Starting a Business in China: When to Choose a FICE Model

By Riccardo Benussi and Dorcas Wong

- Foreign-invested commercial enterprises or FICE allow companies based in China to directly access its local consumer market, businesses, and submit public tenders.

- FICE enjoy a much wider business scope and can be set up via different types of corporate structures – either as a JV or a WFOE, depending on what is most suitable to the business.

- Foreign investors should note that given the wider remit of its operations, there are some limitations, such as the time taken to establish a FICE, the process to secure appropriate import-export licenses, and acquiring authority to issue VAT.

A foreign-invested commercial enterprise (also known as a FICE) is often the ideal choice for foreign investors who need to source from China or wish to have direct access to its domestic consumer market, businesses, and tenders.

Structurally, it is a type of foreign-invested enterprise (FIE) that can be set up as a joint venture (JV) or a wholly foreign owned enterprise (WFOE).

However, what sets FICE apart is its business scope. Unlike other types of FIEs, it is specifically authorized to engage in retail, franchising, or trading operations in China.

This means that an enterprise must carefully consider the scope of its business activities before ultimately selecting to fall within a China-compliant entity type.

In doing so, it is first important to understand the advantages, barriers, and incentives regarding the establishment of a FICE.

Starting a business in China: Legal framework for FICE

The legal framework that applies to a FICE depends on the corporate structure chosen.

Currently, the following laws apply, depending on whether a WFOE, cooperative, or equity joint venture is the subject matter:

- Law of the PRC on Sino-Foreign Equity Joint Ventures;

- Law of the PRC on Sino-Foreign Cooperative Joint Ventures; and

- Law of the PRC on Wholly Foreign-owned Enterprise

However, foreign investors should note that on January 1, 2020, the new Foreign Investment Law will come into effect, abolishing these three existing laws. All FIEs will be subject to the provisions of the Company Law and the Partnership Enterprise Law, in the same way as enterprises established by domestic investors.

FIEs established in accordance with these three laws before the FIL takes effect may keep their original organizational form for five years after January 1, 2020 while complying with the necessary updates imposed by the law.

Foreign investors must also pay attention to the 2019 FI National Negative List and the 2019 FI Encouraged Catalogue, which together identify the sectors that are prohibited, restricted, or encouraged for foreign investment. For investments made prior to 2018, however, investors need to refer to the Catalogue of Industries for Guiding Foreign Investment.

Determining the company’s business scope

As a rule, the extent of what any company (even domestic ones) can do and achieve in China is characterized by what is known as its ‘business scope’.

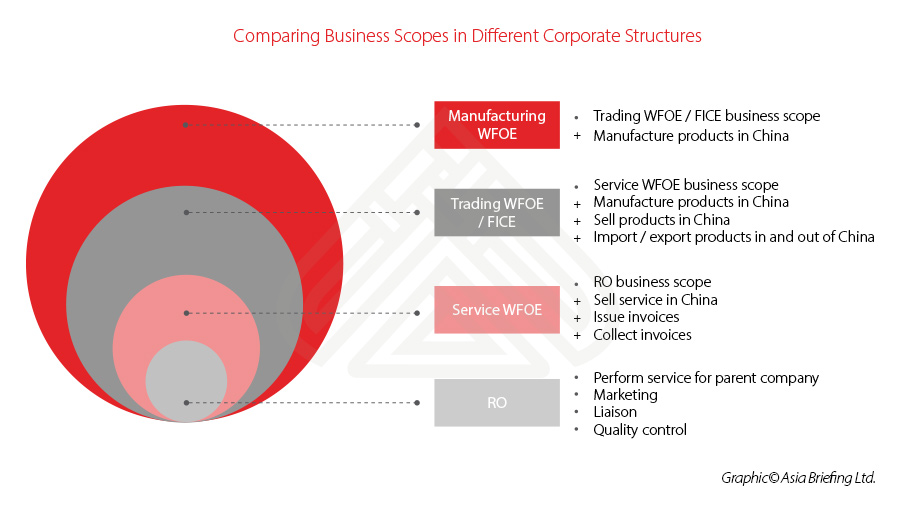

In broad strokes, if a foreign investor’s intentions are focused solely on services – the business will be deemed a Service WFOE and if a business wishes to focus on production, it must apply to the government to qualify for a Manufacturing WFOE.

