Sustainability Reporting in China: The Rise of CSR and ESG Reporting by Businesses

Sustainability reporting is a way for companies to measure their impact and performance on key environmental, social, and governance issues ranging from climate change, resource scarcity, labor practices, product safety, data security, board diversity, to business ethics.

The monitoring of key performance indicators is critical to sustainable business operations and can help improve the company’s existing strategy. Moreover, it is an effective way to stay accountable to staff, investors, and shareholders.

For example, investors are increasingly seeking out the full risk profile of a company before they invest. An Environmental Social Governance (ESG) Report is a good way for companies to provide a standardized and comprehensive set of data to address investor concerns, and will answer key questions, such as “how do the values of this company add value to your investment?”

According to a report released by the Climate Disclosure Standards Board, the number of companies that produce sustainability reports on a regular basis in China increased exponentially over a 10-year period, rising from 19 in 2006 to 3,040 in 2016.

Although non-financial disclosures are still mostly voluntary for the private sector within China, businesses are finding that as concerns for sustainability grow, there is mounting demand from customers and investors for disclosure of their business’ impact.

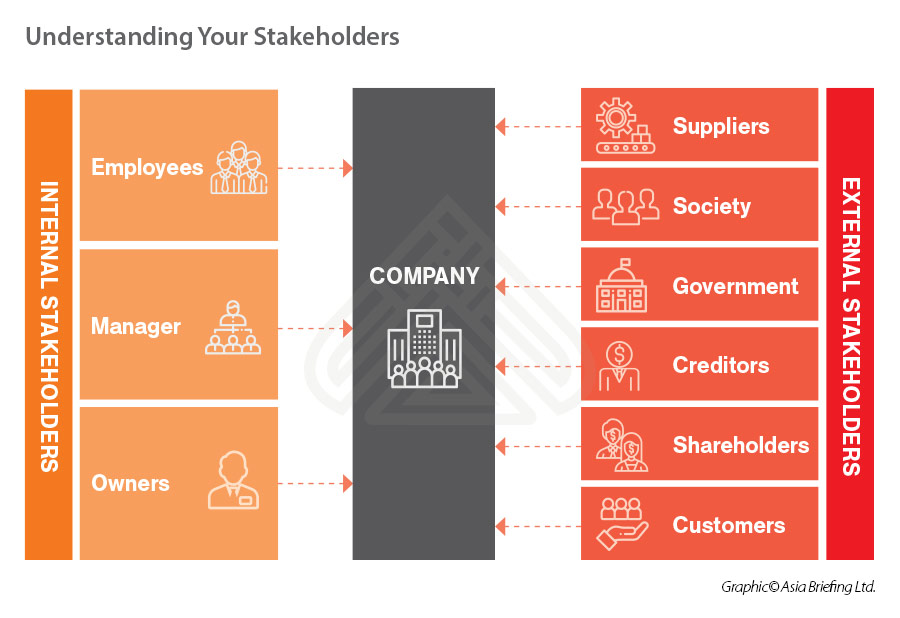

How your metrics are read by different stakeholders

The Global Reporting Initiative (GRI), an independent standards organization that helps businesses report on their impacts, defines ‘sustainability reports’ as an overview of a business’ economic, environmental, and social impact caused by everyday activities. In many cases it can also be a way for an organization to present its values, governance model, and commitments to stakeholders.

These stakeholders can be internal, such as employees, managers, or the board or external, such as investors, suppliers, government, creditors, shareholders, customers, and the wider community.

Each stakeholder will look at the report from a different perspective, gaining different benefits and insights. An employee or potential employee may either be motivated or deterred by the information, which can affect recruitment quality and retention rates.

A wider audience may assess if companies are actually investing in technologies or changing operational processes to reduce their negative impact on the environment or if the changes made are superficial, linked to company bottom lines and managing public relations.

These reports are usually referred to as Corporate Social Responsibility reports (CSR) and refer to a company’s socio-environmental commitments, efforts, and practices more generally.

Investors, for example, will focus on the cost of capital and brand value to screen for investments. For socially and environmentally conscious investors, the environmental social governance report (ESG) mentioned earlier has become increasingly popular as it is specifically designed for investors – it sets the standards for a company’s operations and can help investors when screening for investment potential.

On the other hand, the directors of a board will consider how the company is currently handling ESG-related risks and opportunities in order to embed them into a long-term business strategy and how best it can communicate this with the shareholders.

The rise of CSR and ESG reporting in China

As it stands, there is currently no comprehensive CSR disclosure regime for all businesses. Instead, the regulatory framework for non-financial reporting mostly consists of a series of legislative and policy documents specifying requirements for particular types of businesses – such as public companies, state-owned enterprises, or highly polluting companies.

For example, China’s Securities Regulatory Commission (CSRC) has requirements for listed companies on the disclosure of social responsibility-related information and some local authorities, such as those in Shanghai and Shenzhen, have also issued guidance on corporate sustainable development and social responsibility.

