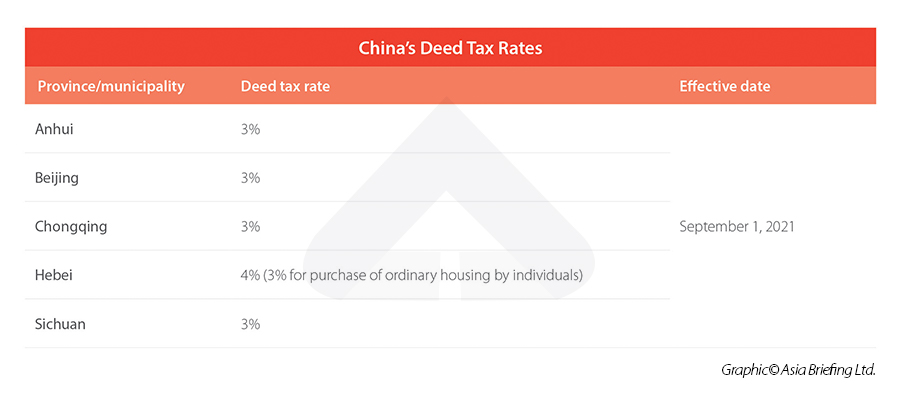

China’s deed tax rates range from three to five percent. The new law states that local governments can choose a specific rate within the said range.

Below we have sorted out the regional deed tax rates that have been updated and confirmed by some provincial and municipal governments.

China’s deed tax rates

Formula to calculate the payable amount of deed tax

The payable amount of deed tax = the tax base × the applicable tax rate

What are the new changes in the Deed Tax Law?

Compared with existing Interim Regulations on Deed Tax, the new Deed Tax Law clarified the deed tax collection policies on the title transfer of land use rights and real properties in forms of conversion into investment (equity participation), debt payment, allocation, and reward.

In addition, regarding what may be exempt from the deed tax, the new Law expands the scope, including:

- Exempting non-profit schools, medical institutions, and social welfare institutions from deed tax in instances where they use land or premises for office space, teaching, healthcare, scientific research, elderly care, or relief purposes.

- Exempting deed tax for using the acquired barren mountains, land, or beaches for agricultural, forestry, animal husbandry, or fishery production.

- Exempting deed tax for title change of the land use right or real properties between husband and wife during marriage.

- Exempting deed tax for the inheritance of land use right and real property ownership by legal heirs.

- Exempting deed tax for assuming title to the land use right and real properties by foreign embassies, consulates, and representative offices of international organizations in China.

Further, the law specifically requires tax authorities and their employees to keep confidential the personal data of taxpayers in the process of tax collection and administration.

