China – India Business Relations Robust Despite Border Hype

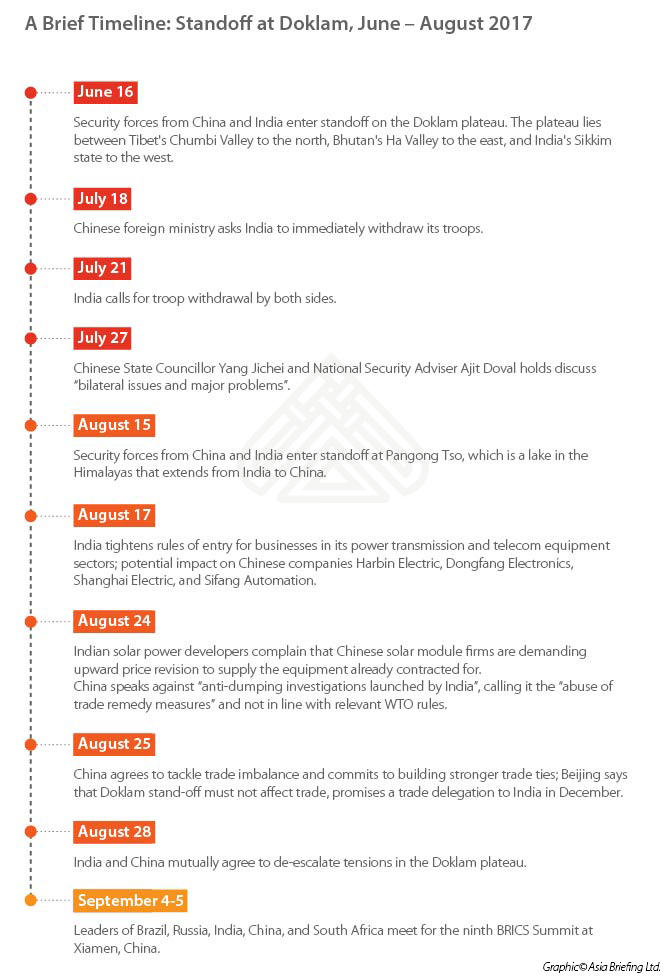

Less than three months after a border standoff began at Doklam, China and India agreed to de-escalate the situation in favor of talks and military disengagement.

The standoff caused some strain in bilateral trade and business relations. Yet, eventually, economic and commercial interests trumped geopolitical concerns, leading to the relatively swift resolution of border tensions.

Indeed, a week after the disengagement, India’s Prime Minister Narendra Modi attended the ninth BRICS Summit in Xiamen, and met separately with Chinese President Xi Jinping for bilateral talks.

Chinese exports to India surge in upscale segments

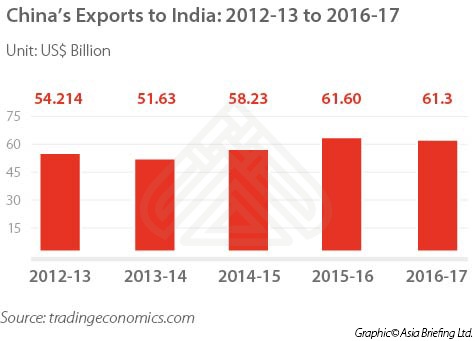

China is India’s largest trade partner, though the balance is heavily in favor of China. In 2016-17, China’s goods exports to India valued at a whopping US$61.3 billion against India’s shipments worth US$10.2 billion

Chinese goods dominate India’s homes, marketplaces, and factories. India imports a wide range of high-value added goods from China: mobile phones and electronic equipment to solar modules and machinery parts, besides cheap and mass manufactured items.

Meanwhile, India exports mainly raw materials like cotton, ore, slag and ash, mineral fuels, organic chemicals, as well as copper and related articles. China’s trade restrictions may have something to do with this – Indian agricultural and pharmaceutical products, for instance, are prevented from reaching the country.

On the other hand, China wants India to remove its anti-dumping duty on 93 products covering broad groups of chemicals and petrochemicals, products of steel and other metals, fibers and yarn, machinery items, plastic items, and electronic items, among others.

China’s investments into India are diversifying

China’s investment pattern in India is changing. After years of sluggish growth, the pace of outbound investments from China has quickened.