For businesses wishing to engage in international or local trade, however, they must apply to be a Trading WFOE or a FICE. Importantly, FICE usually encompasses trade and service activities while the Trading WFOE merely relates to service.

Below we illustrate how FICE compares to the business scope of other corporate structures.

Specifically, a FICE can directly engage in the following activities:

- Retailing (online and offline) – selling goods and related services to individual persons from a fixed location, as well as through TV, telephone, mail order, internet, and vending machines.

- Wholesaling – selling goods and related services to companies and customers from industry, trade, or other organizations.

- Representative transactions with commission – selling other-owned goods and providing related services by sales agency of goods, broker, or other wholesaler based on a contractual relationship.

- Franchising – authorization of the use of its trademark, trade name, and operational mode through signing of contracts for the purpose of getting remuneration or franchise fees.

- Import and export – only if additional licenses are granted.

However, a FICE is also permitted to engage in incidental and complementary services, such as storage, warehousing, inventory management, repair maintenance, training, and delivery.

A company’s business scope can be changed; however, this is usually a lengthy and expensive process. A company that anticipates its activities to be beyond its stated scope can apply for modifications to its business scope if its location, licenses, and permits allow.

When to choose a FICE business model

A FICE structure offers a business more on-the-ground control of its everyday activities.

This is made possible through its wide permitted scope of operations, which allows it to hire domestic and foreign staff, deal directly with local supplies, and execute and receive payments in renminbi and issue fapiaos.

A FICE also allows a company the ability to establish and operate branch offices anywhere within China as long as the business scope of the branch does not exceed that of its parent company.

In addition, business owners are not bound to any annual turnover or minimum asset requirements.

Still, there are some clear limitations for FICE:

- It can take several months to set up before fully operational (typically four to six months);

- Export and VAT issues can be complex;

- Separate licenses need to be obtained for import-export activities; and,

- There are restrictions on how the goods are dealt with and they must not alter in any shape or form in the process of its distribution.

Pre-considerations when setting up a FICE

1) Location

The registered address of a company must have a lease agreement of at least 12 months and must not be an address shared with other companies. Virtual addresses are not suitable for WFOE registration in most areas of mainland China.

Approved addresses can later be changed through an amendment of the business registration, but this process takes roughly one to two months as all the main licenses will need to be updated.

Moreover, the registered address will determine the tax jurisdiction in which the WFOE is registered. Attempts to change jurisdictions later can meet with resistance from the local government, and the requirements necessary to make a move may become disruptive to operations and business activities.

2) Pre-approvals

In 2006, the approval of FICE establishments was transferred to the provincial bureau of Ministry of Commerce (MOFCOM) and the Administrative Committee of Economic and Technological Developments Zones (for FICE set up in economic and technological development zones).

Approval will need to be sought for filing the general FICE set-up, expansion, changes, as well as the opening of new retail shops where they exceed a certain size.

However, in certain circumstances, the central government’s approval will still need to be sought. These include:

- Sales activities conducted via television, telephone, mail ordering, internet, vending machine, etc.,

- Trading and distribution of important raw materials for industrial use, including steel, precious metal, iron ores, fuels, natural rubber, etc.; and

- Trading and distribution of specified products, such as books, newspapers, periodicals, refined oil, automobiles, edible sugar, cotton, and pharmaceutical products.

3) Obtaining licenses

Foreign investors interested in trading goods are required to obtain their own Import-Export License Record with the Customs Bureau, State Administration of Foreign Exchange (SAFE), and the local MOFCOM.

The Import and Export License is comprised of the following four licenses:

- Foreign trade operator filing record;

- Customs Registration Certificate;

- China E-port IC Card application; and

- Goods Trade Foreign Exchange Administration Service Activation (also called Import and Export Enterprise Name List Filing).

A FICE structure may be required to obtain one or more of these licenses depending on their business scope.

Special approvals / licenses are needed for products such as:

- Food and beverage – food operation license, liquor trading license.

- Fruits – only allowed from certain farms; fruits from only certain countries can be exported to China.

- Medical devices – products registration / filing shall be done in China; operation license shall be obtained properly.

- Dangerous goods – operation license of dangerous goods shall be obtained.

Businesses should also have the HS codes handy as this typically determines which licenses need to be obtained. For example, if the codes fall within a restricted or prohibited category this will bar the company from achieving its goals so it must be researched early-on.

