The First Sale Rule: A Way to Reduce Exposure to US-China Tariffs?

As the US-China trade war continues with no resolution in sight, tariffs put in place by both sides have raised costs for many China-based businesses.

Many of them are considering restructuring their supply chains as a result, but the deep level of supply chain integration in China, the high costs of reconfiguration, and strict rule of origin standards in the US complicate such efforts.

A recent report from the South China Morning Post, however, uncovered a potential way for companies to reduce their exposure to US tariffs.

The secret lies in a three-decade-old customs rule in the US called the “First Sale rule”.

According to the First Sale rule, a product subject to tariffs can have its value declared based on its initial selling price rather than its final one.

Will this First Sale rule become a feasible strategy for exporters looking to reduce the impacts of tariffs?

What is the First Sale rule?

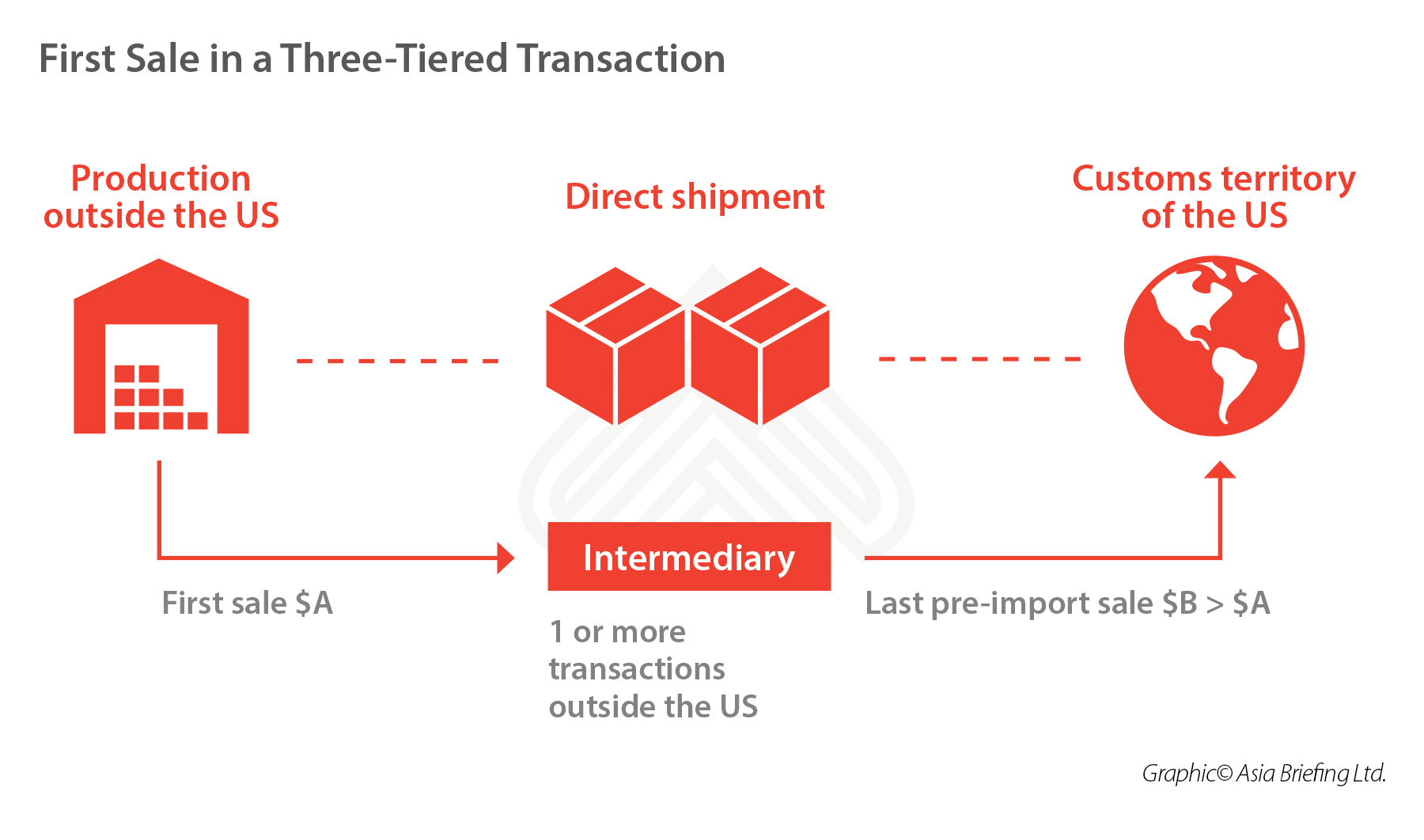

The First Sale rule applies to the Importer of Record (IOR) bringing goods into the US through a “multi-tiered” transaction model — where the product is bought and sold multiple times prior to its import into the US.

