How to Advertise Online in China Through Baidu, Alibaba, and Tencent Platforms

By Mike Vinkenborg

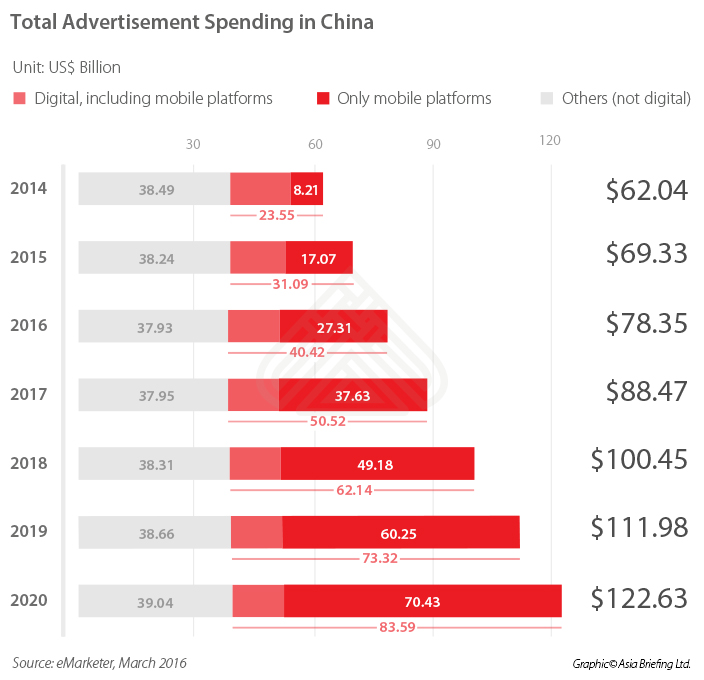

As of June 2016, China has approximately 710 million internet users, indicating an internet penetration rate of 51.7 percent. This number has been steadily increasing over the past decade, rising from 111 million at the end of 2005 to 457 million in 2010 and 688 million in 2015. This makes China by far the largest online market in the world in terms of users. Furthermore, China’s digital population is expected to almost double within the coming 10 years as the rest of the country comes online. As such, digital advertisement spending is seeing a steep increase. While advertisement spending in other sectors such as print and TV is stabilizing, total digital advertisement spending is expected to grow from US$23.6 billion to US$83.59 billion between 2014 and 2020, with the majority being spent on mobile platforms.

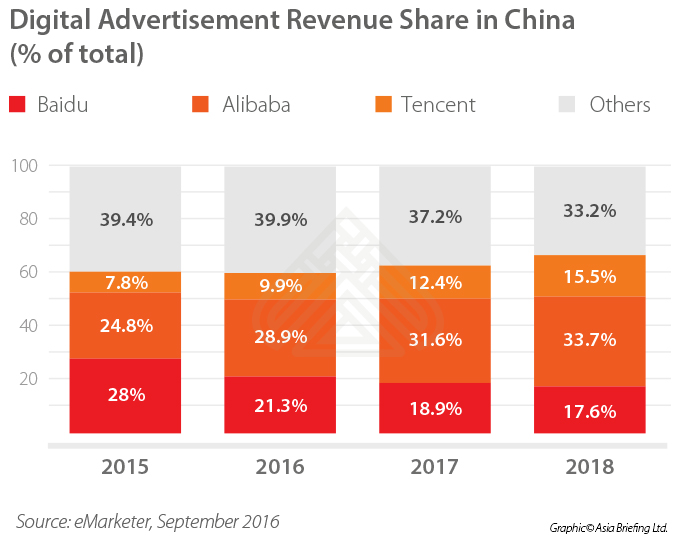

The main recipients of digital advertisements are the three dominant internet players in China: Baidu, Alibaba, and Tencent, together commonly abbreviated as “BAT”. Together, they made up 60.6 percent of all digital ad revenues in 2015, and this is expected to increase to 66.8 percent in 2018. On mobile platforms, these numbers are even higher, going from 71.1 percent in 2015 to a projected 74.4 percent in 2018.