Deed tax exemption policies for company restructuring and reorganization

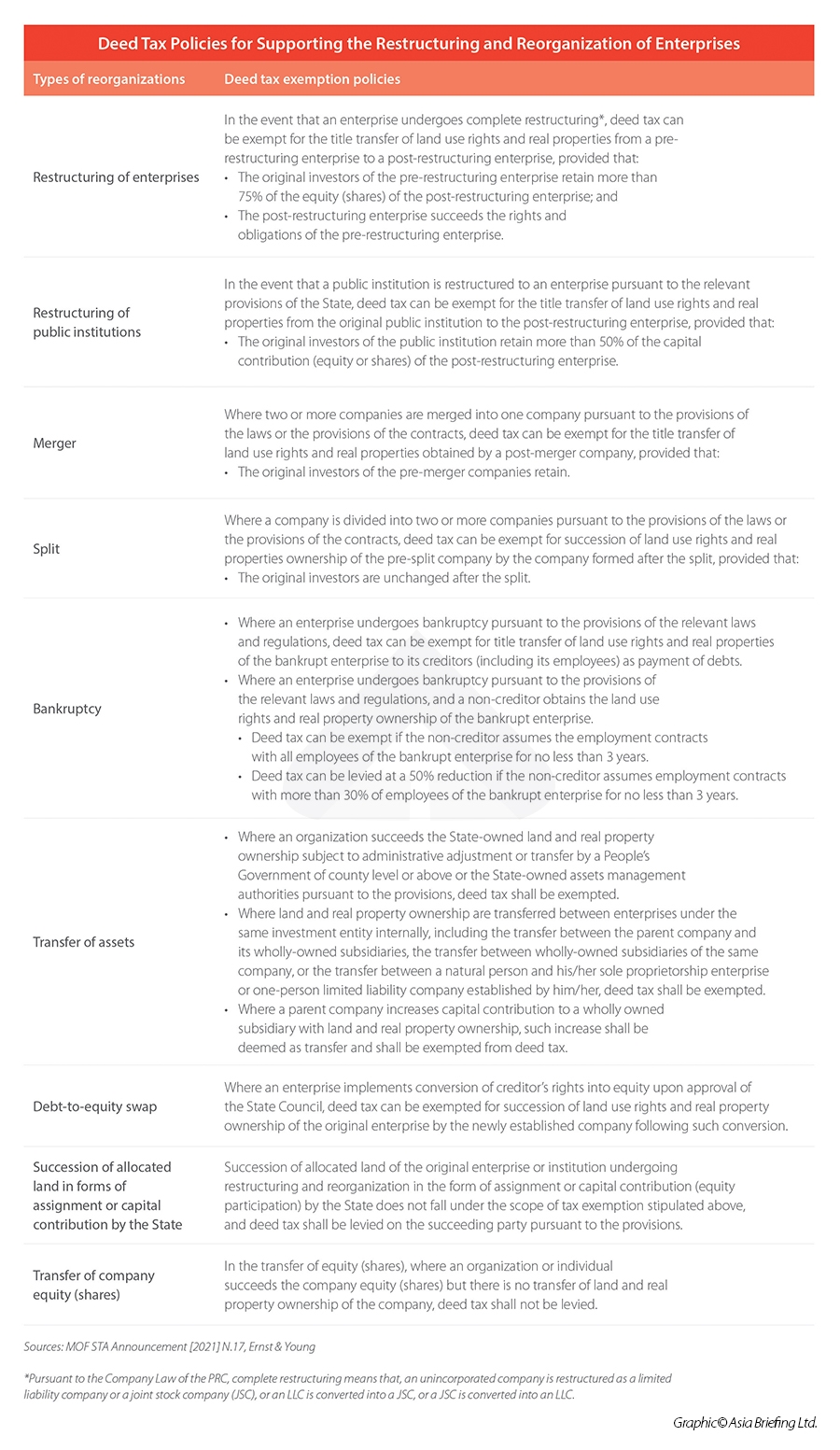

To support certain types of corporate restructuring and reorganization, on April 26, 2021, the Ministry of Finance (MOF) and State Taxation Administration (STA) jointly released the Announcement on Continued Implementation of Relevant Deed Tax Policies for Restructuring and Reorganization of Enterprises and Public Institutions (MOF STA Announcement [2021] N.17), which is retroactively effective from January 1, 2021 to December 31, 2023.

In the table below, we sorted out the types of corporate restructuring and reorganization, and under which conditions the title transfer of land use rights and real properties can be exempt from deed tax.

Simply put, deed tax can be exempt for the title inheritance and transfer of land use right and real properties in cases of complete enterprises restructuring, public institution restructuring, merger and split, transfer as part of bankruptcy proceedings, transfer of assets between enterprises with common owners, and approved debt-to-equity swaps, if the transfer meets certain conditions.

However, the succession of land use rights originally allocated to the restructured enterprises or public institutions through assignment or state capital contribution does not qualify for the exemption.

Furthermore, during the process of corporate restructuring and reorganization, in addition to deed tax, the enterprises can also be exposed to other taxes, including land appreciate tax, value-added tax, corporate income tax, and stamp duty.

For more information on taxes in China’s corporate restructuring and reorganizations, you’re welcome to contact our tax experts at China@dezshira.com.

Bigger background: Law-based tax administration

In 2015, the STA released the Guiding Opinions on Comprehensively Promoting the Governing of Taxes according to Law (Shui Zong Fa [2015] No.32), stipulating that China will accelerate the process of upgrading relevant tax regulations into law, to improve the certainty of tax policies, enhance the authority of the tax documents, and ensure the efficiency of tax administrations. This is an important part of China’s broader efforts to achieve rule of law, that is, law-based governance of the country. Businesses are well-advised to keep a close eye on the future developments of China’s tax laws as it is related to how they will pay tax in China.

China’s tax laws

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Actually, Now Has Never Been a Better Time to Invest in or Sell to China

- Next Article Personal Information Protection Law in China: Technical Considerations for Companies