Hong Kong’s New Two-tiered Profits Tax

By Paul Dwyer, Director, Head of International Tax and Transfer Pricing

On December 29, 2017, the Inland Revenue (Amendment) (No. 7) Bill 2017 (Profits Tax Bill) was gazetted in Hong Kong, thereby introducing a two-tiered profits tax rate regime to the city.

The key objectives of the Profits Tax Bill are to maintain a competitive taxation system to promote economic development, while maintaining a simple and low tax regime.

The introduction of the two-tiered profits tax regime will reduce the overall tax burden on enterprises, especially for small and medium enterprises, and boost Hong Kong’s status as a preferred investment jurisdiction in Asia.

![]() RELATED: Hong Kong BEPs Bill: New Transfer Pricing Regime to Regulate Documentation

RELATED: Hong Kong BEPs Bill: New Transfer Pricing Regime to Regulate Documentation

Overview of the Profits Tax Bill

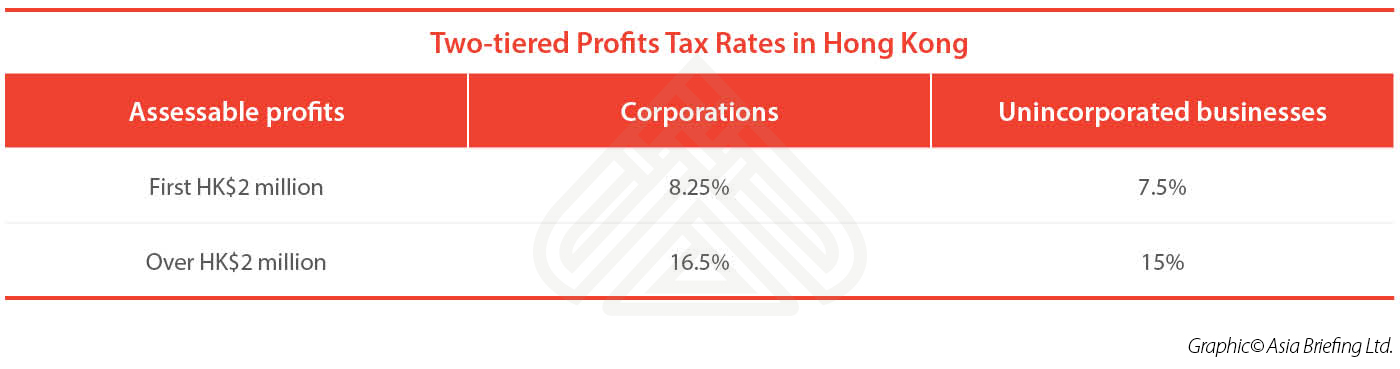

The Profits Tax Bill introduces a two-tiered profits tax regime to Hong Kong, which will apply to both corporations and unincorporated businesses commencing from the year of assessment 2018/19 (i.e., on or after April 1, 2018).

Before the Profits Tax Bill, profits earned by a corporation were taxed at a standard rate of 16.5 percent, while profits earned by unincorporated businesses were taxed at a standard rate of 15 percent.

With the introduction of the Profits Tax Bill, the first HK$2 million (US$256,000) of profits earned by a corporation will be taxed at 8.25 percent – half the current tax rate. The remaining profits will continue to be taxed at the existing 16.5 percent tax rate.

For unincorporated businesses, the first HK$2 million of profits earned will be taxed at 7.5 percent – also half the current tax rate. The remaining profits thereafter will be taxed at the existing 15 percent tax rate.

In order to avoid double benefits, enterprises that already benefit from preferential tax regimes such as the corporate treasury center regime, aircraft leasing regime, etc. shall be excluded from the two-tiered profits tax regime.

Additionally, the assessable profits for sums received by or accrued to holders of qualifying debt instruments as interest, gains, or profits shall be excluded, as these should already be taxed at half the rate (8.25 percent or 7.5 percent, as the case may be).

There will be a specific measure to prevent corporate activities from being divided amongst a large number of group companies who could benefit from the lower tax rate. Each corporate group will need to select one group company to benefit from the preferential profits tax rate.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

A competitive tax environment

According to the Hong Kong government, the two-tiered profits tax system will save corporations up to HK$165,000 per year (US$21,100), and unincorporated business up to HK$150,000 (US$19,180) per year. Given the current commercial and practical difficulties of doing business in Hong Kong, such as opening a corporate bank account, and in light of alternative low-tax jurisdictions like Singapore, the proposed two-tiered profits tax system is a much-needed step to ensure that Hong Kong remains an attractive and competitive investment destination.

From 2006 to 2017, the average corporate tax rate in Asia fell from 29 percent to 21 percent, thereby reducing Hong Kong’s comparative tax advantages. Meanwhile, economic development and liberalizations in mainland China and the rise of ASEAN as an investment destination have also affected Hong Kong’s relative strengths.

The Profits Tax Bill, together with other recently finalized measures such as the ASEAN-Hong Kong Free Trade Agreement and Hong Kong-India Double Tax Avoidance Agreement, reinforce Hong Kong’s reputation as a competitive tax environment and management hub, and should offer a jolt to the city’s economy.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

In this issue of China Briefing magazine, we analyze macro-level foreign investment trends into China, and how the high-tech sector stands out above others. We then shift our focus to China’s healthcare sector in the context of policy reforms and demographic changes. We also examine how to invest in China’s education industry and how China’s war on pollution introduces new opportunities for foreign investors.

- Previous Article Retenue d’impôt à la source pour les investissements étrangers en Chine

- Next Article Sexual Harassment under China’s Law: What Employers Need to Know