The Hong Kong Stock Exchange also upgraded its ESG reporting to “comply or explain” back in 2016. In 2019, it updated its requirements to include gender diversity guidance and the Corporate Governance Code. And more recently in July 2020, the Hong Kong Stock Exchange announced introduced a series of even more stringent requirements – including occupational health and safety (OH&S) disclosures, board oversight of ESG issues disclosures and shorter deadlines for publishing ESG reports.

Below, we have listed the key legislative and policy drivers for corporate sustainability reporting that relate to private businesses (table only includes documents that apply to mainland China).

In addition, the importance of reporting environmental, social, and governance risks is steadily growing in China. In fact, mandatory ESG disclosure is on its way for all listed companies in China.

According to the CSRC, this was expected to come into force by 2020 – however with the advent of the COVID-19 outbreak, this may be pushed back to a later date.

Sustainability reporting uses standardized quantitative and qualitative metrics to measure a business’ overall impact. The key is for the sustainability report to be clear, reliable, and comparable (over time and with other market players).

The most commonly used and globally recognized reporting style is the Global Reporting Initiative (GRI) Sustainability Reporting Standard, modeled after the generally accepted accounting principles (GAAP). This has become increasingly popular in China with large companies, such as China Mobile and BMW Brilliance Automotive Ltd, now using the Simplified Chinese translation of the GRI standards released in 2018.

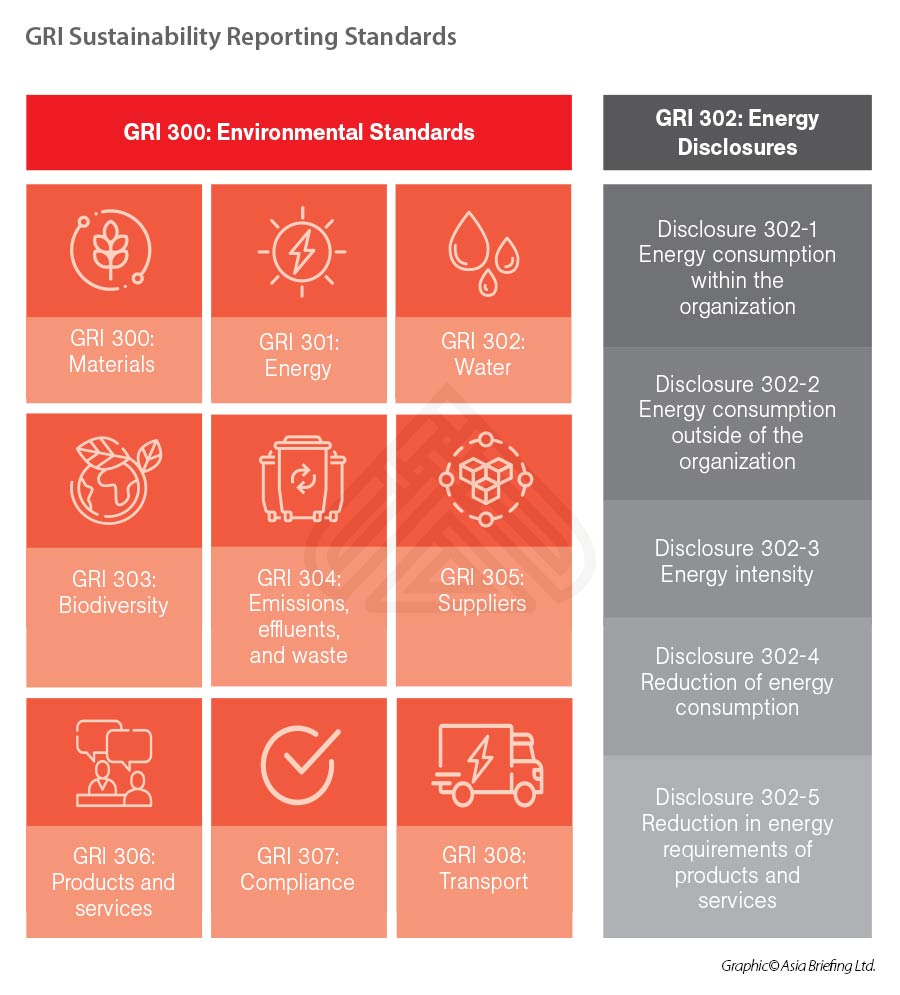

The GRI standards are internationally recognized and track performance indicators under 146 individual data headings. Below is an example of the aspects listed for the environmental category, followed by a closer look at the energy disclosure headings.

For China, sustainability reporting remains an important entry point to implementing its 2030 Sustainable Development Agenda, which was first introduced in 2016. The Chinese government is now rapidly improving its corporate reporting landscape and striving to integrate sustainable development strategies into business’ daily operation and management activities.

Businesses should therefore not only be ready to adopt a sustainability strategy but be ready to communicate its progress to the government and other stakeholders using the globally recognized sustainability reporting standards.

This article was adapted from the China Briefing Magazine titled, “Corporate Sustainability in China“, published in December 2019. For any queries related to doing business in China, please reach us at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong.

Please contact the firm for assistance in China at china@dezshira.com. We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Company Chops in China: What Are They and How to Use Them

- Next Article Come gestire il lavoro dei dipendenti stranieri e i permessi di residenza: Serie Divieti di Viaggio COVID-19 in Cina