Take a look at the numbers: foreign direct investment (FDI) from mainland China into India totaled US$1.55 billion between April 2000 and December 2016 – 77.9 percent of this came after 2014, according to the Indian government.

Between June and August 2016, Chinese firms and investors pumped in approximately US$2.3 billion into India – targeting technology startups and the electronics manufacturing sector.

This in itself is a break away from China’s outbound investment patterns in other Asian markets, where infrastructure and extractive industries have dominated spending.

Economists explain this trend as a gradual shift from strategic to financial equity returns-focused investments. Chinese investors and industry leaders feel that India is where their country was ten years ago, and aim to replicate their homegrown successes.

Over the past year, new Chinese venture capital (VC) firms – including K2VC, Ping An Ventures, and Legend Capital – have visited India to scout for the next great idea.

As such, Chinese investors have paid special attention to India’s digital ecosystem, especially its technology startups, and have invested hundreds of millions of dollars in the e-commerce, online payments, healthcare, and communication media sectors.

For instance, Alibaba, China’s largest e-commerce company and its affiliates own 40 percent stake in India’s largest digital payments company – Paytm. Alibaba plans to raise it to 62 percent.

![Profile-of-Large-Chinese-Investments-Into-Digital-India-CB[75275]](https://www.china-briefing.com/news/wp-content/uploads/2017/09/Profile-of-Large-Chinese-Investments-Into-Digital-India-CB75275.jpg)

Meanwhile, China’s investments in India continue to flow into the more orthodox sectors. Chinese multinational corporations – like Harbin Electric, Dongfang Electronics, Shanghai Electric, and Sifang Automation either supply equipment or manage power distribution networks in 18 cities in India.

Chinese state-run firms – like China Harbour Engineering Co. Ltd and China Datang Corp – have shown interest in acquiring Indian companies in the engineering, procurement, construction (EPC), and power generation segments.

And, India needs these investments.

The consolidated FDI policy for 2017-18 indicates that India needs FDI inflows to fund its current account deficit, to improve the competitiveness of its manufacturing sector, and to make it an integral part of the global value chain.

China’s own domestic plans involve moving towards an innovation-led model of higher value-added manufacturing, while at the same time finding consumer markets for its established manufacturers.

The two economic growth trajectories may just reinforce the other.

![]() RELATED: What China Wants From India – Manufacturing Capacity

RELATED: What China Wants From India – Manufacturing Capacity

China plus one model – Asian giants who need each other

China is trying to transition from a low-end manufacturer to a high-end manufacturer, sourcing cheap products from other places for increasingly wealthy Chinese consumers, and transitioning Chinese jobs to higher paid manufacturing and services.

At the same time, Chinese firms still need to maintain existing production capacity and expand market access for its goods to be able to invest in establishing a higher-end manufacturing ecosystem, with the benefits of value addition coming into China. India, on the other hand, is at an earlier stage – developing its manufacturing base and trying to create the supply chain infrastructure that China is renowned for.

Yet, with increasing labor costs, declining population trends, and reduction of preferential investment policies, China is gradually losing its cost advantage and competitiveness in comparison to other Asian countries. As a result, companies in China are looking to diversify their operations by adding another location in Asia.

This strategy is known as the “China plus one” model. Businesses adopt the China plus one model to reduce operating costs, diversify workforces and supply chains, as well as access new markets.

Companies in China traditionally looked to Southeast Asian countries for alternative manufacturing destinations. In addition to the many benefits of ASEAN as an investment destination, India’s size, regulatory maze, and land acquisition represented more challenges than was viable to take on.

However, three years into Modi’s business friendly government, India is considered a much more attractive location to do business. Chinese firms have taken note of this, and the number of Chinese firms has climbed from between 30 and 40 in 2010 to between 400 and 500 today.

Several firms have also invested in local manufacturing capacity in India, across sectors. Leading examples include: SAIC Motor Corp., China’s largest automaker, which will start production in 2019 through a fully-owned facility in Halol, Gujarat state; Xiaomi, which assembles one phone every second in its second plant in Sri City, Andhra Pradesh state; and solar panel giant Trina Solar, which plans to build a US$44 billion plant near the port of Visakhapatnam.