4) Capital requirements

It is important to note that, like all company establishments, there is no minimum capital requirement for any WFOE thanks to the Company Law amendments that took effect March 1, 2014.

However, in some instances, particularly for businesses located in industrial parks and in specific industries, local governments may still require foreign investors to inject capital within a certain period.

Establishment procedures

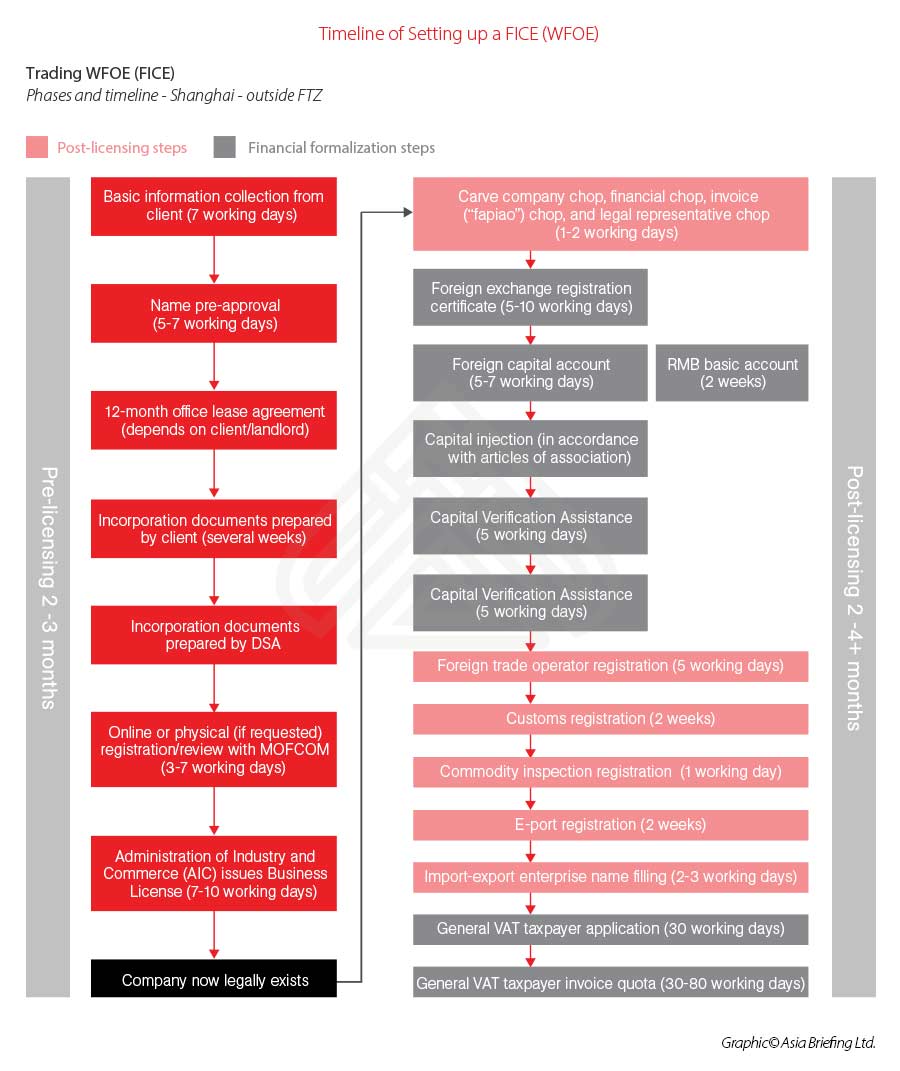

If a foreign investor has taken the time to go through all the relevant pre-considerations and believes that a FICE is the best entity type, the below process will be the natural pathway of setting up this legal entity.

It is prudent for foreign investors to seek professional advice from an early stage in order to avoid mishaps or complications further down the line.

Aside from the set-up itself there are also many adjacent legal considerations, such as choosing corporate governance roles, understanding the trademark regime and filing trademarks appropriately, choosing a local bank, obtaining specific licenses, and acquiring tax registrations that need to be processed adjacent to the mere corporate set up itself.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write to china@dezshira.com for more support on doing business in China.

- Previous Article Esports in China: Industry Boom Leads to Official Recognition

- Next Article 5 Big Changes to China’s VAT in 2019