China’s New FTZ Negative List Removes Restrictions on Foreign Investment

By Alexander Chipman Koty and Zhou Qian

China’s State Council released an updated foreign investment negative list for its 11 free trade zones (FTZs) on June 16, 2017, removing a number of restrictions on foreign investment.

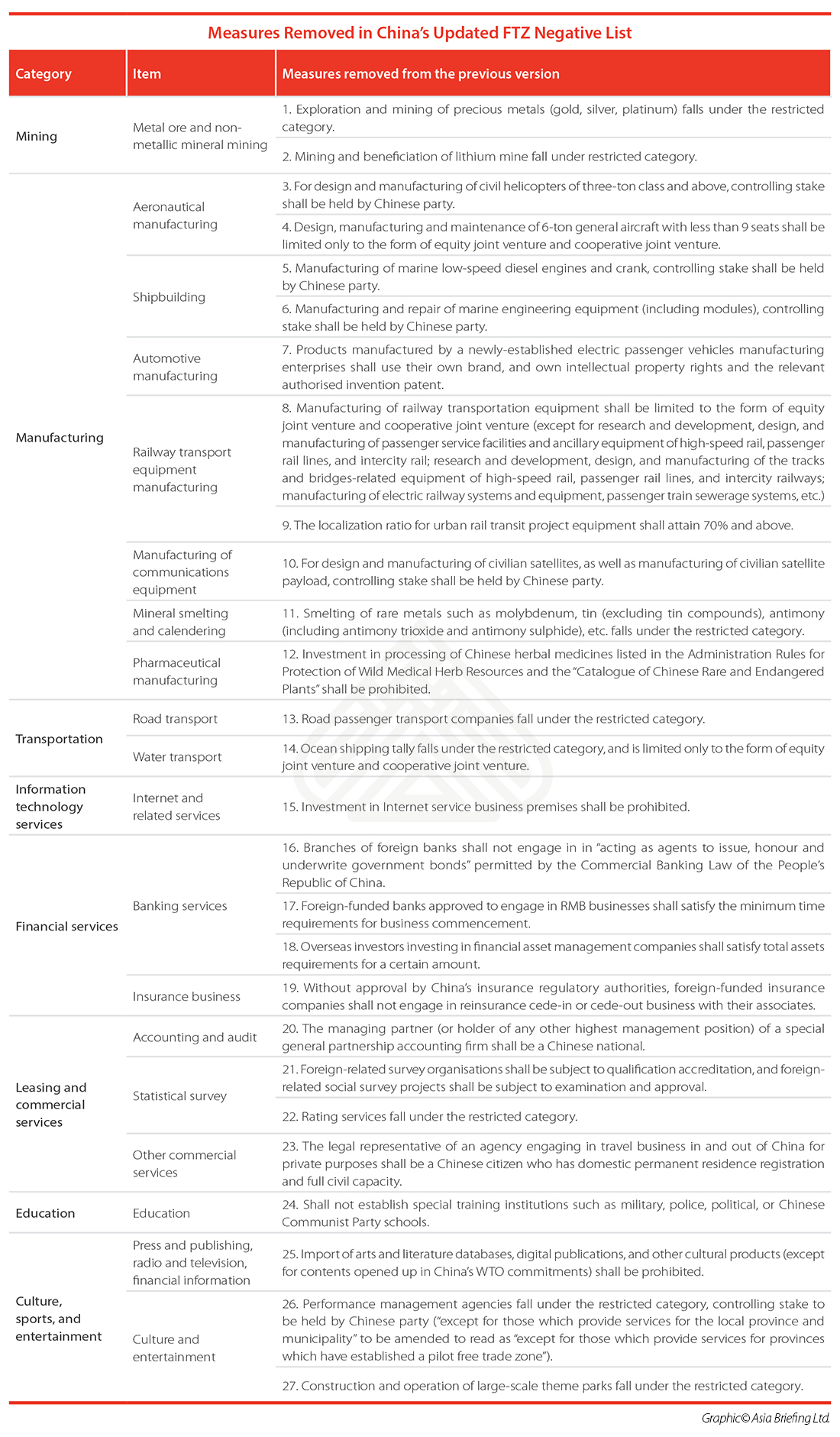

The new negative list, which comes into effect on July 10, 2017, cuts 10 items and 27 special administrative measures from the previous negative list released in 2015. The lifted restrictions on foreign investment apply to a number of industries, including mining, manufacturing, transportation, information, commercial service, finance, scientific research, and culture.

