China Trade Rebound – The Asian Financial Crisis and SARS Impact, Post Coronavirus Implications

Op/Ed by Chris Devonshire-Ellis

With the world currently preoccupied with the coronavirus outbreak, there has understandably been a lot of negative viewpoints concerning prospects for China during 2020. While the coronavirus situation is still unfolding, mathematical modelling suggests infection figures will peak in the latter part of this month (February) and then decline during March. During the latter half of this month we expect China factories to be back into production, and remain so, given isolated incidents. Pockets of infections can be expected to persist until the end of Q2, as occurred with SARS.

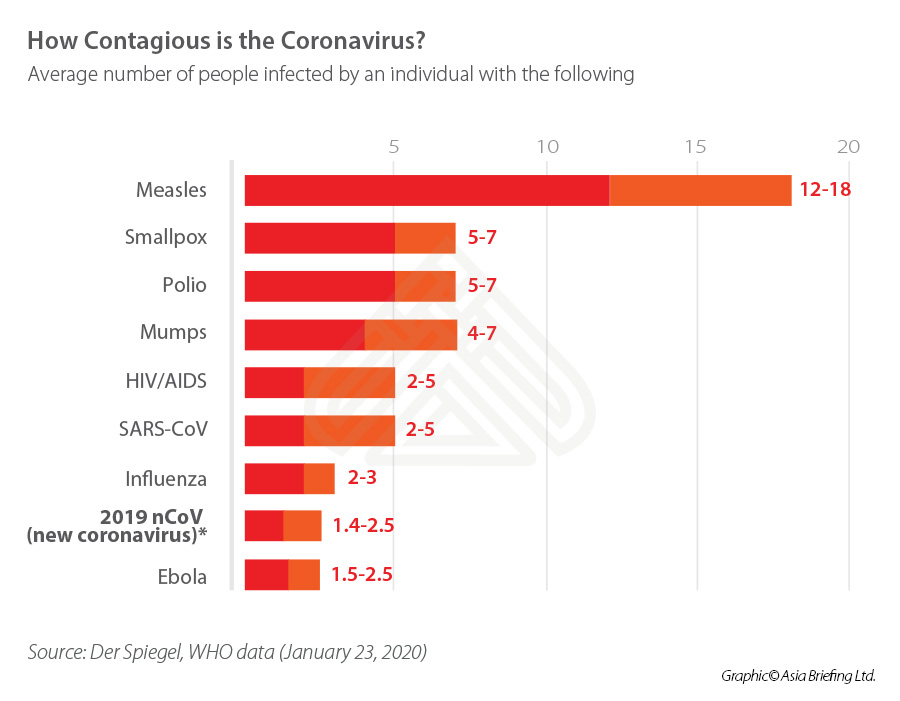

Although the coronavirus is undoubtedly unpleasant, and one in four cases of infection classed as “severe”, there are some brighter spots – the virus tends to be fatal among the old and the sick, and the mortality rate appears relatively low at 2 percent – which is about the same as global annual influenza outbreaks.

The difference this time is that the pathogen is new, fairly contagious (about 10 percent) and appears to have arisen through species jumping. It is unpleasant, but it is not the global killer or doom for China many have been panicking about. Things will get back to normal, and two similar, if rather different events, together with China’s recent overseas Belt and Road spending tell us why.

The Asian Financial Crisis of 1997

The first was the Asian Financial Crisis in 1997, which occurred the same year as the handover of Hong Kong to China. Although this was not caused by any virus, the resulting panic in financial markets had a similar effect to that being caused by today’s coronavirus – investors and buyers held off on purchasing from China.

This was a knee-jerk effect caused by numerous Asian governments, in the wake of many Asian currencies finding themselves unable to maintain their positions to a US-dollar pegged system and higher than advisable foreign debt to GDP ratios. The scenario began predominantly by US short sellers targeting then-vulnerable Asian currencies and making massive speculative bets, forcing their currency values lower.

Thailand devalued its currency, and it halved in value in 6 months. This created knock-on effects in Indonesia, Malaysia, the Philippines, South Korea, and Hong Kong, all of whose currencies came under severe pressure, and in many cases declining significantly in value. But the real target – apart from profiting by short-selling Asian currencies – was reducing China production costs.

Because of this, the unofficial rate between the US dollar and the Chinese yuan also came under extreme pressure with many analysts and economists predicting that China would also devalue its currency. China was under pressure for months until these attacks receded. However, during this time, under the expectation the Chinese currency would lose value against the dollar, foreign investment effectively dried up. Orders were cancelled and Chinese export growth took a large hit, a situation not unlike the recent impact of both the US-China trade war and today’s coronavirus.

At Dezan Shira & Associates, which was just five years old at the time, the Asian Financial Crisis wiped out 9 months of projected income and put the company into effective insolvency for a short period. We were able to trade out of it as the situation improved and also learned some serious, business operational changing lessons so as not to leave us so exposed in the future again. Many of those basic protections – such as concentrating on developing cash flow generating business services, and maintaining significant cash reserves, are still in place today.

