Finding Your “Comfort Zone”: A Guide to Industrial Parks in the Yangtze River Delta (Part 1)

By Rainy Yao

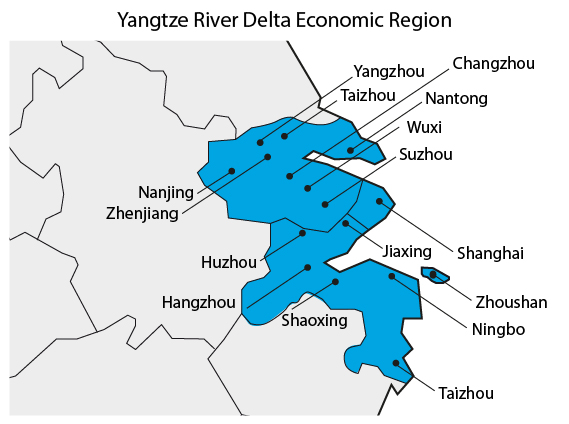

SHANGHAI — The Yangtze River Delta (YRD) Economic Region, comprised of 16 cities (i.e., Shanghai, Nanjing, Suzhou, Wuxi, Changzhou, Yangzhou, Zhenjiang, Nantong, Taizhou, Hangzhou, Ningbo, Huzhou, Jiaxing, Shaoxing, Zhoushan and Taizhou) in Zhejiang and Jiangsu provinces, is the largest megaregion in the world. In 2010, the State Council released the “Yangtze River Delta Regional Plan,” promoting the YRD as a key international gateway for the Asia-Pacific region, as well as an important global center for the modern service and manufacturing industries. The Plan establishes a target per capita GDP in the region of RMB110,000 by 2020.

Over its four years of development, the YRD Economic Region has taken a leading role in China’s economy. In 2013, the region’s GDP was close to RMB10 trillion, accounting for 17.2 percent of national GDP. Attracted by potential revenues and preferential policies, more and more foreign investors have chosen to establish their businesses in the YRD, especially in its many development zones. But given that these zones vary in terms of the tax policies and investment environments they can provide, it can be hard to tell which is right for your business. In this two part article, we compare five major types of development zones in the YRD to help foreign investors find the best fit for their specific industry.

1. Economic and Technological Development Zones (ETDZ) can be divided into four types based on their specific emphasis, namely technology-intensive industries and emerging industries; export and international trade; tourism and service industry; and cooperation between Chinese and foreign countries. Some ETDZs also include high-tech industrial development zones, export processing zones or bonded zones. The preferential policies offered in ETDZs include:

1. Economic and Technological Development Zones (ETDZ) can be divided into four types based on their specific emphasis, namely technology-intensive industries and emerging industries; export and international trade; tourism and service industry; and cooperation between Chinese and foreign countries. Some ETDZs also include high-tech industrial development zones, export processing zones or bonded zones. The preferential policies offered in ETDZs include:

- Resident FIEs shall be subject to a corporate income tax (CIT) rate of 15 percent. FIEs with an operation period of more than 10 years will be exempt from CIT for two years starting from the first profitable year, and taxed at a half rate in the three years following.

- Exemptions and reductions of municipal income tax (MIT) shall be decided by the local government.

- The profit gained by Sino-foreign joint ventures shall be exempt from remittance tax when remitted abroad by the foreign party.

- Raw materials, spare parts, components and packaging materials required by enterprises in bonded zones for the processing of export goods shall be exempt from customs duty and imports tax.

Example: Approved in 1993, the Hangzhou Economic & Technological Development Area (HEDA) is the only national-level development zone in China which includes an industrial park, a high concentration of colleges and universities, and an export processing zone. Pillar industries include equipment manufacturing, electronic information industry, bio-pharmaceutical industry and food & beverage industry.

2. High-Tech Industrial Development Zones (HTDZ) are designed for the commercialization of research and specific technology-heavy industries, namely IT, electronics, pharmaceuticals and new materials. Compared with ETDZs, enterprises set up in an HTDZ receive more incentives for innovation, making this type of zone an attractive option for high-tech industries. Preferential policies are as follows:

Corporate Income Tax (CIT):

- A CIT rate of 15 percent applies to eligible high-tech companies. Foreign-invested manufacturing enterprises with an operating period of more than 10 years will be exempt from CIT for the first two years of operations, and eligible for a 50-percent reduction for the 3 years of operations following the enterprise’s first profitable year.

- Eligible high-tech FIEs can extend the five-year CIT exemption and reduction (10 percent of CIT) period for an additional three years.

- Enterprises with a large output value of export products (more than 70 percent of product output value) shall be subject to a CIT rate of 10 percent in the year after the CIT exemption and reduction period.

- Foreign investors reinvesting profit earned from an FIE for a term of no less than 5 years are eligible for up to a 40 percent refund on CIT paid on the re-investment. If the investment is made into operating or expanding an export production enterprise or advanced technology enterprise, the investor is entitled to a full refund on CIT paid on the re-investment.

- FIEs eligible for a CIT rate of 15 percent shall also be exempt from MIT. Other foreign-invested manufacturing enterprises shall be exempt from MIT during the CIT exemption and reduction period.

Value-added Tax (VAT): Foreign-invested manufacturing enterprises who sell finished goods overseas shall be exempt from VAT.

Tariffs: Raw materials or semi-finished goods shall be exempt from import tariffs and import-related VAT.

Example: Established in 1992, the Changzhou National Hi-Tech District (CND) is home to over 5,000 manufacturing facilities including more than 1,300 foreign-invested enterprises (FIE). Pillar industries include equipment manufacturing, chemical & new materials and emerging industries. Unlike other HTDZs, the CND also features an automotive parts, accessories and tools industry.

Between the two types of zones, HTDZs offer a more sophisticated package of tax exemptions and reductions than ETDZs. To be eligible for these, however, it is necessary that an enterprise’s business scope be sufficiently technology-heavy to qualify for entry to an HTDZ.

In Part 2 of this article, we expand our horizons beyond manufacturing zones and into the realm of imports/exports and logistics, including a look at China’s export processing zones, free trade zones and bonded logistics zones.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Guide to the Shanghai Free Trade Zone

In this issue of China Briefing, we introduce the simplified company establishment procedure unique to the zone and the loosening of capital requirements to be applied nation wide this March. Further, we cover the requirements for setting up a business in the medical, e-commerce, value-added telecommunications, shipping, and banking & finance industries in the zone. We hope this will help you better gauge opportunities in the zone for your business.

An Introduction to Development Zones Across Asia

An Introduction to Development Zones Across Asia

In this issue of Asia Briefing Magazine, we break down the various types of development zones available in China, India and Vietnam specifically, as well as their key characteristics and leading advantages. We then go on to provide a snapshot of the latest development zones across the rest of Asia. This issue provides the fundamentals to understanding one of the most important business tools available to international businesses operating in Asia.

- Previous Article Ausländische Führungskräfte müssen sich mit der Korruption in China auseinandersetzen

- Next Article What China’s Latest Anti-Corruption Campaign Means for Foreign Investment