How Brexit Britain is Already Massively Increasing Investment in China

While media attention is focused solely on the perils of a “hard Brexit”, meaning no deal with the EU will be agreed prior to the established leaving date in March next year, British businesses have quietly been making their own moves to counter-balance a potential downturn in EU trade.

An example is that this year, UK foreign direct investment (FDI) into China increased by a huge 169.8 percent year-on-year, in a massive shift towards Asia.

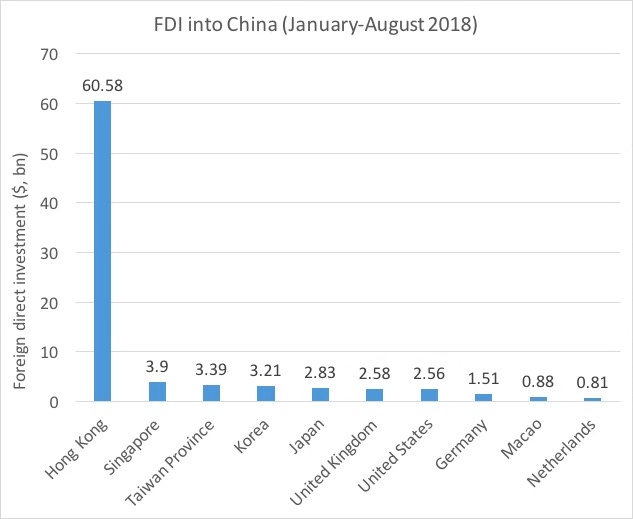

As can be seen in the graph by China’s Ministry of Commerce (MOFCOM) below, Hong Kong (representing a mix of Chinese and foreign investment) made up the bulk of the investment figures, as is normal.

However, the rise of UK investment into China is a substantial one. The South China Morning Post points out that UK investors led the way with inbound capital flows, with FDI soaring by 169.8 percent in the first nine months of 2018.

A breakdown from MOFCOM (only available till August), shared by the UK Trade and Investment Office in Beijing, shows the full picture:

Such large movements in investment flows are indicative of new British trends occurring as a result of Brexit. This means that new trade patterns are beginning to emerge.

What then is the future for UK-China trade?

UK-China Trade Agreement

The UK has until now been part of the EU’s plans to negotiate a free trade agreement (FTA) with China, a process that has been going on since 2013.

Both sides opened up talks aiming to provide investors on both sides with predictable, long-term access to the EU and Chinese markets, and to protect investors and their investments.

These talks have stalled over many issues, not least concerns over access to the Chinese market. At the present, these talks are at an impasse, with no breakthrough expected anytime soon.

A UK-China FTA would certainly be a priority for London. However, it falls behind a UK-US FTA in immediate desirability, and this could become a sticking point.

The issue is because Washington DC could insist, as it has done with the new USMCA agreement between the US, Canada, and Mexico, on elements within the deal that effectively limit Canada and Mexico from reaching their own trade deals with Beijing.

The sticking point is a clause inserted into the USMCA agreement that specifies that if any of the partners enters into a free trade deal with a “non-market” country like China, the other USMCA countries can terminate the USMCA with six months’ notice and negotiate their own bilateral agreement.

This clause, Article 32.10 in the USMCA deal, has created controversy in Canada. But it has helped US President Donald Trump isolate China by preventing China from pursuing agreements with Canada or Mexico that serve as a back-door to ship products into the US.

Although Ottawa has claimed the clause will not prevent Canada seeking a trade deal with China, opponents of the agreement state that Washington DC wants to control how countries trade with China, a situation Beijing has called “an infringement of sovereignty.”

With the UK actively seeking a trade deal with the US as its first priority, much of how a future UK-US trade deal is designed will impact on whether London is prepared to stand up for itself and insist on the UK’s right to negotiate trade agreements with whoever it wishes.

A UK-China free trade deal will or will not happen as a result of what can be agreed between London and Washington DC. If it does, then China is likely to be prepared to offer the UK better terms than it would the EU.

Some academics view the Chinese and Russian political manifestos as being aligned in trying to “divide” the EU, and a UK out of the EU could be expected to be rewarded for this.

China has a huge political need to be seen to be clean, meaning UK services and operational standards are of value to Beijing, and within the financial and legal services sectors in particular. That fits well with China’s outbound adventures into the Belt and Road.

A UK-China trade deal would also encourage additional UK business investment into ASEAN and India as British investors begin to realize that there are, in many industry sectors, more suitable investments to be made with these trade partners.

Vietnam, for example, is a major competitor to China in light manufacturing, while India, although seen as administratively difficult, is without doubt beginning to inherit the cheap labor demographic dividend that spearheaded China’s rise over the past 25 years.

Russia too may become attractive to UK investors once more, despite the current political coldness.

I shall be examining how Brexit Britain is preparing for and making investments in ASEAN, India, and Russia in upcoming articles.

To ensure you receive these, please obtain a complimentary subscription.

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates. The firm is in its 26th year of operations in China and has handled over half a billion pounds worth of British investment into China during that time. Please visit our website at www.dezshira.com or contact us at china@dezshira.com.

- Previous Article Digital Marketing in China: Tips for Foreign Businesses

- Next Article China’s Mega City Clusters: Jing-Jin-Ji, Yangzte River Delta, Pearl River Delta