How China’s New Income Tax Law Affects Expatriates

The new individual income tax (IIT) law in China, which came into effect January 1, introduced key rules that changes the way tax residency is determined for expatriates.

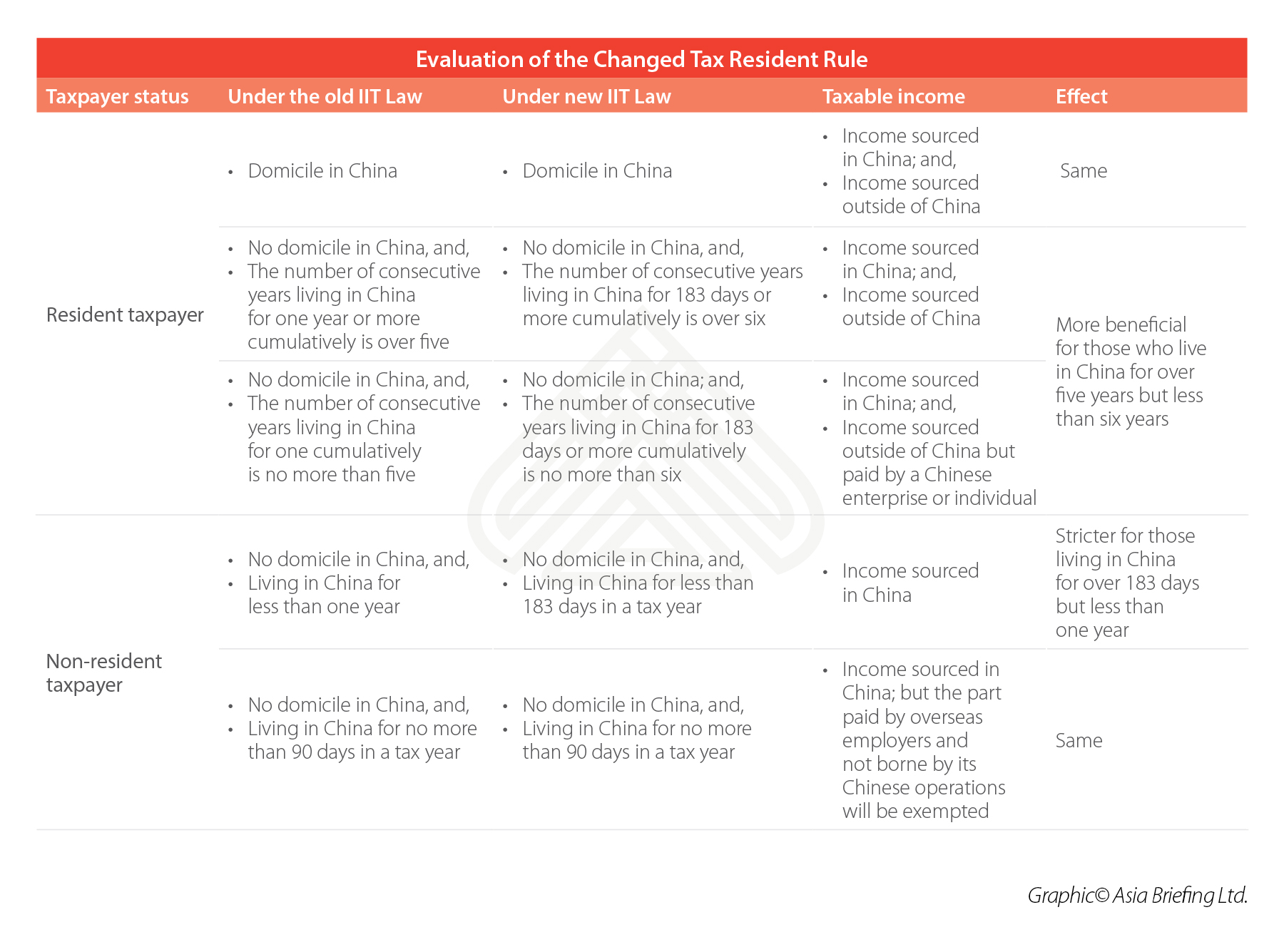

The table below compares the tax residency rule under the old and new laws; it also outlines the scope of taxable income and the relative effect of the change.