The remainder of this article outlines how to successfully advertise to Chinese customers on Baidu, Alibaba, and Tencent, and the key considerations to take into account when launching an online advertisement campaign in China.

![]() RELATED: Information Technology Solutions from Dezan Shira & Associates

RELATED: Information Technology Solutions from Dezan Shira & Associates

Baidu

Baidu is often called China’s Google as it is the largest search engine in the country. It also offers many services similar to Google such as Baidu Maps and Baidu Netdisk, a cloud storage service. In 2015, Baidu held 80 percent of market share coming from search engine revenues, with 71.4 percent of searches in the country having been done on the platform as of October 2015. Due to the rise of Shenma, an app-based search engine deeply integrated with the products of its parent company Alibaba, Baidu’s market share in mobile searches is significantly smaller. In Q3 2016, 44.5 percent of mobile searches were done through Baidu.

Revenues on Baidu mainly come from its search engine advertising services, where it makes use of a pay-for-performance (P4P) platform that utilizes pay-per-click (PPC) technology. Advertising on Baidu is similar to using Google Adwords and mainly revolves around search engine optimization (SEO) tools. As an advertiser, one can purchase keywords, and up to four of the search results shown will be ads, similar to search results on Google.

To become a certified advertiser on Baidu, foreign companies need to fulfill certain requirements. First, as the search engine is targeting Chinese language searches, a website in Chinese is required. Furthermore, Baidu requires foreign enterprises to submit a digital copy of the business registration certificate issued by the relevant government to handle its account registration.

After getting certified, it is important to manage one’s Baidu campaign effectively, and localize advertisements. While this process is comparable to using Google AdWords, significant differences exist. Having a Chinese website is essential, as the search engine doesn’t index many non-Chinese pages. Also, hosting the website outside of China will place one at a disadvantage as these are ranked lower on the platform. Moreover, advertisers should seriously consider using other integrated payment services like UnionPay and Alipay.

These are just a few considerations to keep in mind. Last year, China Briefing posted a series of articles on how to use Baidu’s search engine:

- Using Baidu: China’s Largest Search Engine (March 2015)

- Free Baidu Tools That Can Help You Understand Your Chinese Target Audience: Part I – Baidu Zhishu (Index) (August 2015)

- Free Baidu Tools to Understand Your Chinese Audience: Part II – Baidu Keyword Planner & Baidu Analytics (October 2015)

Alibaba

Alibaba is China’s e-commerce giant, owning large online retail companies such as Taobao and Tmall, the online payment platform Alipay, and many other platforms. In 2016, it overtook Baidu as China’s largest digital advertiser, by generating 29 percent of the country’s total digital ad revenues. It is expected to increase its share to 33 percent in 2018, a more than doubling of its digital advertisement revenues in the coming two years.

This is mainly the result of the huge popularity of e-commerce in China, where Alibaba is leading in terms of sales and innovation. Similar to Baidu, Alibaba auctions prime spots on its platforms for specific keywords. Given the high level of competition, prices can quickly increase. For example, popular items, such as clothing and cosmetics, can reach prices of RMB 10 per click.

Alibaba’s search system works differently than in Western markets. In particular, Alibaba has closed its search function, and as such, items can only be searched within its own controlled websites. This eliminates the need for sellers to spend money in order to appear at the top of external search engine results, thereby frustrating Baidu’s business model. This also helps to explain why Alibaba’s advertisement revenues are expected to grow at approximately 54 percent this year, while Baidu’s growth rate only adds up to 0.3 percent.

