China’s Resource Tax Reform Presents New Opportunities and Restrictions in the Mining Sector

By Dezan Shira & Associates

Editor: Jake Liddle

China’s national resource tax reform will comprehensively come into effect on July 1, 2016. First introduced in 1984, the resource tax originally applied to crude oil, natural gas, coal, and other mineral resources based on their quantity and weight. Since then it has expanded its breadth, with provisional regulations issued in 1994, and a resource tax reform initiated in 2010. The reform further expanded the tax scope and started to levy the tax based on each resource’s price instead of quantity on crude oil, coal, natural gas, rare earth, molybdenum, and tungsten. The ad valorem taxation method was implemented to standardize the interaction between resource taxes and administration fees in order to establish a fairer and more efficient resource taxation system.

However, the reform has gradually increased the production costs for mining enterprises, particularly for foreign ones, as the price of natural resources has been progressively hiked over the past few years in China. The country’s income from resource tax has been at the highest in the last 10 years of its 30 years of existence, with an annual increase of 27 percent.

Expansion of the Ad Valorem Taxation Method

Because of the success of the 2010 pilot scheme, the main feature of the reform is to fully implement the ad valorem taxation method. It is now extended to most mineral products, though clay and sandstone will still be taxed by volume.

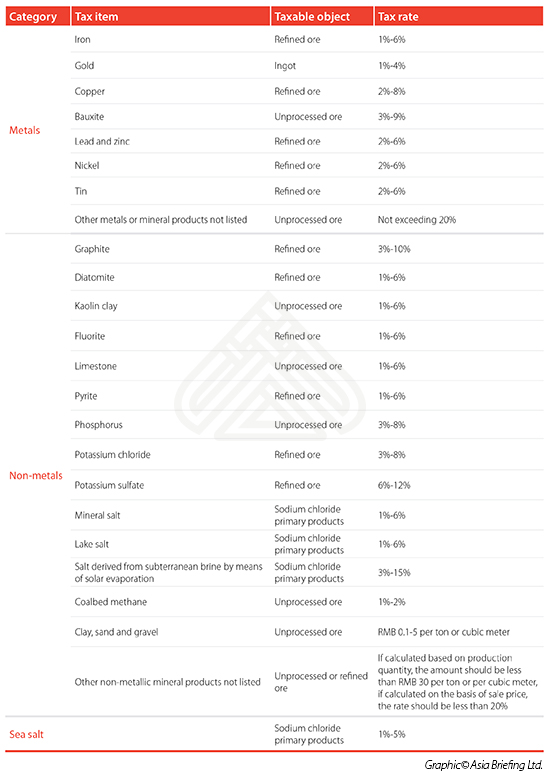

The following table details the tax rates for various metal and non-metal resources. For resources not included on the list, local governments can decide tax calculation and rates. The tax rates will remain the same for resources that are already included in the 2010 reform such as crude oil, natural gas, coal, rare earth, tungsten and molybdenum.

Scope Adjustments

The reform also aims to expand the scope of the resource tax. A pilot reform of water resource taxation will be implemented in the province of Hebei, changing water resource fees into a taxation system. This will include surface water and underground water into the tax collection scheme, and will be further expanded to cover other provinces in the future based on experience gained from the trial period. It also plans to include resources sourced from forests, grasslands, and tidal mudflats in the collection scheme in the future.

Preferential Policies

The reform also provides some preferential policies to certain resources and mining projects. Specifically, minerals extracted from low grade ore, waste rock, slag, sewerage, waste gas, and other such waste mineral products shall enjoy resource tax exemption or a reduced tax rate at the provincial level government’s discretion. Resources obtained by backfill mining methods shall enjoy a 50 percent reduction on resource tax, and resources derived from exhaustion stage mines and low abundance oilfields will enjoy a 30 percent reduction on resource tax.

RELATED: Tax and Compliance Services from Dezan Shira & Associates

RELATED: Tax and Compliance Services from Dezan Shira & Associates

Tax Collection and Government Funding

The reform hands more autonomy regarding resource taxation and administration to local governments, with tax revenue from resources received by local governments rather than the central government (in the case of water, 10 percent is collected by the central government, and the remaining 90 percent by the local government). Meanwhile, it was made clear that all funding and charges related to mineral resources will be cancelled by the reform. This means that all types of mineral subsidies will be cancelled, and the current mineral resources administration fee, the so-called “price regulating fund collection,” will be abolished (generally RMB 10-20 per ton depending on the region). Efforts will also be made to cease and ban all local illegal fees levied on mineral resources.

Reform Impact and Investment Opportunities in China’s Mining Sector

The reform may have a negative impact on both domestic and foreign mining enterprises. Though the Chinese government has stated that the resource tax reform will reduce the overall burden facing natural resources companies, some commentators have added that the ad valorem taxation system will have an adverse effect on companies. For example, commodities such as gold which have a higher sale price will naturally be taxed at a higher rate as a result of the reform. Analysts have also pointed out that the aforementioned power shift to local governments also means companies will be left with less profit, and the government better off.

But on the other hand, the reform may bring new trade and investment opportunities to foreign investors engaging in advanced mining technology and equipment.

China’s 13th Five Year Plan has identified several key issues in the mining sector which it plans to address, including over-capacity and over-supply, an inadequate growth model which has led to pollution and reduced productivity, insufficient research and development which has led to inefficacy and un-competitiveness, and poor safety conditions. In order to overcome and solve these problems, the sector will require a major restructure, and for mining companies to make efforts to boost productivity, technology, and safety. This raises a major opportunity for foreign investors engaging in mining technology, where a rise in demand for high value-added mining equipment will be driven by the need for improved technology and equipment to increase efficiency and reduce environmental pollution. China’s mining sector is one of the world’s largest markets for mining technology equipment, and its revenue comprises nearly half of the total industry revenue.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Tax, Accounting, and Audit in China 2016

Tax, Accounting, and Audit in China 2016

This edition of Tax, Accounting, and Audit in China, updated for 2016, offers a comprehensive overview of the major taxes that foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who must navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China-based operations.

Annual Audit and Compliance in China 2016

Annual Audit and Compliance in China 2016

In this issue of China Briefing, we provide a comprehensive analysis of the various annual compliance procedures that foreign invested enterprises in China will have to follow, including wholly-foreign owned enterprises, joint ventures, foreign-invested commercial enterprises, and representative offices. We include a step-by-step guide to these procedures, list out the annual compliance timeline, detail the latest changes to China’s standards, and finally explain why China’s audit should be started as early as possible.

Managing Your Accounting and Bookkeeping in China

In this issue of China Briefing, we discuss the difference between the International Financial Reporting Standards, and the accounting standards mandated by China’s Ministry of Finance. We also pay special attention to the role of foreign currency in accounting, both in remitting funds, and conversion. In an interview with Jenny Liao, Dezan Shira & Associates’ Senior Manager of Corporate Accounting Services in Shanghai, we outline some of the pros and cons of outsourcing one’s accounting function.

- Previous Article China’s Wind Power Industry: a Dynamic Investment Opportunity, or an Opaque Market for Foreign Companies?

- Next Article Labor Case Study: Work Permit Compliance for Foreign Employees in China