China Rolls-Out New Measures for Tax Credit Restoration, Effective January 1, 2020

- China’s eligible corporate taxpayers seeking to restore their tax credit can apply to tax authorities beginning next year.

- New measures encourage corporate taxpayers to proactively fix their tax incompliance record.

- Corporate taxpayers are advised to leverage the policy to maintain a good tax credit rating to access tax preferential policies and convenient tax-related services.

On November 7, 2019, China’s State Administration of Tax (SAT) released the Announcement on Matters Related to Tax Credit Restoration (SAT Announcement [2019] No.37), effective from January 1, 2020.

Thus, beginning next year, corporate taxpayers included in China’s tax credit management system can apply for tax credit restoration by correcting tax irregularities and making credit commitments.

Who can apply for tax credit restoration?

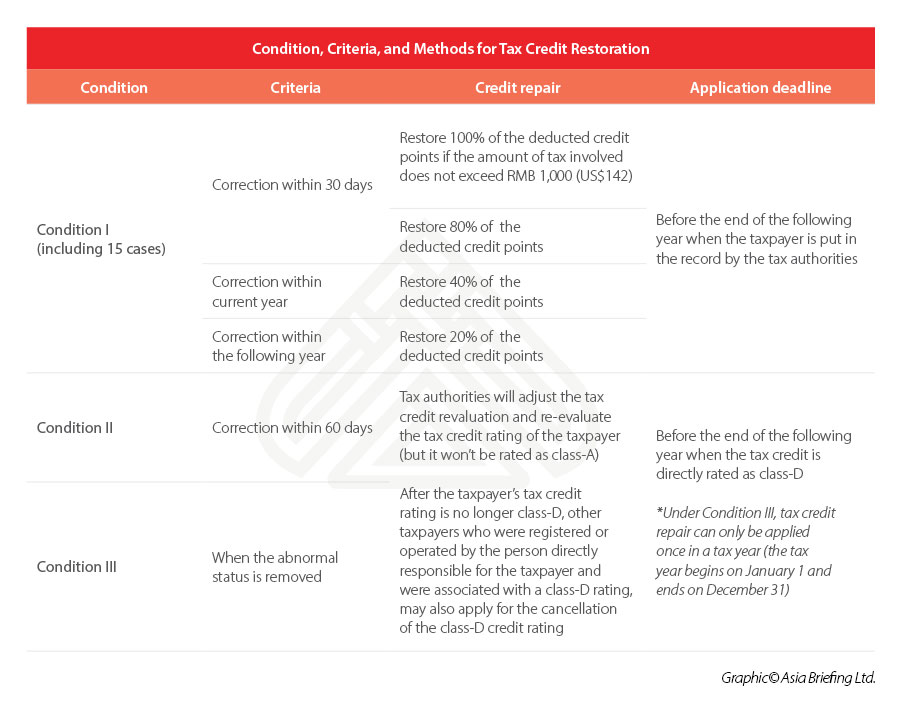

According to the announcement, eligible corporate taxpayers applying for tax credit restoration must satisfy one of the following three conditions:

- Condition I: The enterprise has now completed all tax declarations, tax payments, and data filing, after previously failing to do so, within the statutory time limit;

- Condition II: The enterprise that previously failed to pay or pay in full the taxes owed, late fees, and fines and was categorized as a class-D credit taxpayer (not due to a crime), has now paid or made up the payment within 60 days upon the statutory payment deadline; or

- Condition III: The enterprise has fulfilled all corresponding legal obligations, and thereby the tax authority has lifted its ‘abnormal’ status.

Under these three conditions, the announcement specifies 19 specific cases (Annex 1 of the Announcement), including:

- 15 cases under Condition I

In these 15 cases, taxpayers failed to make tax declaration, tax payment, data filing with the tax authorities, etc. within the prescribed time limit, and thus were punished by point-deduction.

- 4 cases under Condition II and III

In these 4 cases, taxpayers failed to pay or pay in full the taxes, late fees, and fines, or were judged to be an abnormal household, and thus were punished by being rated as a class-D taxpayer.

In each of the cases, the announcement (Annex 1) set out the criteria and methods for restoring tax credit (refer to the table below for details).

How to apply for tax credit restoration?

How to apply for tax credit restoration?

The applicant may submit the application form (Annex 2 of the Announcement) to the relevant tax bureau and make a commitment that the irregularities have been corrected. The tax bureau will then, within 15 workdays, complete the audit and inform the applicant of the result.

After the completion of the tax credit repair, the taxpayer will be subject to the corresponding tax policies and administrative measures based on the recovered tax credit rating. The previously applicable tax policies and measures shall not be retroactively adjusted.

If the tax authority discovers that the taxpayer failed to fulfill the promise of credit repair and applied for tax credit repair by submitting false materials, it will cancel the completed tax credit repair after verification and deduct five points from the offender’s credit score for each violation in the tax credit annual evaluation.

Why businesses in China need to take their tax credit rating seriously

Since April 2016 – when China first introduced the tax credit repair mechanism – until September 2019, a total of 1,650 tax offenders have been removed from the taxation blacklist bulletin board, according to the SAT.

As China constructs a new corporate social credit supervision mechanism, corporate credit, including tax credit rating, is of greater significance to enterprises.

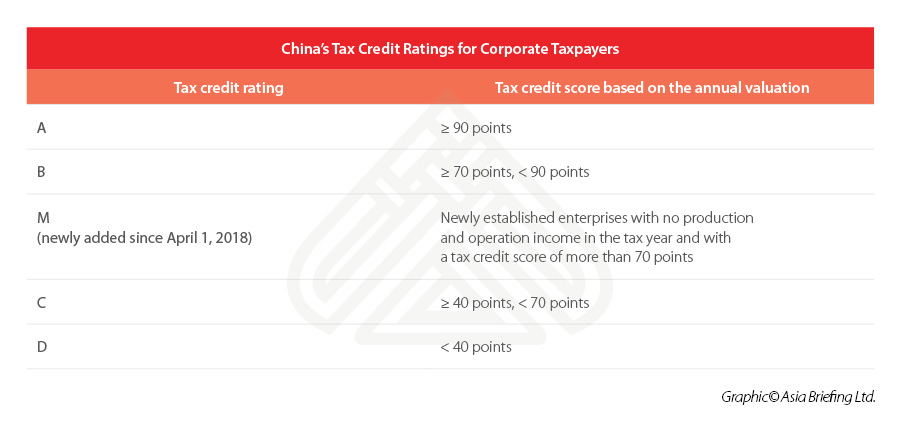

Tax credit rating – currently categorized as A, B, M, C, and D – has become an important reference for enterprises when they interface with tax authorities and seek access to tax preferential policies. It also affects how they conduct business with other enterprises and individuals – taxpayers showing a poor tax credit rating will be avoided.

Corporates are highly advised to keep track of their tax credit ratings and the reasons for their poor rating (if any), refer to the announcement and seek professional advice to make up for the credit loss.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article An Introduction to Doing Business in China 2020 – New Publication from Dezan Shira & Associates

- Next Article How to Stay Compliant under China’s New Foreign Investment Law