Under this rule, when declaring the customs value of the goods to pay the applicable tariff, importers can use the lower price of the goods paid in the first or earlier sale instead of the higher price paid in the last sale.

An example of First Sale into the US

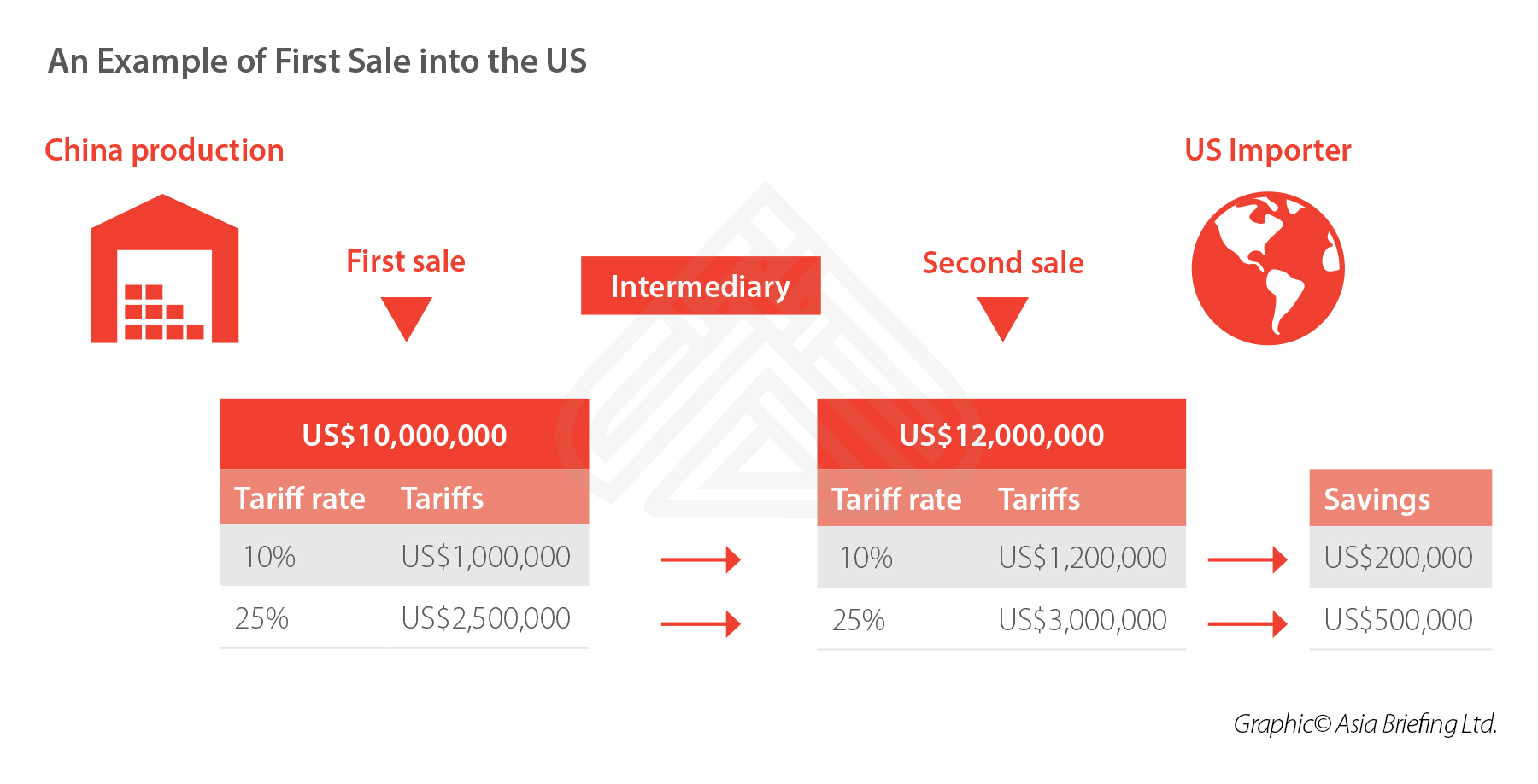

For example, let’s say a Chinese manufacturer produces and sells goods at the price of US$10,000,000 to an intermediary outside the US and the intermediary in turn sells these goods to an importer in the US with a 20 percent mark-up at the price of US$12,000,000.