But it is what happened in China next that is more significant. The speculators had under-estimated. In fact, China had huge capital reserves, a currency that was not freely convertible, and capital inflows that consisted overwhelmingly of long-term, rather than short-term investment. Existing foreign capital was then, as to some extent it is now, locked into China. Although it took several months, eventually the global pro-China trade lobby prevailed over the currency short sellers.

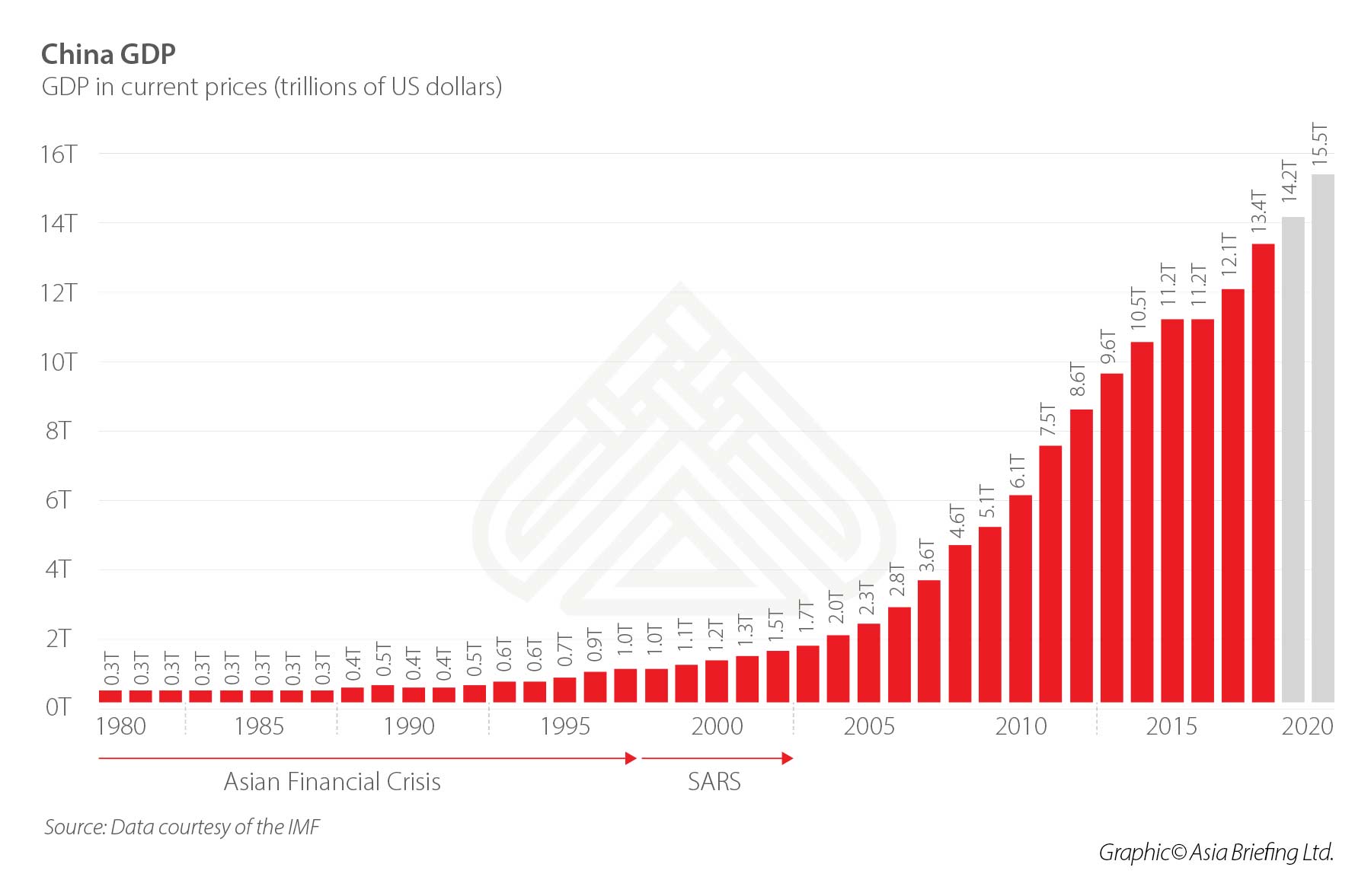

Because of this, and despite the problems, China’s GDP actually grew by 8.9 percent that year. The Chinese government also made various structural changes to prevent any repetition, and to repel future currency raiders, and as a consequence, was able to maintain annual growth rates of 8-10 percent per annum for most of the next 20 years, and the Asian Tigers, chastened, became less fiscally reckless and reduced their exposures.

Meanwhile, Chinese GDP per capita income tripled from just above US$2,300 (PPP) in 1997 to US$6,900 (PPP) in ten years, and is averaging about US$10,300 today, with this being up to five to even ten times higher in principal cities like Shanghai. China has now become a valuable consumer market for foreign investors. It didn’t have that status in 1997.