Thus, similar to Baidu, Alibaba’s largest chunk of advertising revenues come from search engine advertising. Tips for effective selling on Tmall and Taobao include the following, among many others:

- Pick product titles and descriptions that include many popular search terms

- Research keywords to rank as high as possible in search results

- Research visitor data and learn about visitor behavior

- Enable products for the mobile and app versions and integrate WeChat and other social media accounts

![]() RELATED: Accessing China’s Third Party Mobile Payments Market

RELATED: Accessing China’s Third Party Mobile Payments Market

Tencent

Tencent is the market leader in social media in China. Its most popular platforms are QQ and WeChat, which include the online payment system TenPay. Furthermore, it holds a 15 percent stake in e-commerce giant JD.com. As of September 2016, Tencent overtook Alibaba as Asia’s largest company by market capitalization.

Contrary to Baidu and Alibaba, Tencent does not focus on search engine advertising. The largest chunk of its total revenues come from online games – approximately RMB 16 billion out of RMB 31.4 billion in Q4 2015. However, its revenues from advertising are rapidly rising, having more than doubled within a single year to RMB 5.73 billion in Q4 2015. In Q2 2016, they have risen to RMB 6.5 billion, and these numbers are expected to keep rising at similar paces until at least 2018.

This sharp increase in advertisement revenues is mainly coming from WeChat. Whereas before, Tencent only worked with major brands by allowing them to exclusively negotiate deals to advertise on the platform, the company slowly opened up WeChat’s Moments feature since early 2015 to effectively all advertisers by making it possible to apply for slots. Here, companies can place advertisements in users’ Moments newsfeed, similar to ads on Facebook’s newsfeed. Costs for these are RMB 140 per 1,000 views in Shanghai and Beijing, RMB 90 per 1,000 views in other cities, and RMB 40 per 1,000 views if no specific location is targeted.

However, the cost-per-click of this type of advertising is higher than other methods of advertising with Tencent. For example, paying popular WeChat bloggers to promote your products can be an effective way of reaching the right audience. Advertising on Tencent’s other platforms, such as Tencent QQ, should also be considered, as this can be a cheaper alternative in terms of cost-per-click.

Key takeaways

Effective online advertising campaigns are those that are localized and target the Chinese customer. For example, advertisements on e-commerce platforms in China contain considerably more information than they do in Western countries, and having proof of authenticity is often a prerequisite for success. Also, search engines are optimized for the Chinese language and searches in other languages are not only uncommon, but also generate less efficient results as Chinese search results are given priority. Besides this, it is compulsory to comply with China’s unique advertising law, published in 2015 and updated last July. One stipulation of the law is that advertising in certain sectors either may require approval or may be prohibited altogether.

That being said, with Chinese internet users becoming deeply integrated on the Baidu, Alibaba and Tencent platforms, it remains one of the most effective ways of attracting customers in China. As more people come online every day and the three major internet players continually innovate to compete with one another, digital advertising will only become more crucial in the years ahead.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

|

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016

Establishing & Operating a Business in China 2016, produced in collaboration with the experts at Dezan Shira & Associates, explores the establishment procedures and related considerations of the Representative Office (RO), and two types of Limited Liability Companies: the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV). The guide also includes issues specific to Hong Kong and Singapore holding companies, and details how foreign investors can close a foreign-invested enterprise smoothly in China.

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

Selling, Sourcing and E-Commerce in China 2016 (First Edition)

This guide, produced in collaboration with the experts at Dezan Shira & Associates, provides a comprehensive analysis of all these aspects of commerce in China. It discusses how foreign companies can best go about sourcing products from China; how foreign retailers can set up operations on the ground to sell directly to the country’s massive consumer class; and finally details how foreign enterprises can access China’s lucrative yet ostensibly complex e-commerce market.

China Investment Roadmap: the e-Commerce Industry

China Investment Roadmap: the e-Commerce Industry

In this edition of China Briefing magazine, we present a roadmap for investing in China’s e-commerce industry. We provide a consumer analysis of the Chinese market, take a look at the main industry players, and examine the various investment models that are available to foreign companies. Finally, we discuss one of the most crucial due diligence issues that underpins e-commerce in China: ensuring brand protection.

- Previous Article Understanding China’s Tax Offenders Blacklist System

- Next Article China’s Foreign Trade in 2016: Identifying Trends and Opportunities