Company Relocation and Land Appreciation Tax in China

By Amber Liu, Senior Manager, Corporate Accounting Services

Environmental protection is a growing priority for China’s government, which has increasingly been punishing firms that are noncompliant with environmental laws. As a result, some companies are facing spiraling operational costs due to disruption of supply chains and more stringent environmental compliance requirements.

Businesses in heavily polluting industries, such as ceramics, papermaking, printing and dyeing, cement, and electroplating, have at times been requested to escalate anti-pollution measures and production techniques. Failure to do so within a designated time frame directly leads to penalties from environmental regulators and reduction or suspension of production.

In some cities, local governments have reclassified the nature of land from industrial land to residential land, and have moved highly-polluting plants outside of city centers to protect the residential environment.

In such cases, manufacturing companies may be confronted with production scale cut-downs, or relocation to other areas with more moderate local policies, or even hold plans to move production lines to Southeast Asian countries, such as Thailand and Vietnam.

From a legal point of view, there are two main ways to relocate a company in China:

- Physically move the company to another location and modify the business address, including an address change within the same city or across cities;

- Close the company and open a new one, and move all assets, labor, and operations to the new company and location.

Cross city relocation through address modification sometimes may interrupt the operation of the company, as during the relocation, tax registration with the old city needs to be cancelled and there could be a period of time before tax registration in the new city is ready. An alternative way to relocate a business is to open a new company while keeping the old company operating until the new one is ready.

![]() RELATED: China’s Most Polluted Cities – What it Means for Business

RELATED: China’s Most Polluted Cities – What it Means for Business

When a company is closed, all of its assets should be disposed and all liability should be settled. Some companies that hold land and buildings, however, may experience huge pressure from the taxes incurred by sale of the land and buildings.

Taxes involved in asset sales during a company closure will usually be value added tax, consumption tax, enterprise income tax, and land appreciation tax. Due to the rapid growth of the real estate industry in China over the past decade, the value of land and properties has increased several times over, which leads to a high land appreciation tax when the properties are sold.

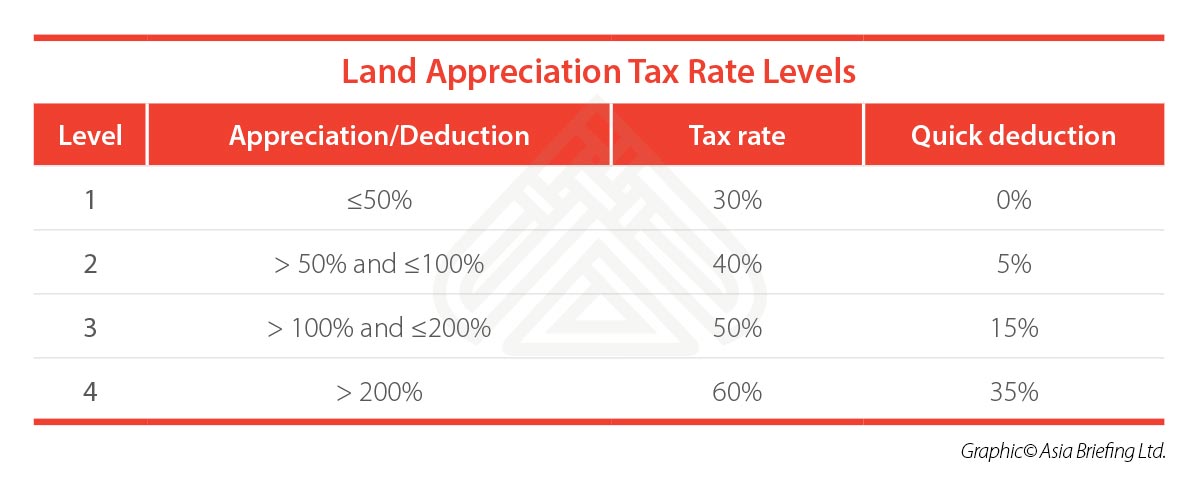

Land appreciation tax is levied on paid transfer of state-owned land use rights, buildings, and structures on that land. Calculation of land appreciation tax is based on the appreciation amount gained by the taxpayer, and should be levied in accordance with a four-step progressive tax rate based on the percentage by which the appreciation amount is in excess of the amount of deducted items.

Land appreciation tax rates in China are as follow:

Under any of the following circumstances, land appreciation tax shall be exempted:

- Where a taxpayer has built a normal standard housing unit for sale and the appreciation amount does not exceed 20 percent of the deductibles. The definition of “normal housing” is determined by the local government.

2. The real estate is expropriated or recovered pursuant to the law due to national development requirements, i.e. implementation of urban plans or state construction requirements.

Aforesaid “implementation of urban plans” shall mean circumstances where the relocation is ordered by the government as a result of reformation of old cities or enterprise pollution or disruption (referring to excessive discharge of gaseous waste, sewage, waste residue, and noise that affect living conditions of urban residents) and relocated in accordance with the approved urban planning.

Aforesaid “state construction requirements” shall mean circumstances where relocation is required so as to implement construction projects approved by the State Council, provincial People’s Government, and the relevant ministries and commissions under the State Council.

Where the taxpayer has to relocate and transfer the real estate due to the implementation of urban plans or state construction requirements, the transfer of real estate shall be exempt from land value-added tax according to this rule.

3. Where one party contributes land and one party contributes funds and both parties cooperate in the construction of buildings, there will be a temporary exemption from land value-added tax if the completed buildings are allocated for each party’s own use in accordance with their respective contributions.

4. An individual who transfers residential housing shall be exempt from land value-added tax.

5. The mutual exchange between individuals of their own residential houses will be exempt from land value-added tax upon verification by the local taxation authority.

6. Other situations approved by the tax authority.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

Taxpayers qualified for land appreciation tax exemption are required to submit an application for the tax exemption to the taxation authority in the place where the real estate is located. Subject to examination and approval by the taxation authority, the taxpayer shall be exempt from land value-added tax.

In order to optimize the market environment for mergers and reorganizations of enterprises, in 2015 the government issued some special policies for enterprises that are restructuring, which entitled companies to the land appreciation tax exemption in certain situations.

On May 22, the Ministry of Finance announced to the public that these policies will be extended to December 21, 2020, and applied retrospectively from January 1, 2018. The extension of the land appreciation tax exemption will reduce the burden on companies that must restructure during this period.

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article China’s FTA with the EAEU Will Improve Market Access, EU Transhipments

- Next Article China, US Suspend Trade War