To summarize, the new tax residency rule impacts foreigners in three ways:

- Tax residency status will be triggered more easily because of shorter time requirements

For expats who reside in China for over 183 days but less than a year, the new rule is less beneficial, considering income sourced outside of China but paid by Chinese enterprises or individuals will be taxable in China.

- Foreigners don’t have to leave China as frequently to get IIT exemption on global income

The six-year rule under the new IIT system enables expats to leave China every six years, instead of five years, to reset the tax clock on their global income.

- The clock-reset rule is less convenient for certain expatriates working in China, such as those who travel internationally frequently

Previously, expatriates could reset the five years tax clock by leaving China for over 90 days cumulatively, but under the new Law, they can only reset the clock by leaving China for over 30 days.

Standard deduction increased slightly

The new IIT Law unifies the standard deductions of resident individuals and non-resident individuals to RMB 5,000 (US$734) per month. Previously, the standard deduction for resident individuals was RMB 3,500 (US$514) per month, while the amount was RMB 4,800 (US$705) for non-resident individuals.

The effect of this measure is less significant for foreigners working in China, considering the standard deduction for domestic employees increased by more than 40 percent, while it only increased around four percent for expatriates.

Special additional deductions available to foreign employees

The new IIT system introduced ‘special additional deductions for specific expenditures’ for foreign employees, if they fulfill requirements of each specific deductions, which is the same standard as local employees.

The special additional deductions are children’s education expenses, continuing education expenses, healthcare costs for serious illness, housing mortgage interest, expense for supporting the elderly, and housing rent.

To enjoy the special additional deduction, taxpayers are required to provide relevant information to the tax bureau and retain the relevant documents as evidence for five years.

For expatriates, the only extra step is that they may need to visit the tax bureau in-person to get their tax ID, which is necessary to obtain for the application.

Expatriates who choose to avail of these special additional deductions are not able to avail of certain other allowances, described immediately below.

Tax-exempt allowances applicable for another three years

Under the old IIT system, expatriates working in China could deduct certain ‘allowances’ before calculating the tax liability on their monthly salary, including:

- Housing, meals, and laundry expenses;

- Relocation expenses upon commencement or cessation of employment in China;

- Reasonable business travel expenses;

- Reasonable expenses for personal trips of home visiting; and,

- Reasonable allowances for language training and children’s education.

According to the Notice on Issues Relating to Transition of Preferential Policies, foreigners can still apply for these allowances for another three years, between January 1, 2019 and December 31, 2021.

However, foreigners need to choose between the tax-exempt allowances or the six special additional deductions during this three-year transitional period. Once decided, the preference cannot be changed within a given tax year.

The tax-exempt allowance policy is believed to be more beneficial to expatriates with a higher income and level of expense; this policy is based on the actual cost of each expenditure, and subject to the limit of a ‘reasonable’ proportion (generally around 30 percent) of the expatriate’s monthly salary.

However, to enjoy this policy, expats are required to provide corresponding invoices or receipts every month for each expense, which is not easy in all circumstances.

For example, if an expatriate wants to claim rent allowance, it is not enough to simply sign a lease contract with the landlord.

To get an invoice for the rent, the individual needs to ask the landlord to file the record for the lease contract and receive the invoice every month. Some people avoid this process by using alternative invoices, but that is difficult to achieve with rental rates, and generally not advisable.

Further, the tax authorities have discretion on whether to grant expatriates these tax-exempt allowances. This can affect the application for these benefits in different ways.

For example, tax authorities could reject applications by expatriates who work for an employer that has a record of tax incompliance.

Ultimately, the transition from the tax-exempt allowance system to the new special additional deduction is not necessarily a bad thing, especially for those who haven’t benefited from tax-exempt allowances due to various impediments.

On the other hand, high-income expatriates may need to speak with their employer about restructuring their salary package to lower their tax burden.

Key takeaways

Under the new IIT system, the tax burden and compliance requirements will be stable or even slightly alleviated for most expatriate employees.

This can be endorsed by the six-year test, slightly increased standard deduction, available tax-exempt allowances, and easier access to special additional deductions.

However, the new IIT system can potentially increase the tax burden of some foreign employees, such as those who earn high net income, travel abroad frequently, or receive income from overseas companies and domestic companies.

In these cases, the foreign employee and their employer should carefully study the new IIT system and adjust lower their tax burden.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Is a “Meatless Meat” Revolution Really Underway in China?

- Next Article Setting Up a Foreign NGO in China