The updated negative list presents new opportunities for investment in China’s growing number of FTZs, and provides a glimpse into future economic reforms.

FTZ negative list explained

China’s negative list specifies the industries where foreign investment is prohibited or restricted in the country’s FTZs.

For prohibited industries – such as those relating to national security – foreign investment is not allowed. For restricted industries, foreign investors may need to acquire special approval or enter into a joint venture (JV) with a Chinese partner. Foreign investors enjoy domestic treatment in industries not listed on the negative list.

China currently has 11 FTZs, with the seven latest in Chongqing, Henan, Hubei, Liaoning, Shaanxi, Sichuan, and Zhejiang. The Shanghai Pilot FTZ was China’s first FTZ, launched in 2013, while FTZs in Fujian, Guangdong, and Tianjin were opened in 2015.

Changes in the new negative list

Of the 27 special administrative measures removed from the 2015 list, 10 are related to manufacturing, four to finance, and four to other services.

Overall, the new negative list reduces restrictions in over 20 industries, including railway transport equipment, pharmaceuticals, road transport, insurance, accounting and audit, and other commercial services.

Foreign investors are no longer be obligated to enter into a JV when engaging in rail transport equipment or civilian satellite manufacturing, as well as certain types of civilian helicopter design and production, for instance. The full list of removed special administrative measures can be found at the end of this article.

![]() RELATED: Made in China 2025: Implications for Foreign Businesses

RELATED: Made in China 2025: Implications for Foreign Businesses

Notably, restrictions may still apply for items removed from the negative list. An industry’s absence on the negative list simply means that foreign investors will be treated the same as Chinese investors in that industry.

For example, though military, police, political, and Chinese Communist Party special training institutions were removed from the negative list, those industries are blocked for Chinese investors as well, meaning that there is no effective change for foreign investors.

The 95 special administrative measures remaining are exactly half as many as there were in the first negative list introduced in the Shanghai Pilot FTZ in 2013. In 2015, the total number of measures were reduced to 139, and then to 122 in late 2015.

Evaluating the new negative list

The updated negative list comes as Premier Li Keqiang reiterated China’s commitment to trade and globalization at the World Economic Forum currently being held in Dalian, echoing the remarks President Xi Jinping made earlier in the year at Davos.

It is part of another round of economic liberalization, which includes the new Catalogue for the Guidance of Foreign Investment Industries, soon to be released by the Ministry of Commerce and the National Development and Reform Commission.

![]() RELATED: Pre-Investment and Entry Strategy Advisory from Dezan Shira & Associates

RELATED: Pre-Investment and Entry Strategy Advisory from Dezan Shira & Associates

The updated Catalogue is expected to introduce a similar style of negative list for the rest of China, effective in 2018, and to ease restrictions in similar industries as the FTZ negative list, including rail transport equipment and mining. FTZs are often treated as grounds for experimental reform in China, making it unsurprising that policies tested since the Shanghai Pilot FTZ opened in 2013 are now being carried over to the rest of China.

Many of the newly liberalized industries, however, are sectors in which Chinese companies are already dominant. China is known for its high-speed rail development, for example, a strength it hopes to export through the One Belt, One Road project.

Further, foreign investors in China’s FTZs may still be subject to national security reviews when participating in sensitive industries. Although the updated negative list provides new areas for investment, foreign investors should carefully study the opportunities and challenges that may arise in practice prior to entry.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article Establishing a Legal Representative Office in China

- Next Article Why Ford Chose China Over Mexico