The contemporary equivalent to the short selling behavior of that time is today’s trade sanctions. Regulatory and insider trading issues have moved the onus on trade manipulation from the US markets to the US government.

SARS in 2003

The “Severe Acute Respiratory Syndrome” or SARS began affecting Guangdong Province in November 2002; however, it wasn’t until February 2003 that it had been identified and China had admitted there was a national problem. Many expatriates in China today will recall that period, which was as concerning then as the coronavirus is now, although without the restrictions and sophistication of social media we currently have in place. The Chinese economy had grown to US$1.2 trillion, recording an 8 percent rise in 2002. The average per capita income in China at that time was about US$4,000 (PPP) although in primary cities, such as Beijing, Shanghai, and Shenzhen – it was far higher.

There were similar instances of facemasks, border controls, passenger screening, and various Chinese villages attempting to isolate themselves by digging up access roads. In fact, although China had been woefully unprepared for SARS, a lot was learned back in those days that are extremely useful in handling today’s coronavirus outbreak, not least prompt liaison with the World Health Organization, which was lacking in 2002-03. SARS didn’t completely clear up until July 2003, eight months after it had originally surfaced. However, China’s growth continued – it actually hit 9.1 percent in terms of GDP growth that year, sparking economic concerns of an overheating, rather than damaged economy.

Li Deshui, then Director of China’s National Bureau of Statistics, calculated that China had in 2003 become a significant global consumer of raw materials, taking in 30 percent of the world’s coal production, 36 percent of the world’s steel, and 55 percent of the world’s cement, and acknowledged that prices for steel and cement were on the rise and that inflation could be a concern. Meanwhile, 12 months after SARS, China’s GDP grew by 9.4 percent.

Coronavirus in 2020

It is hard to make predictions for the Chinese economy in 2020 – the coronavirus has still to run its course and problems could develop elsewhere in Asia, extending concerns. Our ASEAN and Asia Coronavirus updates are here. China’s economy has also changed considerably since 1997 and 2003. However, in 2019 the Chinese economy reached US$14.3 trillion and achieved a growth rate of 6.5 percent. China has become an exporter of finance – providing US$500 billion for its Belt and Road Initiative infrastructure projects alone.

China has also just concluded the US-China Trade War and tariffs on products have in many cases been relaxed from the position they were in a year ago. However, overall the situation remains the same as last year – an economy in some uncertainty. A virus has replaced the US-China trade war as the new economic challenger.

Reasons to be Cheerful

But there are bright spots. According to McKinsey, China’s consumer confidence figures at the end of 2019 were at a ten-year high. The coronavirus outbreak will put an initial dent in that, but there is no reason to suggest the fundamentals will change very much. In fact, there is likely to be some pent-up demand once the situation is over, and a release of positive emotions. China has also been putting in place infrastructure to allow the digital processing of goods purchased and delivery, both, to consumers in China and those overseas.

Many of these infrastructure developments, along with free trade investments will kick in during 2020. Many of the Belt and Road infrastructure projects China spent US$500 billion on either are, or shortly will be, completed, providing the infrastructure required to keep China’s imports and exports on track, and in multiple cases, enhancing these.

Then there is China’s internal infrastructure spend as concerns trade. This includes the six free trade zones China is in the process of establishing on its borders, the 24 e-commerce zones it is also setting up, and the enhanced freight traffic facilities it has established in numerous hubs both on a global basis as well as within the EU, Russia, Latin America, and Africa. On top of those, there is an improved China-ASEAN Free Trade Agreement and the upcoming tariff conclusions to the China-EAEU FTA, which when it happens will spur a US$100 billion in additional bilateral trade between China and Russia. It is also possible that the Phase Two US-China Trade deal could include a US-China Bilateral Investment Treaty should Washington be in the mood to throw Beijing a bone.

All things considered, at Dezan Shira & Associates, we expect China to recover from the coronavirus sooner rather than later. There is a long way to go, and as I pointed out, uncertainty remains. But that was also the case, albeit under different circumstances, last year and growth still reached 6.5 percent.

History shows us China’s economy has rebounded or emerged relatively unscathed from previous serious stressors. With 2018 and 2019 also being years China invested a great deal in securing supplies, and developing and improving infrastructure, I expect any shortfalls caused by the coronavirus outbreak to be made up by the trade enhancements both in infrastructure and in terms of improved and new FTA it can expect to take advantage of in 2020.

Related Reading

- China’s Global Trade Outlook in 2020: The Risks and Rewards

- China’s Belt & Road Initiative: Where We Are Now And What Is Arriving In 2020

Corporate Sustainability in China

Corporate Sustainability in China

Customers, clients, stakeholders, and the government now demand businesses be accountable for polluting behavior. In this issue of China Briefing we explain how a sustainability strategy can benefit your business and take a closer look at how certain established firms have already started shifting towards sustainability.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Digital Tax in Singapore, India’s Budget 2020 – China Outbound

- Next Article The Top Ten 2020 Business Websites about China as Read by Foreign Investors in China