What China-based businesses gain in India

The following factors make choosing India as your “China plus one” destination an easier decision today:

Economic reforms: The Modi government is keen to transform India’s manufacturing ecosystem under its “Make in India” initiative. Other flagship initiatives, such as “Digital India” and “Startup India” have already caught the attention of the biggest Chinese technology companies and VC firms. Meanwhile, ease of doing business is an important target of government reforms in the regulatory and corporate establishment domains, as are tax, real estate, and bankruptcy regulation.

Market size: India is the world’s third largest market after China and the US. Its economy posted a Gross National Income (PPP) of US$8.59 trillion in 2016-17, growing at a rate of 7.1 percent. Foreign businesses entering India now are comparing their experiences to China in previous decades – and despite ASEAN’s ambitions, none of the Southeast Asian economies offer a single, unified market this size.

Analysts estimate that India’s nominal year-on-year expenditure growth of 12 percent will result in India becoming the third largest consumer market by 2025. Maximum consumer spending is expected in food, housing, consumer durables, transport, and communication sectors.

Labor surplus: India’s population was 1.32 billion in 2016, and there are more than 605 million people below the age of 25. What this translates into is a projected 115 million workers in the 20-24 age bracket, according to the International Labor Organization (ILO). This young workforce will make a significant contribution to India’s consumer base, and contrast favorably to demographic changes in China.

Low labor costs: China is committed to developing high-end, value-added manufacturing to fuel the next stage of its economic development. Companies that want to manufacture cheap goods in Asia need to understand how lower labor costs in India can help them achieve their goals. India has some of the lowest labor costs in Asia: a monthly minimum wage of US$137 as compared to US$155 in China at the end of 2016, at its lowest.

In 2017, 14 regions in China increased their minimum wage, including Shanghai, which raised it by five percent from RMB 2,190 (US$335) to RMB 2,300 (US$351) and Shenzhen, which raised it from RMB 2,030 (US$310) to RMB 2,130 (US$325). In 2016, nine provinces raised their minimum wages and in 2015, 19.

In India, social insurance benefits are available only to firms in the organized sector. This means they are legally registered under law and pay tax. Furthermore, provision of social security benefits are mandated for only those firms that have a minimum number of employees. In contrast, businesses in China have considerably higher social insurance commitments.

Government support for industry: The Indian government is making foreign investment easier in India, announcing a much more liberalized and streamlined FDI policy in 2017. Government initiatives to create smart cities, trade corridors, industrial clusters, special economic zones (SEZs), and advance port infrastructure offer various preferential policies for foreign firms and investors.

Beyond this, Modi’s encouragement of “competitive federalism” has helped localize economic reforms and business incentives, adding a healthy dose of realism to the federal government’s expansive vision.

![]() Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

An important relationship

Dezan Shira & Associates Chairman Chris Devonshire-Ellis said, “The media has a tendency to play up any hint of conflict between India and China. But in actual fact, a huge amount is being done behind the scenes to position both economies as complementary with each other rather than competitive. In reality, both countries, like growing siblings, occasionally squabble yet develop together. Both are concentrating on efforts towards development, and don’t want to be distracted by other issues”.

According to Devonshire-Ellis, “the future is bright for an Asian axis with Beijing and Delhi both taking major and powerful roles in the shaping of Asia’s destiny.”

Analyzing China-India bilateral trade and investment data showcase the benefits of cooperation-based growth in the region. The policy of delinking economic objectives from geopolitical developments emerges from this understanding – evident in the resolution of the Doklam standoff.

Finally, the two countries are Asian giants, representing two of the three largest and fastest-growing economies in the world, and showing complementary development trajectories. They cannot be ignored by foreign investors on one hand, neither can they ignore each other.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

China’s Investment Landscape: Identifying New Opportunities

China’s Investment Landscape: Identifying New Opportunities

China’s foreign investment landscape has experienced pivotal changes this year. In this issue of China Briefing magazine, we examine how foreign investors can capitalize on China’s latest FDI reforms. First, we outline new industry liberalizations in both China’s FTZs and the country at large. We then consider when an FTZ makes sense as an investment location, and what businesses should consider when entering one. Finally, we give an overview of China’s latest pro-business reforms that streamline a wide range of administrative and regulatory measures.

- Previous Article China’s Investment Landscape: Finding New Opportunities – New Issue of China Briefing Magazine

- Next Article Двусторонняя торговля между Китаем и Россией является самым быстрорастущим коридором в мире