Updated: China Factory and Offices Reopening Schedules after Lunar New Year

By Chris Devonshire-Ellis, Founding Partner, Dezan Shira & Associates

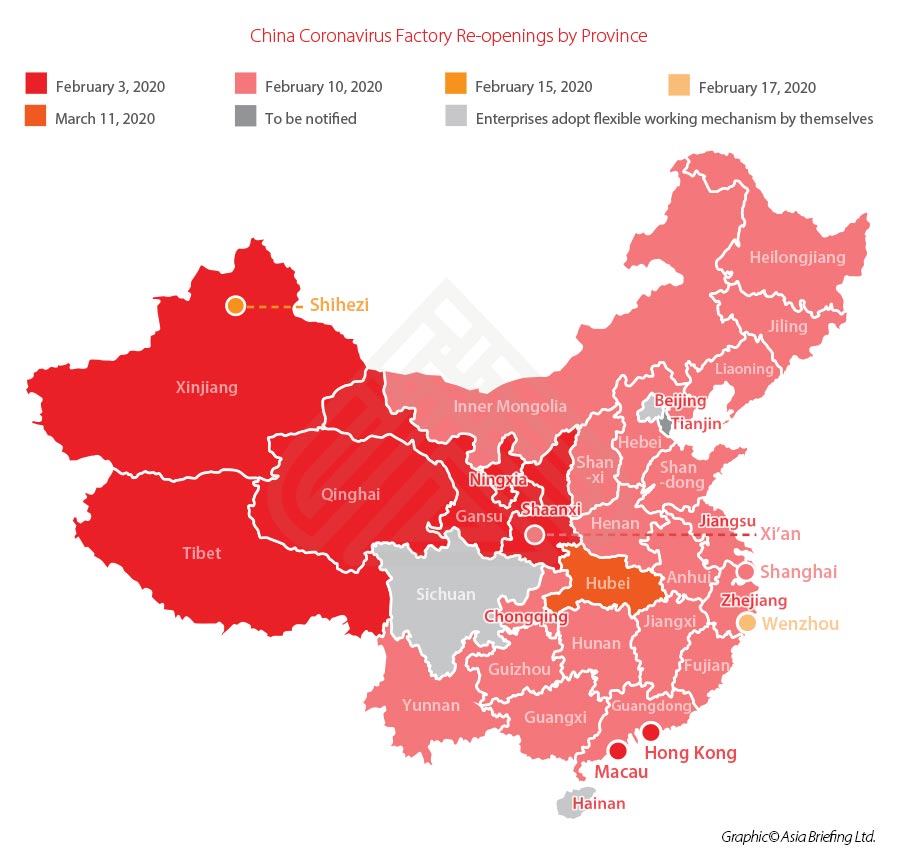

Most factories in China were expected to start opening from February 10 – although with regional variations across the country, which have also been subject to change. The attached map explains the official position.

However, there are caveats to this – regional travel restrictions still in place mean that some employees will not be able to return immediately, especially migrant workers from Hubei, where most of the coronavirus (COVID-19) infections have been reported.

This means that expectations over who will be able to return to work will vary, depending on the geographic location of the business and how many migrant employees it has. At Dezan Shira & Associates, about 5 percent of our workforce of several hundred staff are currently unable to return as of today. However, we are in the professional services industry, and have multiple offices that, to some extent, share the non-returning burden around – our Shenzhen office will report close to 100 percent staff back at work, our Tianjin office will be closer to 50 percent.

Factories located in just one city will be hit harder – we estimate a national employee downtime of about 20 percent, and this will be higher the closer the factory is to Hubei. We would expect factories to return to a minimum of 80 percent capacity by February 24 – provided their immediate work force, suppliers, and distributors are not located in or in close proximity to Hubei province.

In terms of handling HR issues for returning employees and assessing payment for the extended holiday period, in addition to those having to work from home, we have given an explanation of how to calculate and manage these days away from work in the article HR Compliance in China During the Coronavirus Outbreak.

Some governments are also providing financial assistance to affected businesses. We covered that in this article.

There will also be cases of “force majeure”, where it becomes obvious that production contracts in place will be severely impacted, with China factories unable to fulfill part, or all, of the delivery terms. Businesses overseas dealing with Chinese factories need to assess force majeure clauses in place and take the appropriate action. We covered this issue in the article Applicability of Force Majeure in China.

Meanwhile, concerning returning employees – appropriate sanitary and the wearing of face masks is strongly recommended – as is an HR audit of who can return to work and who cannot. Contact with suppliers, distributors, and retail outlets all need to be conducted to develop an overall business plan for how your business will be impacted and where and how to manage it. China is gradually starting to return to work, and barring any further sizable outbreaks, we estimate things should be back to normal by the end of March.

China operating businesses looking at relocating all or part of their production to nearby countries in Asia that are less likely to be impacted by conditions in China may review the article Relocating Your China Production to Asia: Procedures and Choices.

We wish all our readers, employees, and clients a safe and speedy return to work.

(Editor’s Note: This article was originally published on February 10. It was last updated on February 21 as per latest developments.)

Related Reading

- Managing Your China Business during the Coronavirus Outbreak: Ongoing Updates and Advisory

- China to Cut 50% Off Tariffs on 1,717 US Imported Goods from February 14

- China Trade Rebound: Post-Coronavirus Implications

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article New Business Opportunities Emerging in China Under COVID-19 Outbreak

- Next Article China to Reduce Corporate Social Insurance Premiums, Defer Housing Provident Fund Payment