By leveraging the First Sale rule and using the original manufacturing price of US$10,000,000 rather than the last price of US$12,000,000 as the basis of appraisement, the importer can save US$200,000 or US$500,000 under a 10 percent or 25 percent tariff, respectively, as shown below.

Maximum tariff savings

Usually, importers use the First Sale rule when there are high duty rates, high intermediary markup, or high free on board (FOB) volumes in the transaction.

Another way to save more is by restructuring the supply chain.

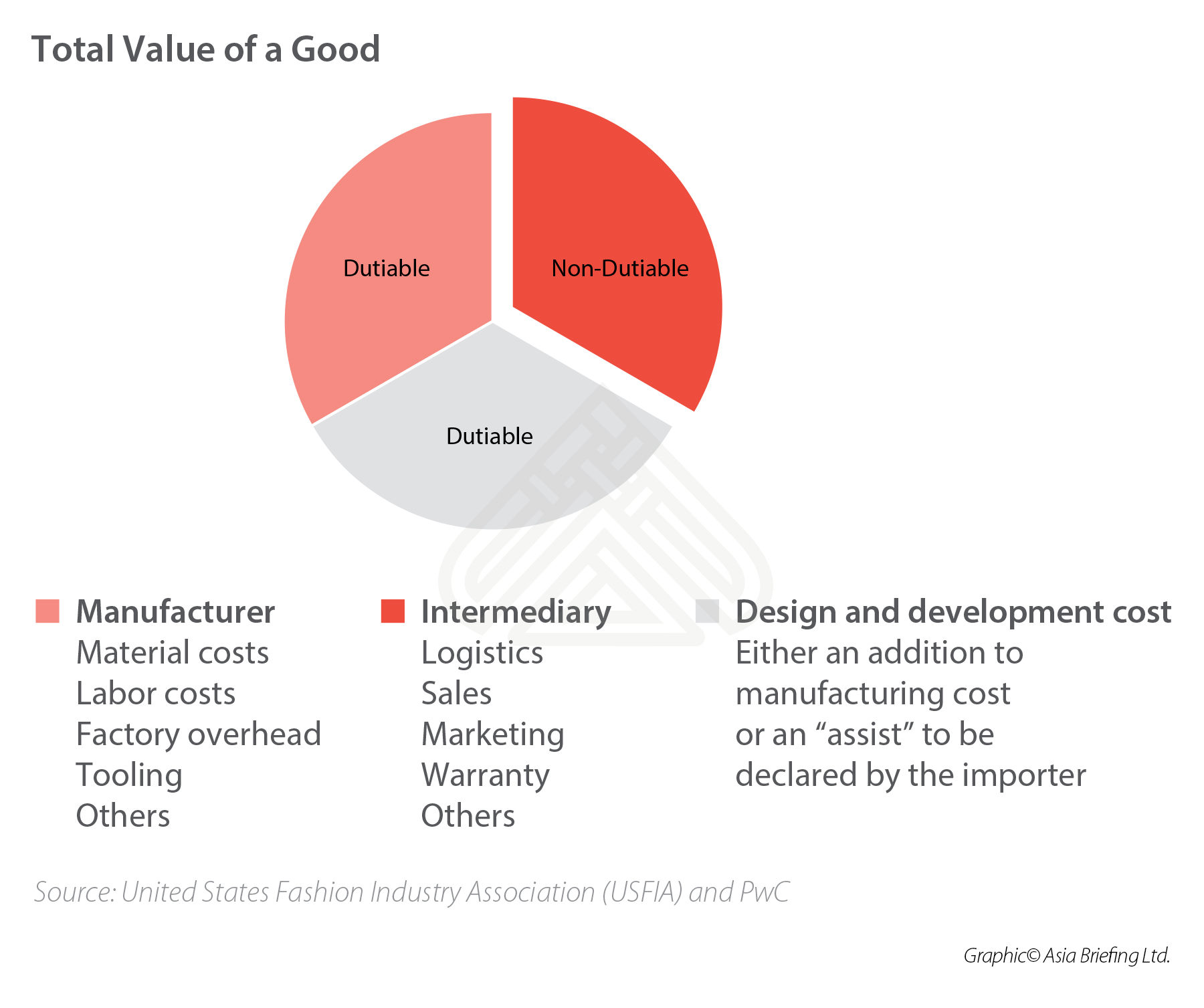

US Customs and Border Protection (CBP) allows certain expenditures unrelated to the production of goods (non-dutiable value) to be transferred from the manufacturer to the relevant intermediary. As a result, the first price could be cut lower without affecting the last pre-import price.

Requirements for First Sale valuation

The First Sale rule could offer significant tariff savings for US importers.

However, few companies have adopted this rule in practice, as the legal requirements, documentation headaches, and practical problems involved can be daunting at the beginning.

Firstly, the multi-tier transaction generally must meet the following requirements by CBP:

- Bona Fide Sale: The transaction – which is the first sale – between the manufacturer and the intermediary must be a bona fide sale, complete with a transfer of title.

- Arm’s Length: The Chinese manufacturer and the intermediary must be unrelated or, if related, conduct their transactions at “arm’s length”.

- Clearly Destined for Export: At the time of the “first sale”, the merchandise must be clearly destined for export to the US. For example, the goods are shipped directly from the supplier to the US, or the goods are specially designed or labeled according to the standards of the US market or according to the requirements by the US importer.

Secondly, to prove that the initial “first sale” price is accurate, the manufacturer, the intermediary, and the US buyer have to be prepared to submit the following documents:

- Purchase orders with copies of terms between all parties;

- Confirmations;

- Invoices;

- Written contracts or sales agreements;

- Bills of lading for final products and materials;

- Proof of payment (e.g. letters of credit);

- Production orders and/or manufacturing instructions and other unique specifications of the merchandise to conform to the buyer’s standards;

- Examples of labels, logos, stock numbers, bar codes, and other unique merchandise or carton marks; and

- Examples of country of origin marking on finished goods, hang tags, etc.

Why don’t more companies take advantage of the First Sale rule?

There are various reasons why more companies haven’t employed the First Sale rule, but the main reason is that businesses need to expend a considerable amount of time and resources to ensure a given transaction meets compliance and internal control requirements.

Since the information as mentioned above is often kept by different partners in the supply chain, cooperative relationships and responsibilities need to be developed between the manufacturer, the intermediary, and the importer.

Importers need to persuade other partners to disclose the “first sale” price and ensure only the right people see the sensitive documentation and data, which requires tight control over the process.

In addition, there are risks of errors and non-compliance, and failure to comply with the requirements of the First Sale rule could be construed as a lack of reasonable care and may result in a fine.

What are the experts saying?

A growing number of foreign firms are studying the applicability of the First Sale rule, as they look to offset rising costs stemming from the trade war.

Maxfield Brown, Business Intelligence Manager at Dezan Shira & Associates, said, “Application of the First Sale rule is a smart tax optimization strategy for US companies purchasing goods from international markets.”

Brown explained, “In the case of a Chinese good sold through a wholesaler in Hong Kong to a US buyer, the good would still be subject to US import tariffs set for China but the value of the Chinese good, on which taxes are calculated, would be lower.”

While this strategy has clear benefits, experts caution that not all businesses qualify to use it. Dezan Shira & Associates Partner Hannah Feng warned, “The First Sale rule is subject to a strict assessment by US Customs, so it is not possible for all firms to use this strategy.”

“Firms that are seriously considering using the First Sale rule should closely study whether they are eligible,” Feng said, “or else they risk being overturned by US Customs at a time they are likely paying closer attention to the rule.”

Besides legal eligibility, Brown also said that the rule is not suited to all types of businesses. “The ability of companies to leverage the First Sale rule in the context of the US-China trade war will depend on the presence and markup of wholesalers between a Chinese manufacturer and US buyer.”

Brown continued, “If wholesalers are not present in the supply chain or the First Sale rule is already being applied, there will be little benefit in exploring this option as a trade war mitigation instrument.”

Although it is not a universal solution for all companies hit by the trade war, it can still be an effective tool for those whose business model and legal status fit. “If wholesalers are present and the First Sale rule is not being applied, larger wholesaler markups will provide greater room for maneuverability,” Brown said.

With businesses on both sides of the Pacific feeling the impact of eight months of US-China tariffs, affected businesses are eager to explore any solution to minimize their costs.

In this regard, the First Sale rule could be an effective option for businesses to lower costs without sacrificing operational inputs or significantly altering pre-existing supply chains.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article What is the Greater Bay Area Plan?

- Next Article China Cuts Red Tape, Seeks to Better Engage with Business Community